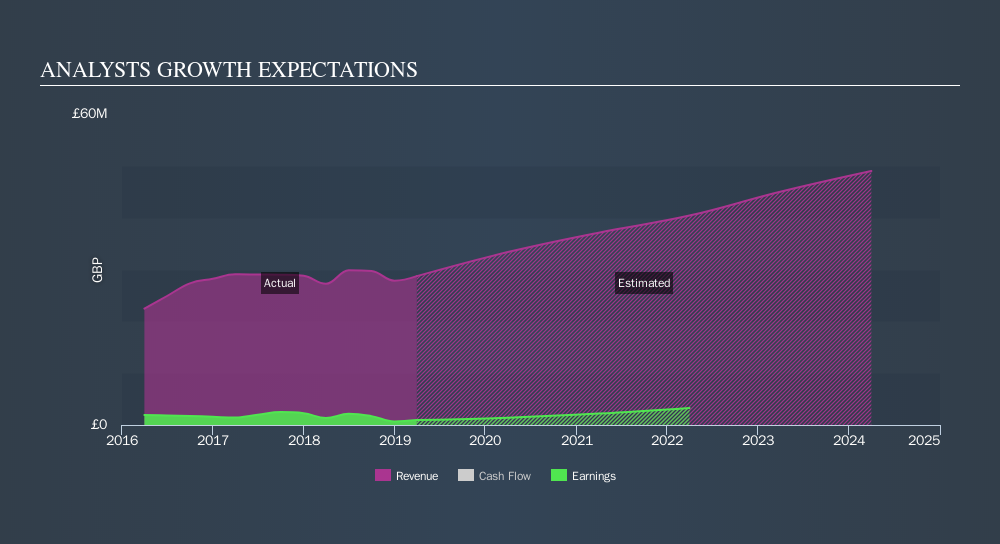

Eckoh plc's (LON:ECK) most recent earnings update in June 2019 signalled that the business faced a immense headwind with earnings falling by -30%. Below, I've presented key growth figures on how market analysts predict Eckoh's earnings growth trajectory over the next couple of years and whether the future looks brighter. I will be looking at earnings excluding extraordinary items to exclude one-off activities to get a better understanding of the underlying drivers of earnings.

View our latest analysis for Eckoh

Market analysts' prospects for the coming year seems buoyant, with earnings expanding by a robust 48%. This growth in earnings is expected to continue at an exponential rate, bringing the bottom line up to UK£3.3m by 2022.

Although it’s helpful to understand the growth year by year relative to today’s figure, it may be more beneficial gauging the rate at which the earnings are moving every year, on average. The benefit of this method is that we can get a better picture of the direction of Eckoh's earnings trajectory over the long run, irrespective of near term fluctuations, which may be more relevant for long term investors. To calculate this rate, I've inserted a line of best fit through analyst consensus of forecasted earnings. The slope of this line is the rate of earnings growth, which in this case is 40%. This means that, we can expect Eckoh will grow its earnings by 40% every year for the next few years.

Next Steps:

For Eckoh, there are three important aspects you should further examine:

- Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

- Valuation: What is ECK worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether ECK is currently mispriced by the market.

- Other High-Growth Alternatives: Are there other high-growth stocks you could be holding instead of ECK? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:ECK

Eckoh

Provides customer engagement data and payment security solutions in the United Kingdom, the United States, Canada, Ireland, and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion