- United Kingdom

- /

- Specialty Stores

- /

- LSE:KGF

After Leaping 25% Kingfisher plc (LON:KGF) Shares Are Not Flying Under The Radar

Kingfisher plc (LON:KGF) shares have had a really impressive month, gaining 25% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

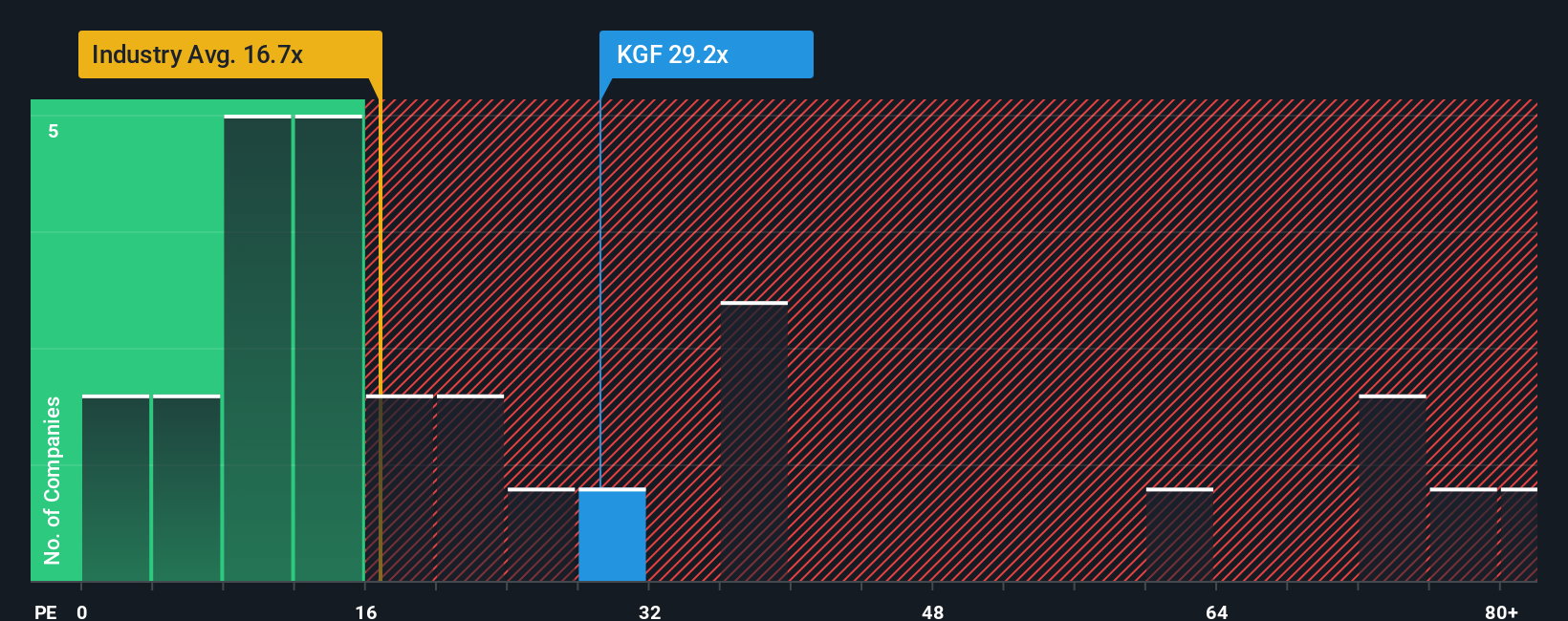

After such a large jump in price, Kingfisher's price-to-earnings (or "P/E") ratio of 29.2x might make it look like a strong sell right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios below 16x and even P/E's below 10x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, Kingfisher's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Kingfisher

How Is Kingfisher's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Kingfisher's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 44%. The last three years don't look nice either as the company has shrunk EPS by 67% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 38% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 15% each year, which is noticeably less attractive.

In light of this, it's understandable that Kingfisher's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Kingfisher's P/E

Kingfisher's P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Kingfisher's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Kingfisher that you need to be mindful of.

Of course, you might also be able to find a better stock than Kingfisher. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Kingfisher might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:KGF

Kingfisher

Supplies home improvement products and services in the United Kingdom, Ireland, France, Poland, and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success