Stock Analysis

- United Kingdom

- /

- Semiconductors

- /

- LSE:AWE

Despite shrinking by UK£53m in the past week, Alphawave IP Group (LON:AWE) shareholders are still up 14% over 1 year

Passive investing in index funds can generate returns that roughly match the overall market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Alphawave IP Group plc (LON:AWE) share price is up 14% in the last 1 year, clearly besting the market decline of around 2.5% (not including dividends). That's a solid performance by our standards! Alphawave IP Group hasn't been listed for long, so it's still not clear if it is a long term winner.

While this past week has detracted from the company's one-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for Alphawave IP Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year Alphawave IP Group saw its earnings per share (EPS) drop below zero. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. It may be that the company has done well on other metrics.

However the year on year revenue growth of 106% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

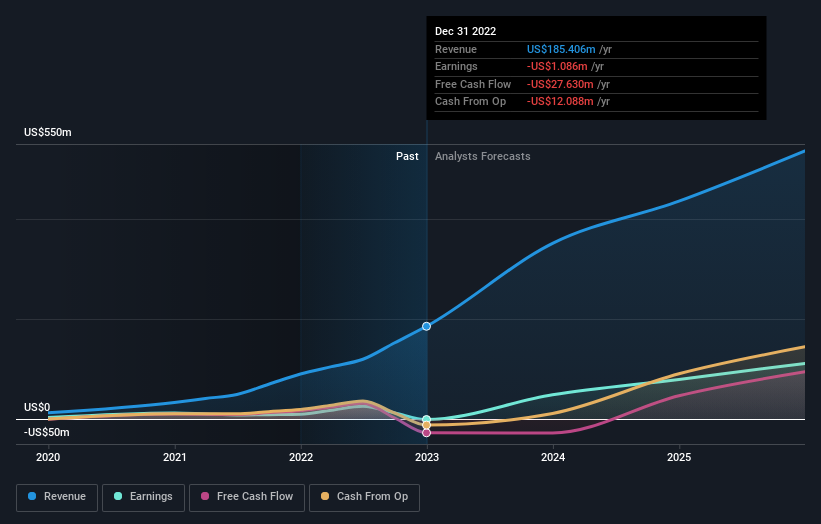

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Alphawave IP Group will earn in the future (free profit forecasts).

A Different Perspective

Alphawave IP Group boasts a total shareholder return of 14% for the last year. A substantial portion of that gain has come in the last three months, with the stock up 53% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. It's always interesting to track share price performance over the longer term. But to understand Alphawave IP Group better, we need to consider many other factors. For instance, we've identified 2 warning signs for Alphawave IP Group that you should be aware of.

Alphawave IP Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Alphawave IP Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:AWE

Alphawave IP Group

Develops and sells connectivity solutions in North America, China, the Asia Pacific, Europe, the Middle East, Africa, and the United Kingdom.

Reasonable growth potential with adequate balance sheet.