- United Kingdom

- /

- Residential REITs

- /

- LSE:UTG

We Think The Compensation For The Unite Group plc's (LON:UTG) CEO Looks About Right

CEO Richard Smith has done a decent job of delivering relatively good performance at The Unite Group plc (LON:UTG) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 13 May 2021. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

View our latest analysis for Unite Group

Comparing The Unite Group plc's CEO Compensation With the industry

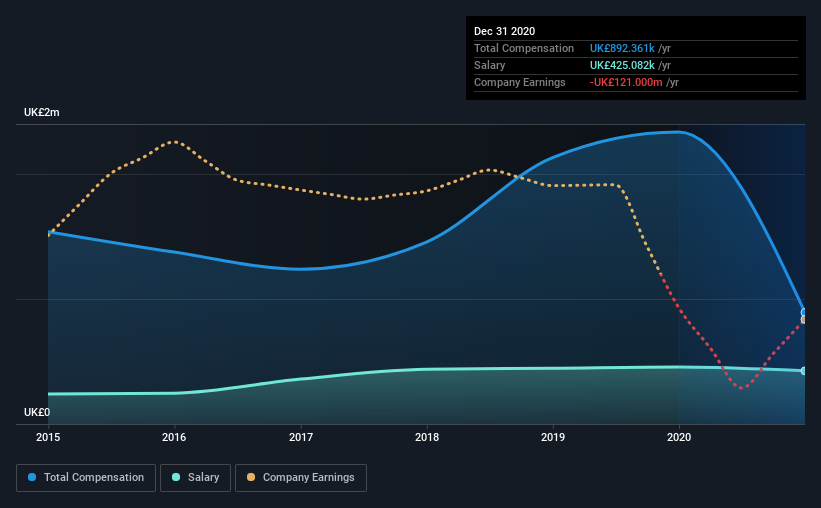

According to our data, The Unite Group plc has a market capitalization of UK£4.7b, and paid its CEO total annual compensation worth UK£892k over the year to December 2020. Notably, that's a decrease of 62% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at UK£425k.

On examining similar-sized companies in the industry with market capitalizations between UK£2.9b and UK£8.6b, we discovered that the median CEO total compensation of that group was UK£1.2m. From this we gather that Richard Smith is paid around the median for CEOs in the industry. Moreover, Richard Smith also holds UK£2.7m worth of Unite Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£425k | UK£457k | 48% |

| Other | UK£467k | UK£1.9m | 52% |

| Total Compensation | UK£892k | UK£2.3m | 100% |

Talking in terms of the industry, salary represented approximately 38% of total compensation out of all the companies we analyzed, while other remuneration made up 62% of the pie. Unite Group is paying a higher share of its remuneration through a salary in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

The Unite Group plc's Growth

The Unite Group plc has reduced its earnings per share by 92% a year over the last three years. It achieved revenue growth of 23% over the last year.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has The Unite Group plc Been A Good Investment?

We think that the total shareholder return of 43%, over three years, would leave most The Unite Group plc shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Some shareholders will be pleased by the relatively good results, however, the results could still be improved. Still, we think that until shareholders see an improvement in EPS growth, they may find it hard to justify a pay rise for the CEO.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 2 warning signs for Unite Group (of which 1 can't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Unite Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Unite Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:UTG

Unite Group

Unite Students is the UK's largest owner, manager and developer of purpose-built student accommodation (PBSA) serving the country's world-leading higher education sector.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success