- United Kingdom

- /

- Software

- /

- AIM:BLTG

Blancco Technology Group (LON:BLTG) Might Have The Makings Of A Multi-Bagger

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. With that in mind, we've noticed some promising trends at Blancco Technology Group (LON:BLTG) so let's look a bit deeper.

What is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Blancco Technology Group:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

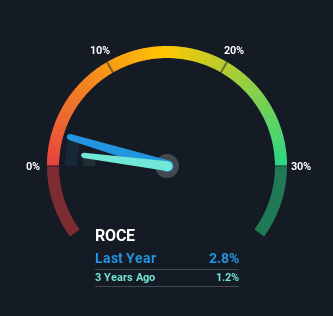

0.028 = UK£2.2m ÷ (UK£87m - UK£8.2m) (Based on the trailing twelve months to December 2021).

Thus, Blancco Technology Group has an ROCE of 2.8%. In absolute terms, that's a low return and it also under-performs the Software industry average of 8.3%.

Check out our latest analysis for Blancco Technology Group

In the above chart we have measured Blancco Technology Group's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Blancco Technology Group.

What Does the ROCE Trend For Blancco Technology Group Tell Us?

We're glad to see that ROCE is heading in the right direction, even if it is still low at the moment. The data shows that returns on capital have increased substantially over the last five years to 2.8%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 24%. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, a combination that's common among multi-baggers.

In another part of our analysis, we noticed that the company's ratio of current liabilities to total assets decreased to 9.5%, which broadly means the business is relying less on its suppliers or short-term creditors to fund its operations. So shareholders would be pleased that the growth in returns has mostly come from underlying business performance.

The Bottom Line On Blancco Technology Group's ROCE

A company that is growing its returns on capital and can consistently reinvest in itself is a highly sought after trait, and that's what Blancco Technology Group has. Given the stock has declined 27% in the last five years, this could be a good investment if the valuation and other metrics are also appealing. With that in mind, we believe the promising trends warrant this stock for further investigation.

One more thing: We've identified 4 warning signs with Blancco Technology Group (at least 1 which doesn't sit too well with us) , and understanding these would certainly be useful.

While Blancco Technology Group may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if Blancco Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:BLTG

Blancco Technology Group

Blancco Technology Group plc provides data erasure and mobile lifecycle solutions in the United States, the United Kingdom, the Asia Pacific, Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success