- United Kingdom

- /

- Software

- /

- AIM:ACSO

UK£6.41 - That's What Analysts Think accesso Technology Group plc (LON:ACSO) Is Worth After These Results

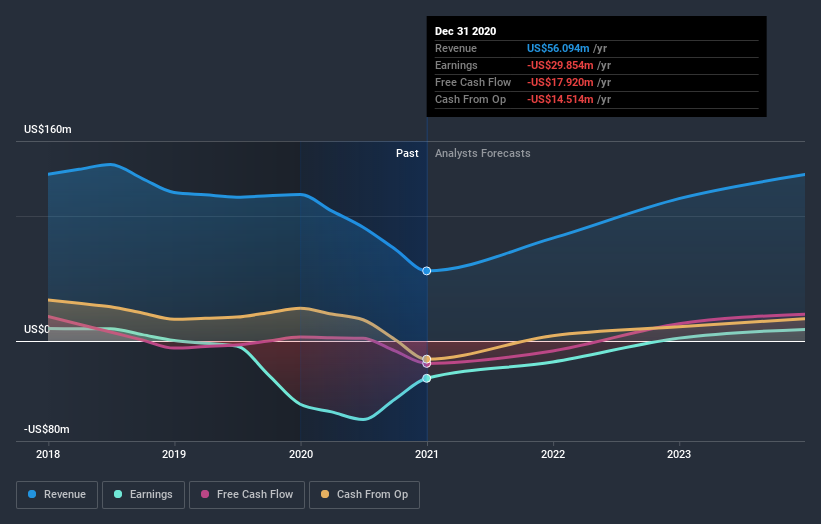

Shareholders of accesso Technology Group plc (LON:ACSO) will be pleased this week, given that the stock price is up 12% to UK£5.70 following its latest annual results. The results don't look great, especially considering that statutory losses grew 10% toUS$0.83 per share. Revenues of US$56,094,000 did beat expectations by 3.0%, but it looks like a bit of a cold comfort. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Check out our latest analysis for accesso Technology Group

Taking into account the latest results, the consensus forecast from accesso Technology Group's three analysts is for revenues of US$82.3m in 2021, which would reflect a major 47% improvement in sales compared to the last 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 56% to US$0.37. Before this earnings announcement, the analysts had been modelling revenues of US$82.7m and losses of US$0.37 per share in 2021.

The average price target fell 13% to UK£6.41, with the ongoing losses seemingly a concern for the analysts, despite the lack of real change to the earnings forecasts. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on accesso Technology Group, with the most bullish analyst valuing it at UK£7.00 and the most bearish at UK£6.10 per share. This is a very narrow spread of estimates, implying either that accesso Technology Group is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Of course, another way to look at these forecasts is to place them into context against the industry itself. For example, we noticed that accesso Technology Group's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 47% growth to the end of 2021 on an annualised basis. That is well above its historical decline of 2.5% a year over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 13% annually. Not only are accesso Technology Group's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts reconfirmed their loss per share estimates for next year. Fortunately, they also reconfirmed their revenue numbers, suggesting sales are tracking in line with expectations - and our data suggests that revenues are expected to grow faster than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple accesso Technology Group analysts - going out to 2023, and you can see them free on our platform here.

Plus, you should also learn about the 2 warning signs we've spotted with accesso Technology Group (including 1 which is potentially serious) .

If you decide to trade accesso Technology Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:ACSO

accesso Technology Group

Develops technology solutions for the attractions and leisure industry.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives