- United Kingdom

- /

- Semiconductors

- /

- LSE:AWE

The Price Is Right For Alphawave IP Group plc (LON:AWE) Even After Diving 29%

The Alphawave IP Group plc (LON:AWE) share price has fared very poorly over the last month, falling by a substantial 29%. The recent drop has obliterated the annual return, with the share price now down 7.0% over that longer period.

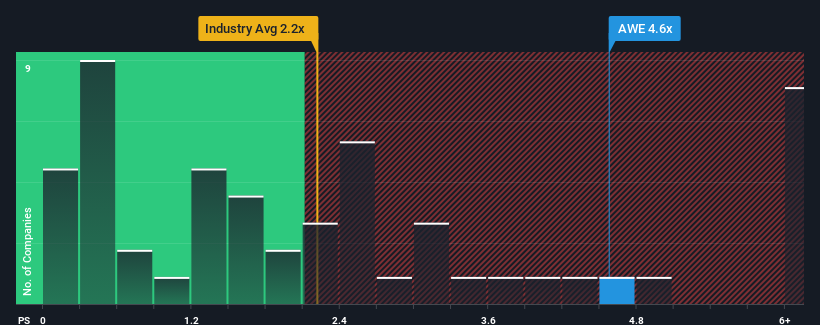

Although its price has dipped substantially, given around half the companies in the United Kingdom's Semiconductor industry have price-to-sales ratios (or "P/S") below 2.3x, you may still consider Alphawave IP Group as a stock to avoid entirely with its 4.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Alphawave IP Group

What Does Alphawave IP Group's P/S Mean For Shareholders?

Recent times haven't been great for Alphawave IP Group as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Alphawave IP Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Alphawave IP Group's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 29%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 70% over the next year. With the industry only predicted to deliver 54%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Alphawave IP Group's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Alphawave IP Group's P/S

Even after such a strong price drop, Alphawave IP Group's P/S still exceeds the industry median significantly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Alphawave IP Group's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Alphawave IP Group that you should be aware of.

If these risks are making you reconsider your opinion on Alphawave IP Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:AWE

Alphawave IP Group

Develops and sells wired connectivity solutions in North America, China, the Asia Pacific, Europe, the Middle East, Africa, and the United Kingdom.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives