- United Kingdom

- /

- Food

- /

- LSE:AEP

Unveiling Undiscovered Gems In The UK Market This September 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index grapples with global economic challenges, particularly those stemming from China's sluggish recovery, investors are increasingly turning their attention to smaller-cap opportunities that may be less exposed to international headwinds. In this environment, identifying stocks with strong fundamentals and growth potential within the domestic market becomes crucial for those seeking untapped value in the UK market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 38.21% | 41.39% | ★★★★★★ |

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| Goodwin | 19.83% | 10.66% | 18.55% | ★★★★★★ |

| Bioventix | NA | 7.39% | 5.15% | ★★★★★★ |

| Georgia Capital | NA | 6.53% | 10.96% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.15% | 50.88% | 67.63% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

AdvancedAdvT (AIM:ADVT)

Simply Wall St Value Rating: ★★★★★★

Overview: AdvancedAdvT Limited provides software solutions across Europe, the United Kingdom, North America, and internationally with a market cap of £262.62 million.

Operations: The primary revenue stream for AdvancedAdvT Limited is from its Blank Checks segment, generating £43.27 million.

AdvancedAdvT stands out with its debt-free status for the past five years, highlighting financial prudence. The company's earnings surged by 54% over the last year, significantly outpacing the software industry's growth of 15%. For the fiscal year ending February 2025, AdvancedAdvT reported sales of £43.27 million and a net income of £10.88 million, translating to basic earnings per share of £0.08. Trading slightly below its estimated fair value by 0.8%, it seems positioned for steady revenue growth at an anticipated rate of 11% annually, reflecting a robust outlook in its niche market segment.

- Click here to discover the nuances of AdvancedAdvT with our detailed analytical health report.

Review our historical performance report to gain insights into AdvancedAdvT's's past performance.

MS INTERNATIONAL (AIM:MSI)

Simply Wall St Value Rating: ★★★★★★

Overview: MS INTERNATIONAL plc, along with its subsidiaries, focuses on the design, manufacture, construction, and servicing of various engineering products and structures across multiple regions including the UK, Europe, the USA, Asia, South America, and other international markets; it has a market cap of £200.20 million.

Operations: MS INTERNATIONAL generates revenue primarily from its Defence and Security segment (£82.45 million), followed by Forgings (£13.77 million), Petrol Station Superstructures (£13.24 million), and Corporate Branding (£8.60 million).

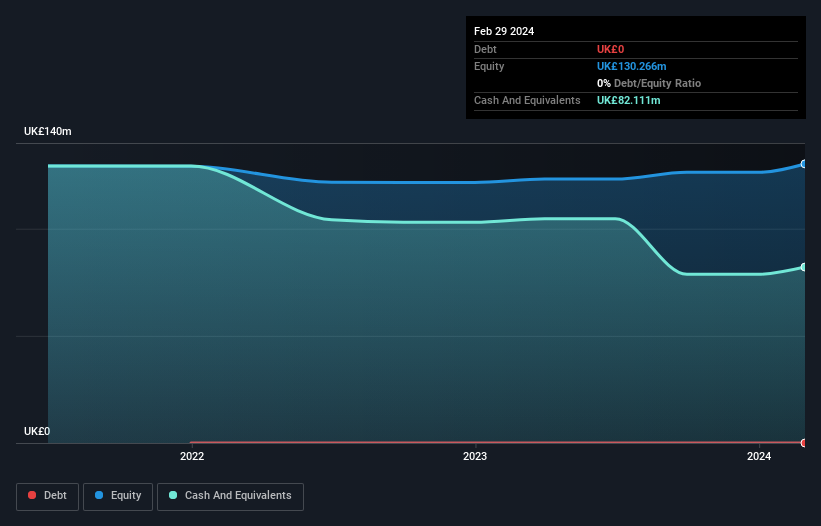

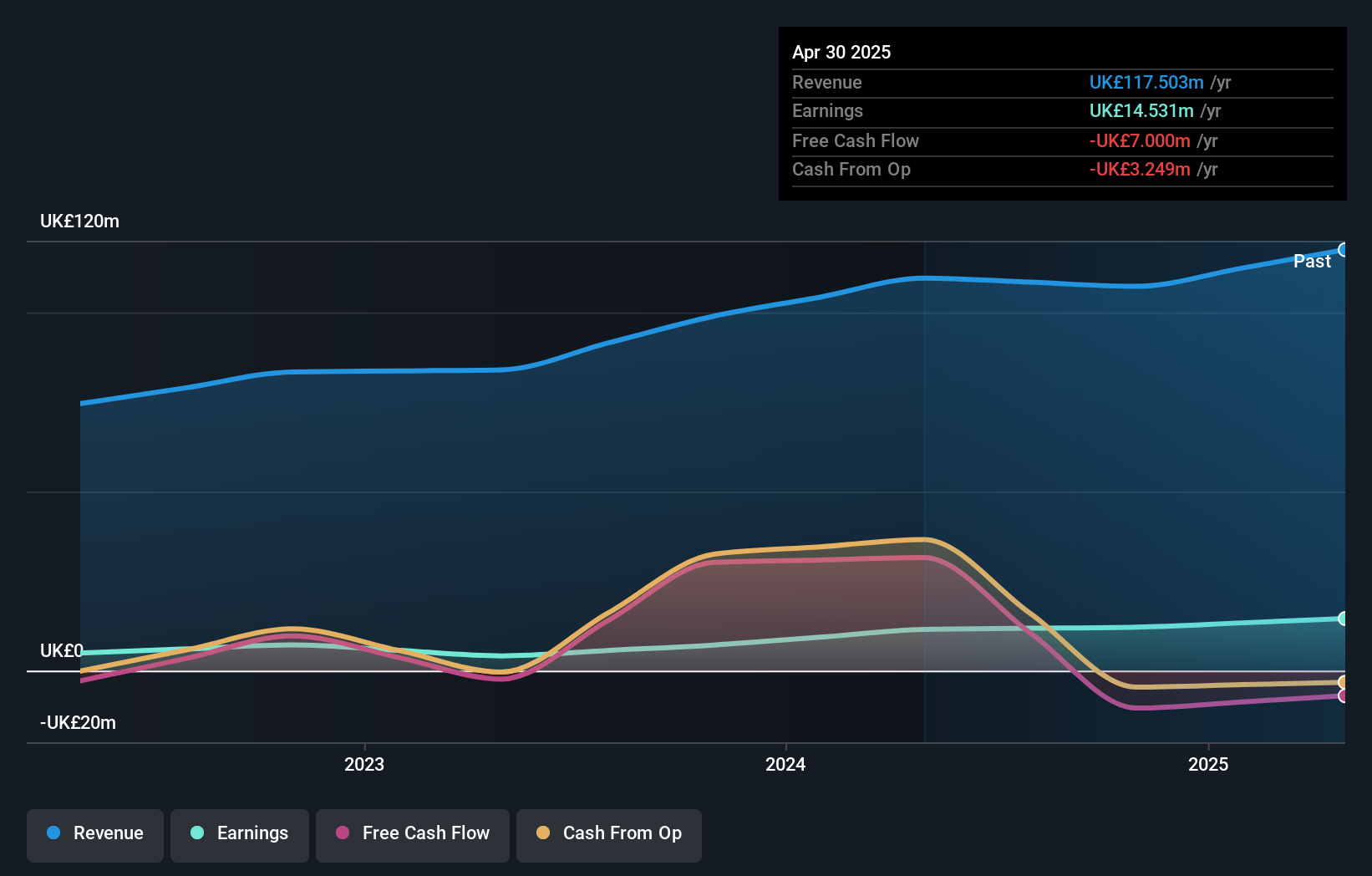

MSI, a player in the Aerospace & Defense sector, has demonstrated robust financial health with no debt over the past five years and a price-to-earnings ratio of 13.8x, which is favorable compared to the UK market average of 16x. Despite not surpassing industry growth last year, MSI's earnings have impressively grown by 53% annually over five years. Recent board changes include John Meldrum joining as Executive Director. The company reported sales of £117.5 million for the latest fiscal year and increased its annual dividend to 23 pence per share from last year's 19.5p, reflecting solid shareholder returns.

- Click to explore a detailed breakdown of our findings in MS INTERNATIONAL's health report.

Assess MS INTERNATIONAL's past performance with our detailed historical performance reports.

Anglo-Eastern Plantations (LSE:AEP)

Simply Wall St Value Rating: ★★★★★★

Overview: Anglo-Eastern Plantations Plc, along with its subsidiaries, engages in the ownership, operation, and development of oil palm plantations in Indonesia and Malaysia with a market capitalization of £493.66 million.

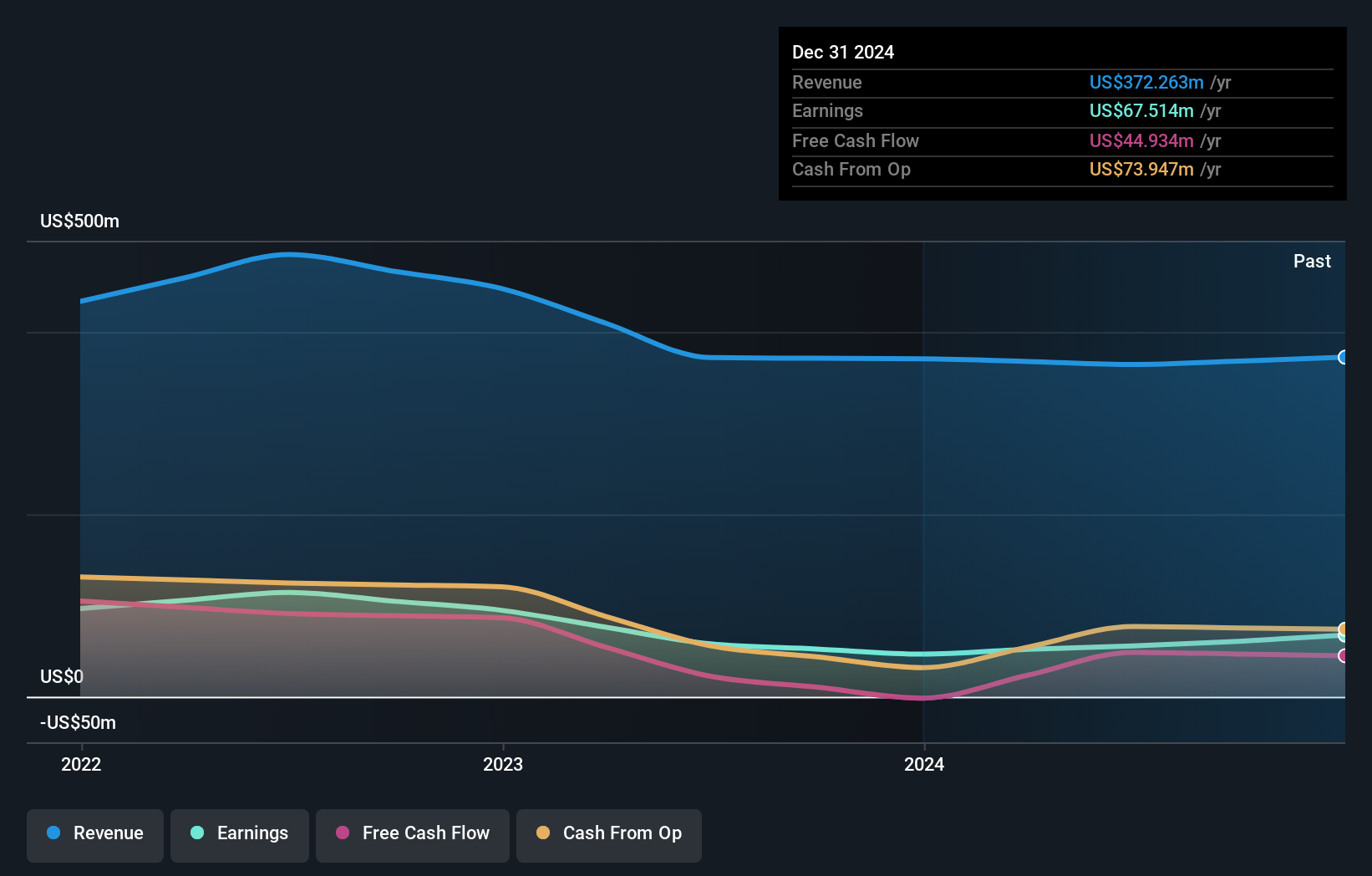

Operations: Anglo-Eastern Plantations generates its revenue primarily from the cultivation of plantations, amounting to $436.63 million. The company's financial performance is reflected in its net profit margin, which has shown varying trends over recent periods.

Anglo-Eastern Plantations, a noteworthy player in the agricultural sector, showcases impressive financial health with earnings growth of 63.4% over the past year, outpacing the industry average of 11.2%. Trading at 81.2% below its estimated fair value suggests potential undervaluation, making it an intriguing prospect for investors. The company is debt-free and recently initiated a share repurchase program authorized to buy back up to 3.96 million shares or 10% of its issued capital. With net income reaching US$48.66 million for H1 2025 compared to US$27.87 million last year, AEP's robust performance continues to shine brightly in its field.

- Dive into the specifics of Anglo-Eastern Plantations here with our thorough health report.

Evaluate Anglo-Eastern Plantations' historical performance by accessing our past performance report.

Taking Advantage

- Click this link to deep-dive into the 61 companies within our UK Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AEP

Anglo-Eastern Plantations

Owns, operates, and develops oil palm plantations in Indonesia and Malaysia.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives