- United Kingdom

- /

- Semiconductors

- /

- AIM:IQE

IQE plc (LON:IQE) Surges 40% Yet Its Low P/S Is No Reason For Excitement

IQE plc (LON:IQE) shares have had a really impressive month, gaining 40% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 27% over that time.

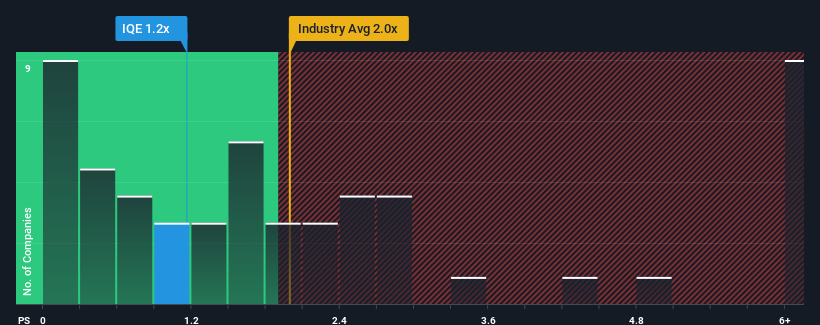

Although its price has surged higher, it would still be understandable if you think IQE is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 1.2x, considering almost half the companies in the United Kingdom's Semiconductor industry have P/S ratios above 1.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for IQE

What Does IQE's P/S Mean For Shareholders?

Recent times have been more advantageous for IQE as its revenue hasn't fallen as much as the rest of the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders probably aren't pessimistic about the share price if the company's revenue continues outplaying the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on IQE.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, IQE would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 3.0% decrease to the company's top line. As a result, revenue from three years ago have also fallen 23% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 1.3% per year during the coming three years according to the three analysts following the company. Meanwhile, the broader industry is forecast to expand by 15% each year, which paints a poor picture.

With this in consideration, we find it intriguing that IQE's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

The latest share price surge wasn't enough to lift IQE's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of IQE's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for IQE you should know about.

If these risks are making you reconsider your opinion on IQE, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:IQE

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives