- United Kingdom

- /

- Software

- /

- AIM:ARC

What We Learned About Arcontech Group's (LON:ARC) CEO Pay

Matthew Jeffs has been the CEO of Arcontech Group plc (LON:ARC) since 2013, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Arcontech Group pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Arcontech Group

Comparing Arcontech Group plc's CEO Compensation With the industry

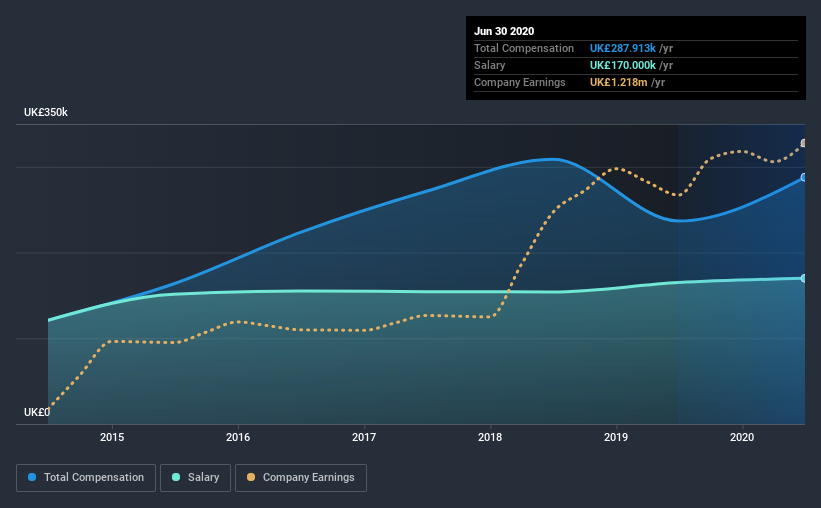

According to our data, Arcontech Group plc has a market capitalization of UK£25m, and paid its CEO total annual compensation worth UK£288k over the year to June 2020. Notably, that's an increase of 22% over the year before. Notably, the salary which is UK£170.0k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under UK£147m, the reported median total CEO compensation was UK£227k. This suggests that Arcontech Group remunerates its CEO largely in line with the industry average. Moreover, Matthew Jeffs also holds UK£1.7m worth of Arcontech Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

On an industry level, around 68% of total compensation represents salary and 32% is other remuneration. Arcontech Group sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Arcontech Group plc's Growth

Arcontech Group plc's earnings per share (EPS) grew 34% per year over the last three years. It achieved revenue growth of 3.9% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Arcontech Group plc Been A Good Investment?

We think that the total shareholder return of 217%, over three years, would leave most Arcontech Group plc shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

As we noted earlier, Arcontech Group pays its CEO in line with similar-sized companies belonging to the same industry. Investors would surely be happy to see that returns have been great, and that EPS is up. Although the pay is close to the industry median, overall performance is excellent, so we don't think the CEO is paid too generously. Also, such solid returns might lead to shareholders warming to the idea of a bump in pay.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 3 warning signs for Arcontech Group you should be aware of, and 1 of them doesn't sit too well with us.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Arcontech Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:ARC

Arcontech Group

Engages in the development and sale of proprietary software in the United Kingdom, rest of Europe, Africa, North America, Australasia, and the Asia Pacific.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Is This Lens Maker Mispriced? A Blind Spot in Plain Sight

From Porcelain to Silicon: Why the World’s Most Famous Toilet Maker is Now an AI Powerhouse

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks