This article will reflect on the compensation paid to Nik Philpot who has served as CEO of Eckoh plc (LON:ECK) since 2006. This analysis will also assess whether Eckoh pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Eckoh

Comparing Eckoh plc's CEO Compensation With the industry

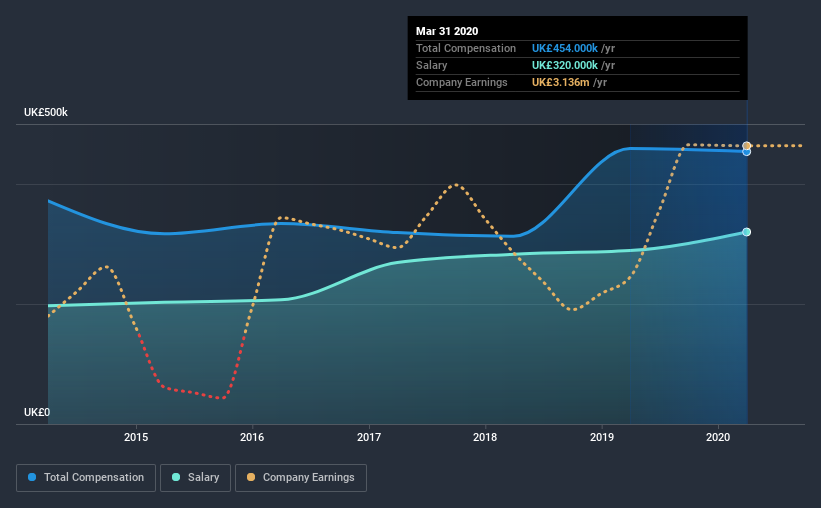

At the time of writing, our data shows that Eckoh plc has a market capitalization of UK£159m, and reported total annual CEO compensation of UK£454k for the year to March 2020. This means that the compensation hasn't changed much from last year. In particular, the salary of UK£320.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar companies from the same industry with market caps ranging from UK£74m to UK£295m, we found that the median CEO total compensation was UK£492k. So it looks like Eckoh compensates Nik Philpot in line with the median for the industry. What's more, Nik Philpot holds UK£4.4m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£320k | UK£289k | 70% |

| Other | UK£134k | UK£170k | 30% |

| Total Compensation | UK£454k | UK£459k | 100% |

On an industry level, around 69% of total compensation represents salary and 31% is other remuneration. Although there is a difference in how total compensation is set, Eckoh more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Eckoh plc's Growth Numbers

Eckoh plc's earnings per share (EPS) grew 6.8% per year over the last three years. It saw its revenue drop 8.3% over the last year.

We generally like to see a little revenue growth, but the modest EPSgrowth gives us some relief. It's hard to reach a conclusion about business performance right now. This may be one to watch. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Eckoh plc Been A Good Investment?

Boasting a total shareholder return of 44% over three years, Eckoh plc has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

As previously discussed, Nik is compensated close to the median for companies of its size, and which belong to the same industry. But the company has been found wanting in terms of EPS growth over the past three years. At the same time, shareholder returns have remained strong over the same period. There is room for improved company performance, but we don't see the CEO compensation as a big issue here.

So you may want to check if insiders are buying Eckoh shares with their own money (free access).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Eckoh, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eckoh might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:ECK

Eckoh

Provides customer engagement data and payment security solutions in the United Kingdom, the United States, Canada, Ireland, and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion