- United Kingdom

- /

- Software

- /

- LSE:PINE

High Growth Tech Stocks To Watch In September 2025

Reviewed by Simply Wall St

The United Kingdom's market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China and broader global cues impacting investor sentiment. In such a climate, identifying high growth tech stocks requires a focus on companies that can demonstrate resilience and adaptability in the face of external economic pressures.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| M&C Saatchi | -9.67% | 25.20% | ★★★★☆☆ |

| Pinewood Technologies Group | 25.20% | 40.70% | ★★★★★☆ |

| Cerillion | 12.26% | 12.17% | ★★★★☆☆ |

| ActiveOps | 14.51% | 43.34% | ★★★★★☆ |

| Beeks Financial Cloud Group | 15.25% | 43.83% | ★★★★☆☆ |

| Raspberry Pi Holdings | 15.00% | 30.98% | ★★★★☆☆ |

| Eleco | 15.58% | 22.80% | ★★★★☆☆ |

| Skillcast Group | 14.74% | 52.30% | ★★★★★☆ |

| Trustpilot Group | 15.30% | 39.03% | ★★★★★☆ |

| Xaar | 10.85% | 181.07% | ★★★★☆☆ |

Click here to see the full list of 10 stocks from our UK High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Cerillion (AIM:CER)

Simply Wall St Growth Rating: ★★★★☆☆

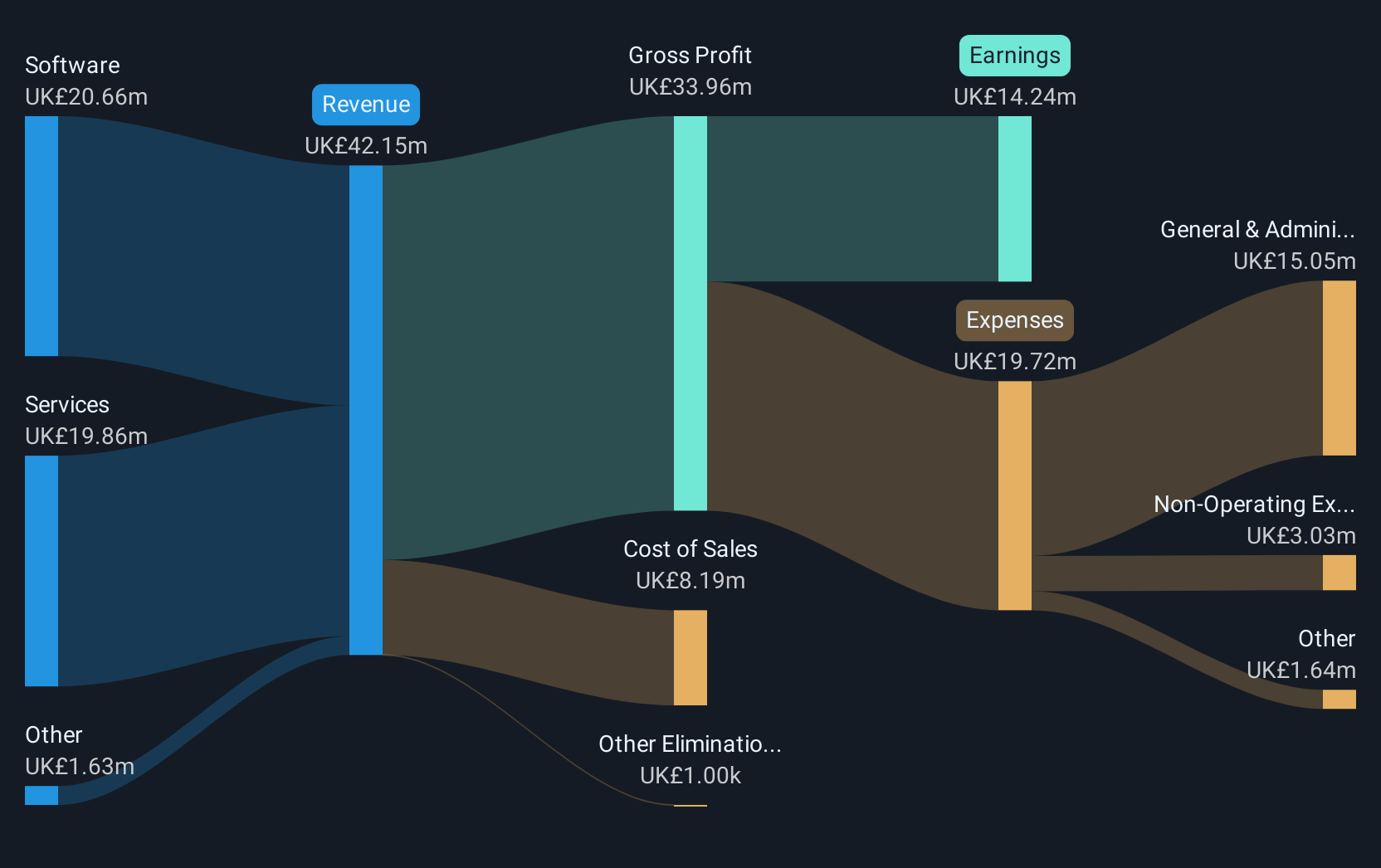

Overview: Cerillion Plc is a company that offers software solutions for billing, charging, and customer relationship management (CRM) to the telecommunications sector across various regions including the United Kingdom, Europe, the Middle East, the Americas, and the Asia Pacific with a market capitalization of £421.86 million.

Operations: The company generates revenue primarily from two segments: Software (£20.66 million) and Services (£19.86 million), serving the telecommunications sector globally.

Cerillion, a player in the UK tech scene, has shown robust financial health with a consistent earnings growth of 12.2% per year, outpacing the broader UK market's growth of 11.4%. Despite its revenue growth not exceeding the high benchmark of 20%, it still surpasses the market average at 12.3% annually. The company recently bolstered its capabilities through strategic conference presentations and expanded its financial base with a £45.65 million follow-on equity offering, demonstrating agility and adaptiveness in evolving tech landscapes. These moves could enhance Cerillion's competitive stance in providing scalable solutions amid shifting industry demands.

- Click here and access our complete health analysis report to understand the dynamics of Cerillion.

Gain insights into Cerillion's historical performance by reviewing our past performance report.

M&C Saatchi (AIM:SAA)

Simply Wall St Growth Rating: ★★★★☆☆

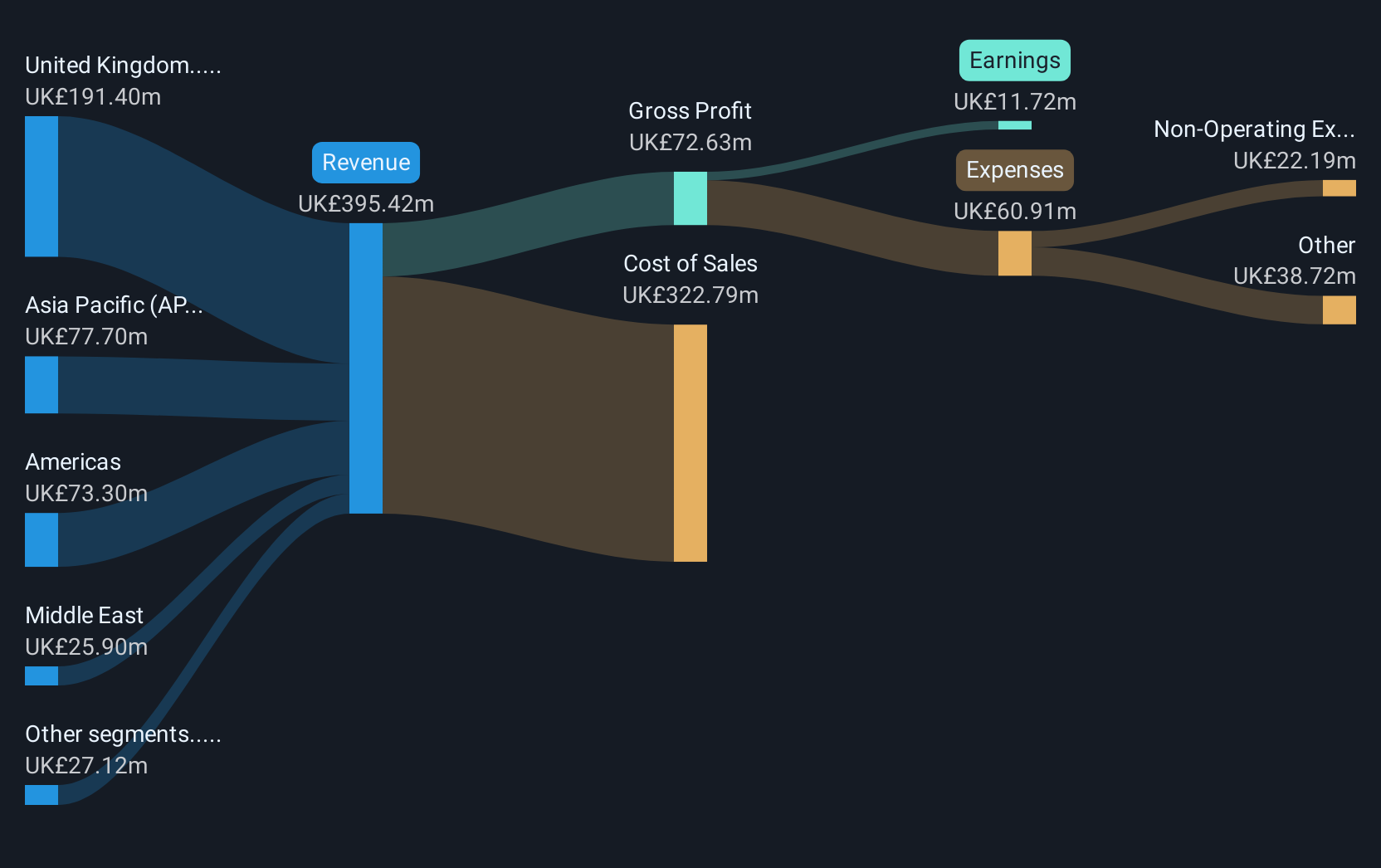

Overview: M&C Saatchi plc offers advertising and marketing communications services across the UK, Europe, the Middle East, Asia Pacific, and the Americas with a market cap of £198.78 million.

Operations: M&C Saatchi generates revenue through a diverse range of advertising and marketing communications services across various global regions. The company focuses on delivering creative solutions to clients, contributing to its financial performance.

M&C Saatchi, navigating through a challenging landscape with a revenue forecast to shrink annually by 9.7%, stands out with its robust earnings growth projection at 25.2% per year, significantly outpacing the UK market average of 11.4%. Despite a substantial one-off loss of £11.9M last year affecting its financials, the firm's strategic management shifts, including appointing Dame Heather Rabbatts as Non-Executive Chair, signal a strengthening leadership aimed at reversing current trends. This backdrop of high earnings growth potential amidst revenue contraction presents an intriguing dynamic for stakeholders monitoring the evolving tech sector in the UK.

- Take a closer look at M&C Saatchi's potential here in our health report.

Evaluate M&C Saatchi's historical performance by accessing our past performance report.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Growth Rating: ★★★★★☆

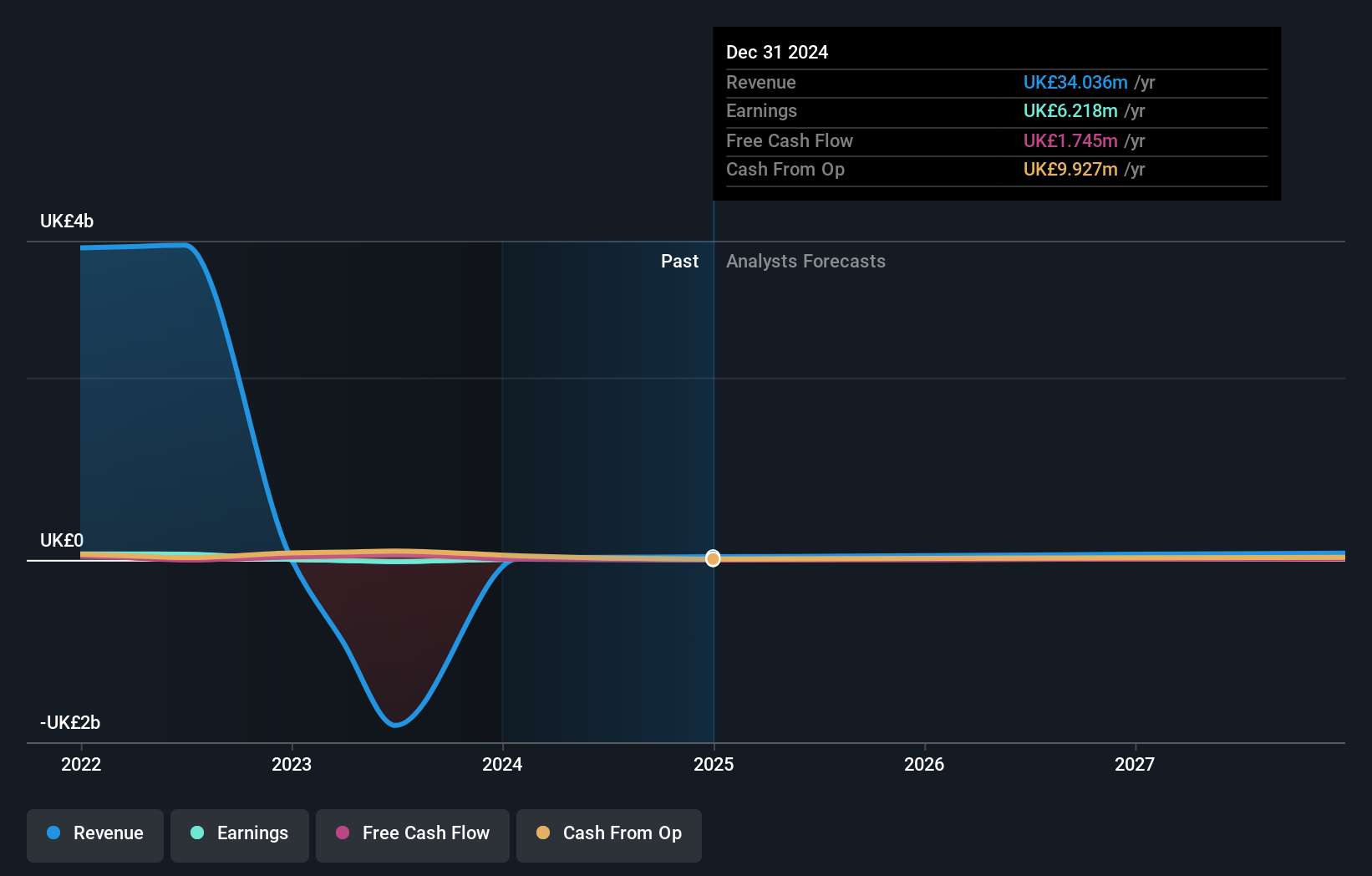

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider operating in the United Kingdom, Europe, Africa, Asia, the Middle East, and internationally with a market cap of £521.79 million.

Operations: Pinewood Technologies Group focuses on providing cloud-based dealer management software across multiple regions, including the UK and internationally. The company generates revenue primarily through its software solutions tailored for automotive dealerships.

Pinewood Technologies Group, amid recent executive changes and a bustling annual general meeting agenda, is poised for notable growth with projected revenue increases at 25.2% annually and earnings expected to surge by 40.7% per year. This performance starkly outpaces the UK market's average growth rates of 9.4% for revenue and 11.4% for earnings, underscoring Pinewood's robust position in the tech sector despite a significant one-off loss of £2.4M last year impacting financial results. With these dynamics, Pinewood not only demonstrates resilience but also an ability to exceed industry standards, making it a focal point in discussions about the future trajectory of high-growth technology firms in the UK.

Next Steps

- Discover the full array of 10 UK High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PINE

Pinewood Technologies Group

Operates as a cloud-based dealer management software provider in the United Kingdom, rest of Europe, Africa, Asia, the Middle East, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives