- United Kingdom

- /

- Office REITs

- /

- LSE:WKP

Workspace Group (LSE:WKP) Eyes Growth with 5% Profit Rise Despite Challenges in London's SME Market

Reviewed by Simply Wall St

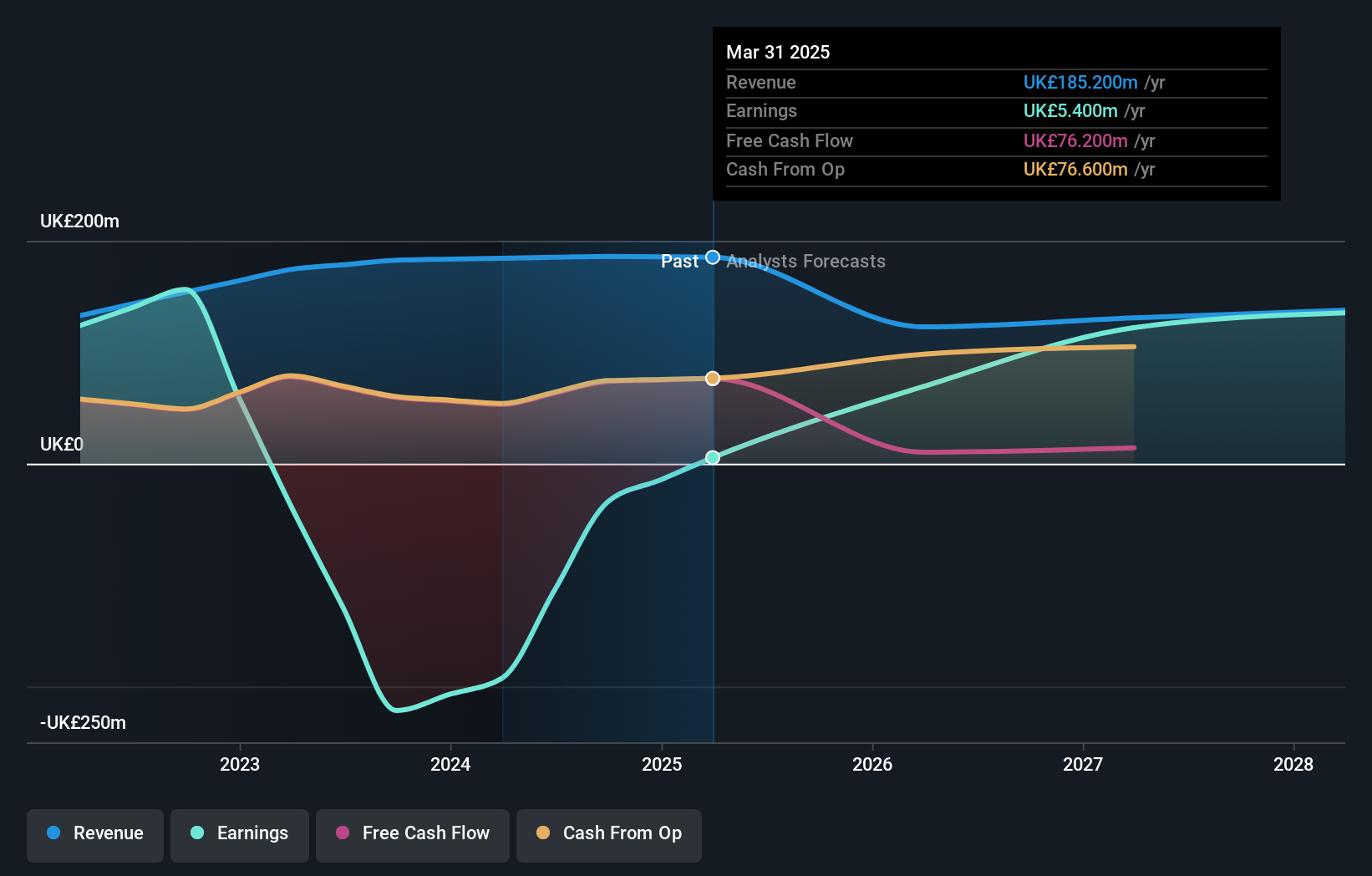

Workspace Group (LSE:WKP) is making strides in supporting London's SMEs through a focus on customer satisfaction and operational efficiency, as highlighted by CEO Lawrence Hutchings. Despite a 5% increase in trading profit, the company faces challenges such as a high net debt to equity ratio and a projected decline in revenue. The latest company report covers key areas such as financial resilience, market opportunities, and the competitive pressures impacting Workspace Group's growth trajectory.

See the full analysis report here for a deeper understanding of Workspace Group.

Innovative Factors Supporting Workspace Group

Workspace Group's focus on customer satisfaction is a standout feature, as emphasized by CEO Lawrence Hutchings. This dedication aligns with the company's mission to support London's SMEs, leveraging its 35-year history in the sector. The company's strategic market position is further bolstered by its financial resilience, as CFO David Benson reported a 5% increase in trading profit, despite a slight dip in rental income due to disposals. Maintaining a stable balance sheet with net debt at GBP 856 million, the company enjoys significant financial flexibility. Operational efficiency is another strength, with high conversion rates from inquiries to deals, indicating strong demand for its smaller units, which cover 1.1 million square feet and are less than 1,000 square feet each. Furthermore, the company's valuation, trading at a Price-To-Sales Ratio of 5.6x, is favorable compared to the industry average of 8.3x, suggesting a strong market position.

Challenges Constraining Workspace Group's Potential

Workspace faces several challenges. The company is currently unprofitable with a Return on Equity of -2.26%, and revenue is expected to decline by 1.9% annually over the next three years. This financial strain is compounded by a high net debt to equity ratio of 55.5%, which is above industry norms. Additionally, the company has experienced a drop in occupancy due to a higher-than-usual number of customer vacations, potentially indicating difficulties in retaining larger clients. Cost pressures from persistent wage inflation in the U.K. have also impacted service charge costs and administrative expenses, further straining financial resources.

Future Prospects for Workspace Group in the Market

Looking ahead, Workspace Group has significant opportunities for growth. With only a 3% market share, there is ample room for expansion, as highlighted by Hutchings' excitement about increasing market share. The company plans to enhance occupancy and rental growth in the coming months, leveraging its efficient operating platform and asset management capabilities. Ongoing refurbishment and subdivision of larger units are expected to drive rental growth, while sustainability initiatives, such as the refurbishment of Leroy House, align with industry trends and customer preferences.

Competitive Pressures and Market Risks Facing Workspace Group

However, Workspace Group must navigate several external threats. Economic and political uncertainties, including concerns around the U.K. budget, could dampen customer demand and market sentiment. Although inflation rates are decreasing, cost inflation pressures persist, mainly due to wage inflation. Additionally, the competitive environment for larger spaces and the substantial replacement costs for London offices pose significant risks. These factors could challenge Workspace's ability to maintain its market position and achieve its growth objectives.

Explore the current health of Workspace Group and how it reflects on its financial stability and growth potential.

Conclusion

Workspace Group's strategic focus on customer satisfaction and its financial flexibility, as evidenced by a 5% increase in trading profit, position it well to capitalize on growth opportunities within London's SME sector. Challenges such as a negative Return on Equity of -2.26% and a projected 1.9% annual revenue decline remain, but the company's efficient operations and planned expansions offer potential for improved occupancy and rental growth. Trading at a Price-To-Sales Ratio of 5.6x, below the industry average of 8.3x, Workspace is attractively priced relative to the broader market, though slightly above its peers, suggesting room for value realization as it addresses cost pressures and competitive risks. The company's ability to navigate economic uncertainties and enhance its market share will be crucial in achieving sustainable growth and improving profitability.

Next Steps

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workspace Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WKP

Workspace Group

Workspace is London's leading owner and operator of flexible workspace, currently managing 4.3 million sq.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives