- United Kingdom

- /

- Specialty Stores

- /

- LSE:WOSG

3 UK Stocks Estimated To Be Trading Below Fair Value By Up To 49.6%

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting concerns over global demand. As these broader economic factors weigh on the market, identifying stocks that are trading below their fair value can offer potential opportunities for investors seeking to capitalize on undervalued assets in a fluctuating environment.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| ASA International Group (LSE:ASAI) | £0.795 | £1.50 | 47% |

| Gooch & Housego (AIM:GHH) | £3.99 | £7.29 | 45.2% |

| Aptitude Software Group (LSE:APTD) | £2.65 | £5.25 | 49.5% |

| Trainline (LSE:TRN) | £2.698 | £5.25 | 48.6% |

| Deliveroo (LSE:ROO) | £1.203 | £2.24 | 46.3% |

| Vanquis Banking Group (LSE:VANQ) | £0.55 | £1.02 | 45.8% |

| Ibstock (LSE:IBST) | £1.644 | £3.26 | 49.6% |

| Kromek Group (AIM:KMK) | £0.0515 | £0.10 | 49.2% |

| Fintel (AIM:FNTL) | £2.21 | £4.24 | 47.8% |

| CVS Group (AIM:CVSG) | £9.69 | £18.45 | 47.5% |

Here we highlight a subset of our preferred stocks from the screener.

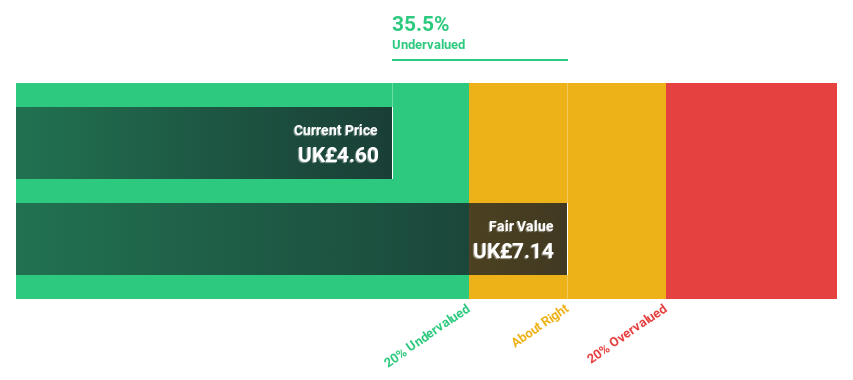

Property Franchise Group (AIM:TPFG)

Overview: The Property Franchise Group PLC operates in the United Kingdom, focusing on managing and leasing residential real estate properties, with a market cap of £262.43 million.

Operations: The company generates revenue through the management and leasing of residential real estate properties in the UK.

Estimated Discount To Fair Value: 42.2%

Property Franchise Group is trading at £4.15, significantly below its estimated fair value of £7.18, suggesting it may be undervalued based on cash flows. Earnings are forecast to grow at 29.2% annually, outpacing the UK market's average growth rate of 13.9%. However, profit margins have decreased from last year and revenue growth is expected to be moderate at 13% per year. Recent earnings show a substantial increase in sales but a decline in basic earnings per share.

- In light of our recent growth report, it seems possible that Property Franchise Group's financial performance will exceed current levels.

- Dive into the specifics of Property Franchise Group here with our thorough financial health report.

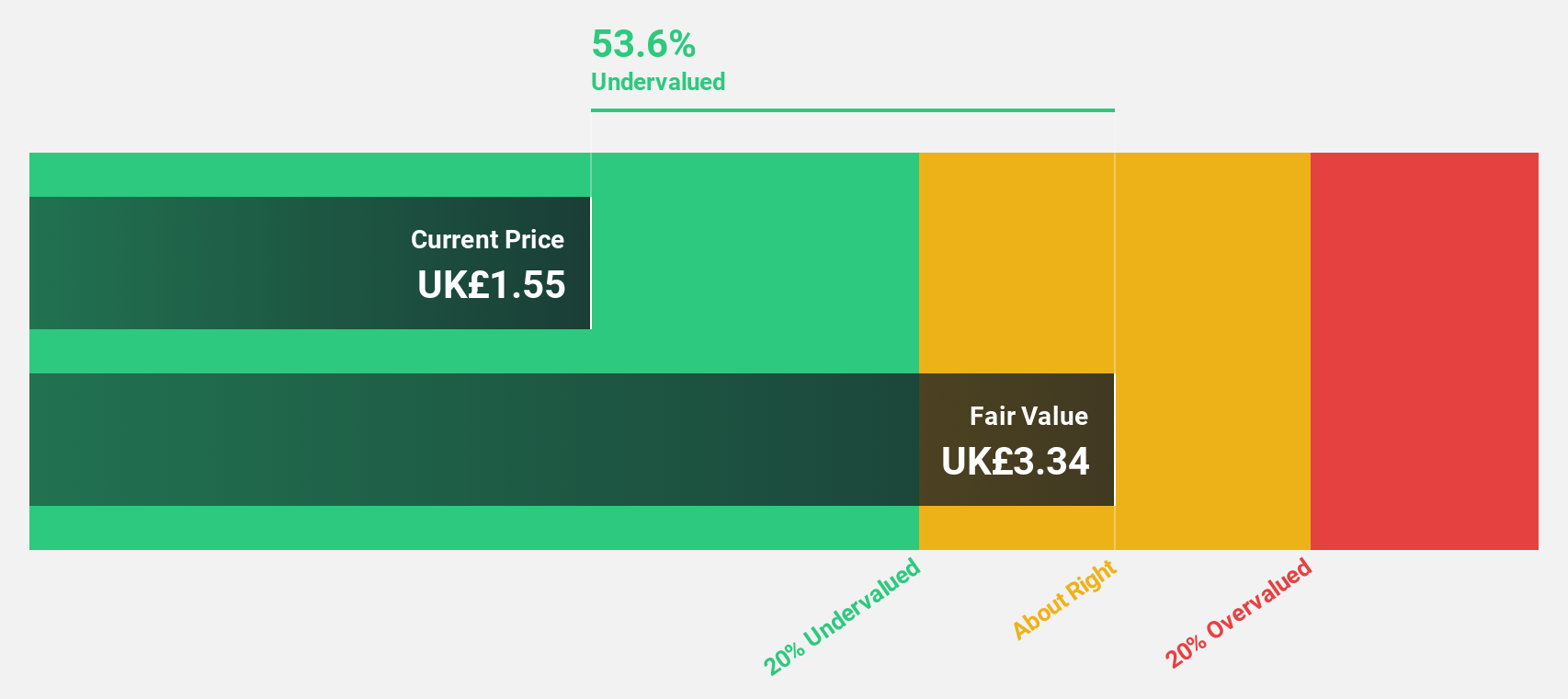

Ibstock (LSE:IBST)

Overview: Ibstock plc is a UK-based company that manufactures and sells clay and concrete building products for the residential construction sector, with a market cap of £647.76 million.

Operations: The company's revenue segments include £248.76 million from clay products and £117.44 million from concrete products, catering to the residential construction sector in the UK.

Estimated Discount To Fair Value: 49.6%

Ibstock is trading at £1.64, well below its estimated fair value of £3.26, indicating potential undervaluation based on cash flows. Earnings are projected to grow significantly at 31.65% annually, surpassing the UK market's growth rate of 13.9%. Despite this, recent results show a decline in sales and net income from the previous year, alongside a reduced dividend payout. Leadership changes include Richard Akers' appointment as Chair Designate in May 2025.

- Upon reviewing our latest growth report, Ibstock's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Ibstock's balance sheet by reading our health report here.

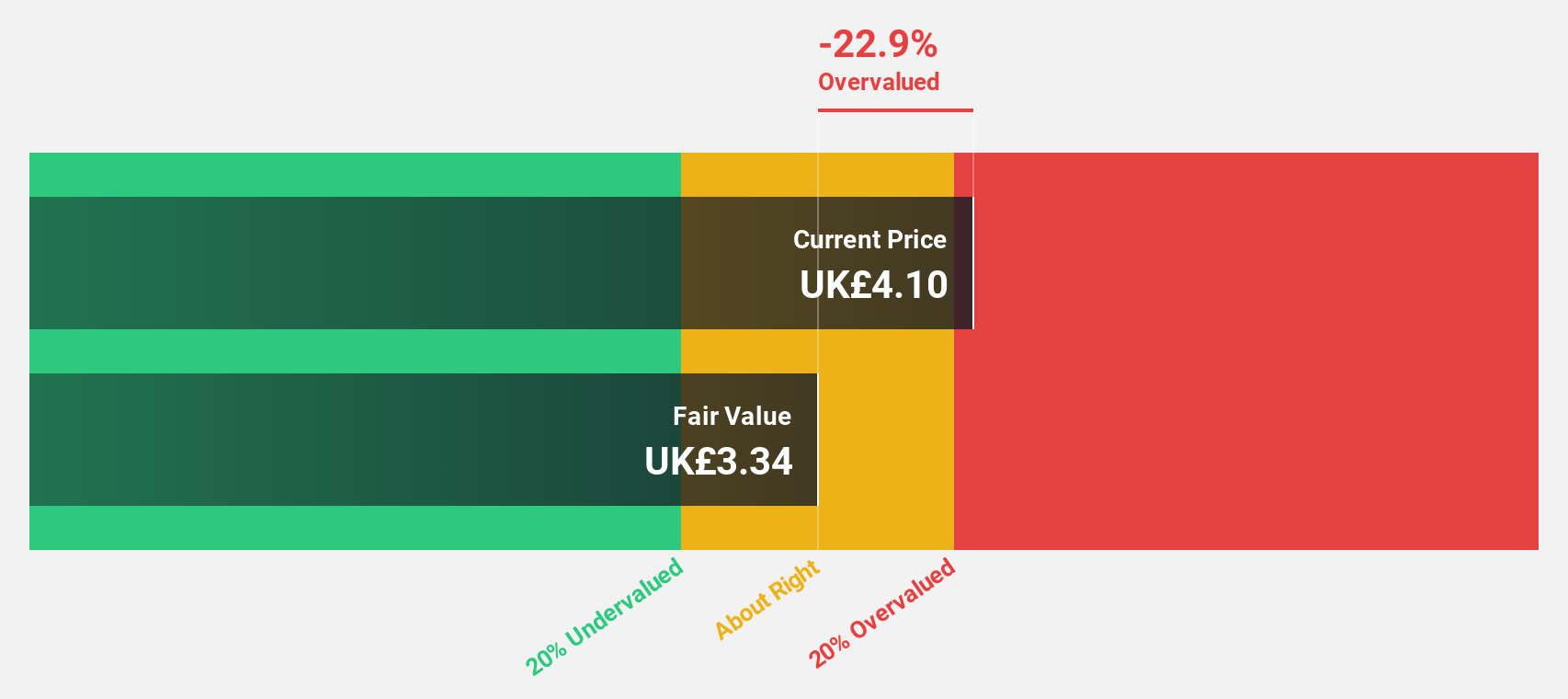

Watches of Switzerland Group (LSE:WOSG)

Overview: Watches of Switzerland Group PLC is a retailer specializing in luxury watches and jewelry across the United Kingdom, Europe, and the United States with a market cap of £824.60 million.

Operations: The company's revenue is derived from its operations in the US, generating £718.90 million, and in the UK & Europe, contributing £842.40 million.

Estimated Discount To Fair Value: 43.7%

Watches of Switzerland Group, trading at £3.44, is significantly undervalued with an estimated fair value of £6.11. Forecasted earnings growth is robust at 27.07% annually, outpacing the UK market's 13.9%. However, profit margins have decreased from 6.8% to 2.6%. The company has initiated a share buyback program for up to 10% of its issued capital, potentially enhancing shareholder value amid strong revenue growth projections of 8.8% per year.

- Our comprehensive growth report raises the possibility that Watches of Switzerland Group is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Watches of Switzerland Group.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued UK Stocks Based On Cash Flows screener has unearthed 54 more companies for you to explore.Click here to unveil our expertly curated list of 57 Undervalued UK Stocks Based On Cash Flows.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Watches of Switzerland Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WOSG

Watches of Switzerland Group

Operates as a retailer of luxury watches and jewelry in the United Kingdom, Europe, and the United States.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026