If you're looking at a mature business that's past the growth phase, what are some of the underlying trends that pop up? Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. Ultimately this means that the company is earning less per dollar invested and on top of that, it's shrinking its base of capital employed. In light of that, from a first glance at QUIZ (LON:QUIZ), we've spotted some signs that it could be struggling, so let's investigate.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on QUIZ is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.17 = UK£4.0m ÷ (UK£39m - UK£15m) (Based on the trailing twelve months to September 2022).

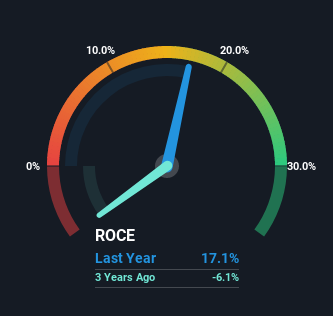

Thus, QUIZ has an ROCE of 17%. In absolute terms, that's a satisfactory return, but compared to the Specialty Retail industry average of 13% it's much better.

See our latest analysis for QUIZ

In the above chart we have measured QUIZ's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for QUIZ.

What The Trend Of ROCE Can Tell Us

The trend of ROCE at QUIZ is showing some signs of weakness. The company used to generate 24% on its capital five years ago but it has since fallen noticeably. In addition to that, QUIZ is now employing 39% less capital than it was five years ago. When you see both ROCE and capital employed diminishing, it can often be a sign of a mature and shrinking business that might be in structural decline. If these underlying trends continue, we wouldn't be too optimistic going forward.

While on the subject, we noticed that the ratio of current liabilities to total assets has risen to 39%, which has impacted the ROCE. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. While the ratio isn't currently too high, it's worth keeping an eye on this because if it gets particularly high, the business could then face some new elements of risk.

What We Can Learn From QUIZ's ROCE

To see QUIZ reducing the capital employed in the business in tandem with diminishing returns, is concerning. Unsurprisingly then, the stock has dived 93% over the last five years, so investors are recognizing these changes and don't like the company's prospects. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

Like most companies, QUIZ does come with some risks, and we've found 2 warning signs that you should be aware of.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if QUIZ might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:QUIZ

QUIZ

Provides occasion and dressy casual wear for women under the QUIZ brand name in the United Kingdom and internationally.

Fair value low.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026