- United Kingdom

- /

- Semiconductors

- /

- AIM:CYAN

Trade Alert: The Executive Chairman Of CyanConnode Holdings plc (LON:CYAN), John Cronin, Has Just Spent UK£67k Buying 39% More Shares

Whilst it may not be a huge deal, we thought it was good to see that the CyanConnode Holdings plc (LON:CYAN) Executive Chairman, John Cronin, recently bought UK£67k worth of stock, for UK£0.046 per share. While we're hesitant to get too excited about a purchase of that size, we do note it increased their holding by a solid 39%.

View our latest analysis for CyanConnode Holdings

The Last 12 Months Of Insider Transactions At CyanConnode Holdings

The Non-Executive Director William Johns-Powell made the biggest insider purchase in the last 12 months. That single transaction was for UK£77k worth of shares at a price of UK£0.024 each. Although we like to see insider buying, we note that this large purchase was at significantly below the recent price of UK£0.047. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

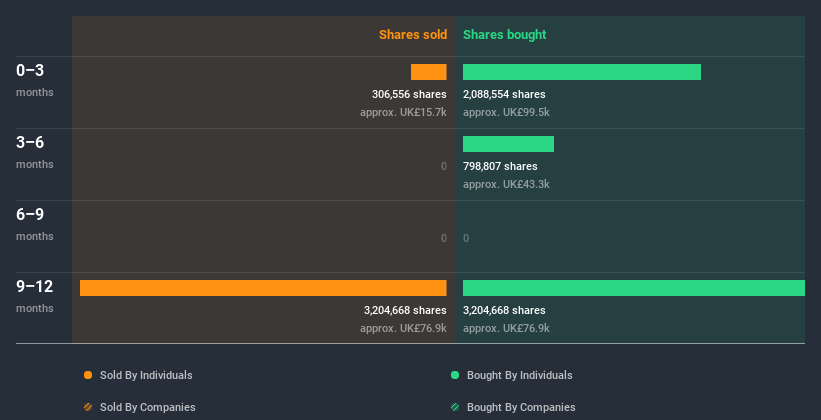

Happily, we note that in the last year insiders paid UK£218k for 6.09m shares. But they sold 3.51m shares for UK£93k. In total, CyanConnode Holdings insiders bought more than they sold over the last year. Their average price was about UK£0.036. To my mind it is good that insiders have invested their own money in the company. However, you should keep in mind that they bought when the share price was meaningfully below today's levels. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

CyanConnode Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership of CyanConnode Holdings

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. From our data, it seems that CyanConnode Holdings insiders own 14% of the company, worth about UK£1.2m. However, it's possible that insiders might have an indirect interest through a more complex structure. Overall, this level of ownership isn't that impressive, but it's certainly better than nothing!

So What Do The CyanConnode Holdings Insider Transactions Indicate?

It's certainly positive to see the recent insider purchases. And an analysis of the transactions over the last year also gives us confidence. But we don't feel the same about the fact the company is making losses. On this analysis the only slight negative we see is the fairly low (overall) insider ownership; their transactions suggest that they are quite positive on CyanConnode Holdings stock. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. Case in point: We've spotted 4 warning signs for CyanConnode Holdings you should be aware of, and 2 of these are concerning.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade CyanConnode Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:CYAN

CyanConnode Holdings

Designs, develops, and sells narrowband radio frequency (RF) mesh and cellular networks that enable Omni Internet of Things (IoT) communications in India, the United Arab Emirates, and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success