- United Kingdom

- /

- Specialty Stores

- /

- AIM:WRKS

TheWorks.co.uk plc (LON:WRKS) Stock Rockets 80% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, TheWorks.co.uk plc (LON:WRKS) shares have been powering on, with a gain of 80% in the last thirty days. The last 30 days bring the annual gain to a very sharp 87%.

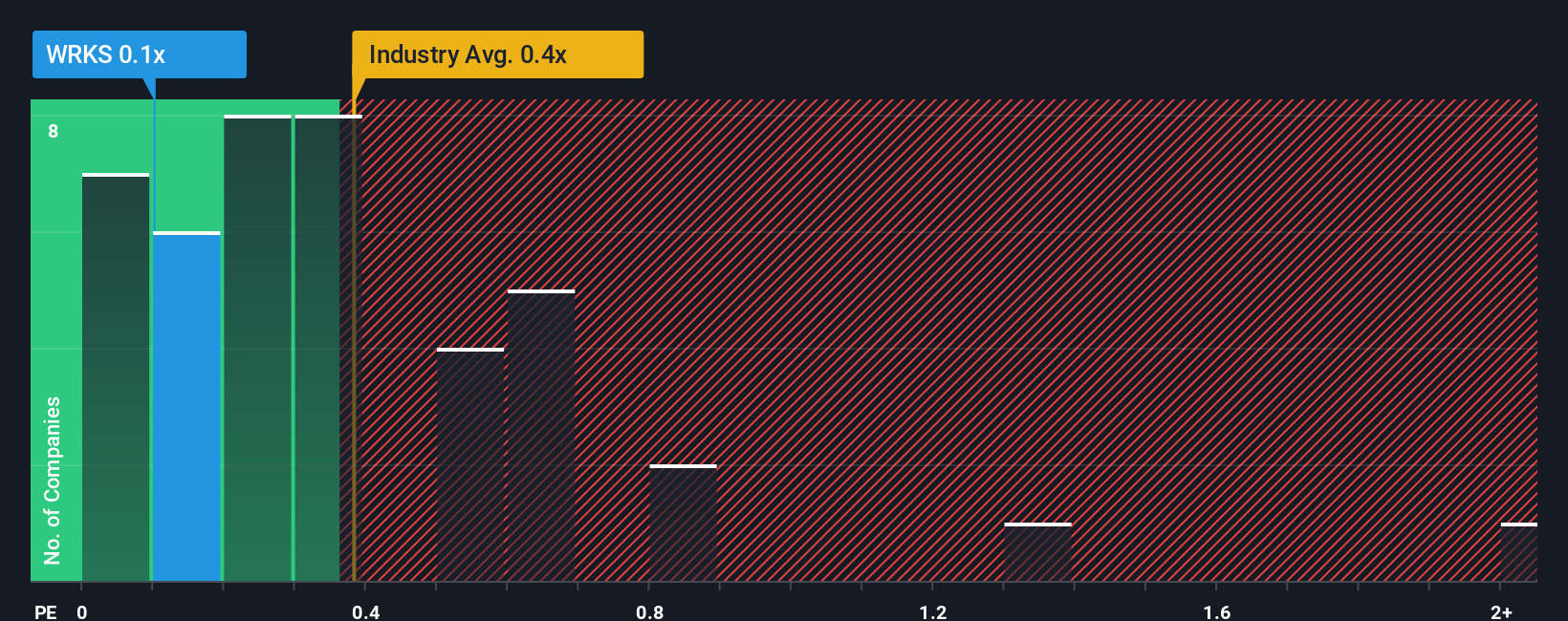

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about TheWorks.co.uk's P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Specialty Retail industry in the United Kingdom is also close to 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for TheWorks.co.uk

How Has TheWorks.co.uk Performed Recently?

Recent revenue growth for TheWorks.co.uk has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on TheWorks.co.uk will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like TheWorks.co.uk's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Although pleasingly revenue has lifted 37% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Looking ahead now, revenue is anticipated to slump, contracting by 0.7% during the coming year according to the lone analyst following the company. Meanwhile, the broader industry is forecast to expand by 3.6%, which paints a poor picture.

In light of this, it's somewhat alarming that TheWorks.co.uk's P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On TheWorks.co.uk's P/S

TheWorks.co.uk appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

While TheWorks.co.uk's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

There are also other vital risk factors to consider and we've discovered 4 warning signs for TheWorks.co.uk (1 is a bit concerning!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if TheWorks.co.uk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:WRKS

TheWorks.co.uk

Engages in the retailing of art and craft products, stationery, toys, games, books, gifts, and seasonal products in the United Kingdom and Ireland.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives