We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So should Deliveroo (LON:ROO) shareholders be worried about its cash burn? For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Deliveroo

When Might Deliveroo Run Out Of Money?

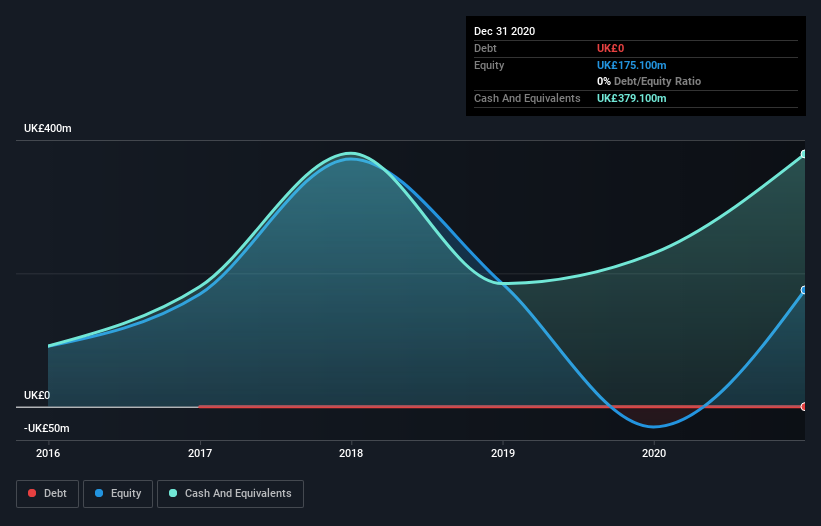

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Deliveroo last reported its balance sheet in December 2020, it had zero debt and cash worth UK£379m. In the last year, its cash burn was UK£19m. That means it had a cash runway of very many years as of December 2020. Importantly, though, analysts think that Deliveroo will reach cashflow breakeven before then. In that case, it may never reach the end of its cash runway. You can see how its cash balance has changed over time in the image below.

How Well Is Deliveroo Growing?

Deliveroo managed to reduce its cash burn by 92% over the last twelve months, which is extremely promising, when it comes to considering its need for cash. This reduction was no doubt supported by its strong revenue growth of 54% in the same period. Considering these factors, we're fairly impressed by its growth trajectory. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Deliveroo To Raise More Cash For Growth?

There's no doubt Deliveroo seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Deliveroo has a market capitalisation of UK£5.2b and burnt through UK£19m last year, which is 0.4% of the company's market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

How Risky Is Deliveroo's Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way Deliveroo is burning through its cash. In particular, we think its cash burn reduction stands out as evidence that the company is well on top of its spending. But it's fair to say that its cash burn relative to its market cap was also very reassuring. Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. An in-depth examination of risks revealed 1 warning sign for Deliveroo that readers should think about before committing capital to this stock.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you decide to trade Deliveroo, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:ROO

Deliveroo

A holding company, operates an online on-demand food and non-food delivery platform in the United Kingdom, Ireland, France, Italy, Belgium, Hong Kong, Singapore, the United Arab Emirates, Kuwait, and Qatar.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives