- United Kingdom

- /

- Specialty Stores

- /

- LSE:JD.

Does JD Sports Fashion (LON:JD.) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like JD Sports Fashion (LON:JD.). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide JD Sports Fashion with the means to add long-term value to shareholders.

View our latest analysis for JD Sports Fashion

JD Sports Fashion's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. JD Sports Fashion managed to grow EPS by 10% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

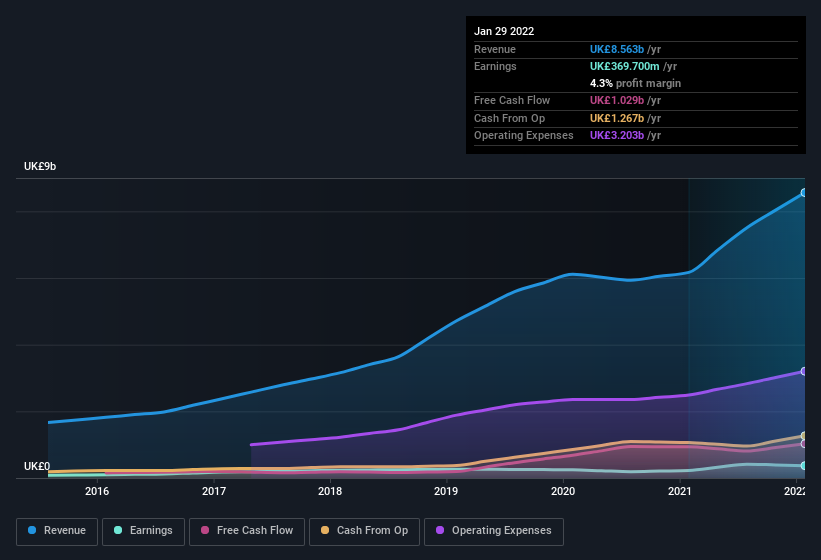

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. JD Sports Fashion shareholders can take confidence from the fact that EBIT margins are up from 7.9% to 12%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for JD Sports Fashion's future EPS 100% free.

Are JD Sports Fashion Insiders Aligned With All Shareholders?

Since JD Sports Fashion has a market capitalisation of UK£7.2b, we wouldn't expect insiders to hold a large percentage of shares. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. As a matter of fact, their holding is valued at UK£14m. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 0.2%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. A brief analysis of the CEO compensation suggests they are. The median total compensation for CEOs of companies similar in size to JD Sports Fashion, with market caps between UK£3.3b and UK£10.0b, is around UK£2.7m.

JD Sports Fashion's CEO took home a total compensation package of UK£58k in the year prior to January 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add JD Sports Fashion To Your Watchlist?

One important encouraging feature of JD Sports Fashion is that it is growing profits. The fact that EPS is growing is a genuine positive for JD Sports Fashion, but the pleasant picture gets better than that. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. However, before you get too excited we've discovered 1 warning sign for JD Sports Fashion that you should be aware of.

Although JD Sports Fashion certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:JD.

JD Sports Fashion

Engages in the retail of branded sports fashion and outdoor clothing, footwear, accessories, and equipment for kids, women, and men in the United Kingdom, Republic of Ireland, Europe, North America, and internationally.

Reasonable growth potential with proven track record.