- United Kingdom

- /

- Semiconductors

- /

- AIM:KMK

Here's Why Shareholders Should Examine Kromek Group plc's (LON:KMK) CEO Compensation Package More Closely

Kromek Group plc (LON:KMK) has not performed well recently and CEO Arnab Basu will probably need to up their game. At the upcoming AGM on 08 September 2021, shareholders can hear from the board including their plans for turning around performance. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. From our analysis, we think CEO compensation may need a review in light of the recent performance.

View our latest analysis for Kromek Group

Comparing Kromek Group plc's CEO Compensation With the industry

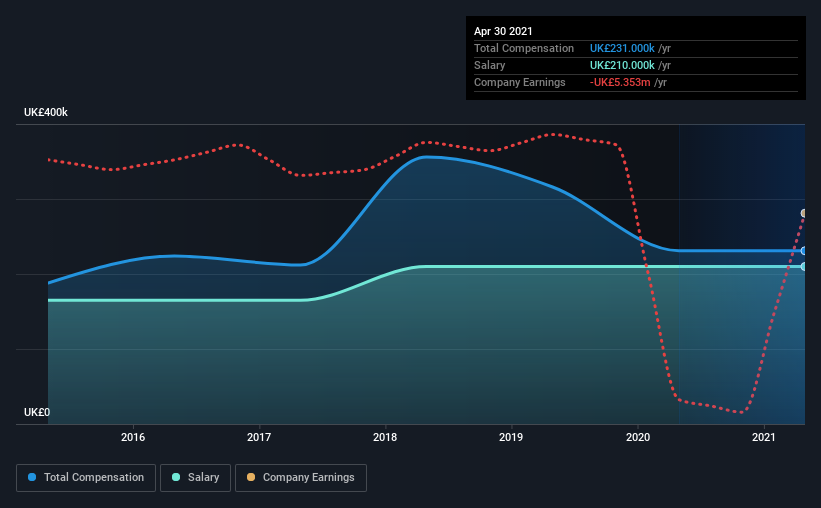

Our data indicates that Kromek Group plc has a market capitalization of UK£80m, and total annual CEO compensation was reported as UK£231k for the year to April 2021. This was the same amount the CEO received in the prior year. We note that the salary portion, which stands at UK£210.0k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under UK£145m, the reported median total CEO compensation was UK£231k. So it looks like Kromek Group compensates Arnab Basu in line with the median for the industry. Moreover, Arnab Basu also holds UK£572k worth of Kromek Group stock directly under their own name.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£210k | UK£210k | 91% |

| Other | UK£21k | UK£21k | 9% |

| Total Compensation | UK£231k | UK£231k | 100% |

Talking in terms of the industry, salary represented approximately 41% of total compensation out of all the companies we analyzed, while other remuneration made up 59% of the pie. Kromek Group is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Kromek Group plc's Growth Numbers

Over the last three years, Kromek Group plc has shrunk its earnings per share by 71% per year. Its revenue is down 21% over the previous year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Kromek Group plc Been A Good Investment?

With a three year total loss of 29% for the shareholders, Kromek Group plc would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 4 warning signs for Kromek Group (1 doesn't sit too well with us!) that you should be aware of before investing here.

Important note: Kromek Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Kromek Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kromek Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:KMK

Kromek Group

Develops, manufactures, and sells radiation detection components and bio-detection technology solutions for the advanced imaging, CBRN detection, and biological threat detection markets.

Excellent balance sheet with acceptable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026