Exploring Undervalued European Small Caps With Insider Buying In September 2025

Reviewed by Simply Wall St

In September 2025, the European market has been navigating a complex landscape marked by mixed performances across major indexes and concerns about global growth, particularly after weak U.S. jobs data. The pan-European STOXX Europe 600 Index ended slightly lower, reflecting cautious sentiment amid economic uncertainties and a stronger euro. In this environment, identifying promising small-cap stocks involves looking for companies with solid fundamentals that can weather economic fluctuations and potentially benefit from strategic insider buying, which might signal confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Boozt | 15.4x | 0.7x | 44.84% | ★★★★★☆ |

| Cairn Homes | 13.2x | 1.7x | 20.10% | ★★★★★☆ |

| Bytes Technology Group | 18.3x | 4.6x | 7.06% | ★★★★☆☆ |

| Sabre Insurance Group | 8.4x | 1.6x | -2.71% | ★★★★☆☆ |

| Renold | 10.6x | 0.7x | 2.90% | ★★★★☆☆ |

| CVS Group | 45.4x | 1.3x | 37.66% | ★★★★☆☆ |

| Oxford Instruments | 40.7x | 2.1x | 15.68% | ★★★☆☆☆ |

| Nyab | 22.0x | 1.0x | 36.12% | ★★★☆☆☆ |

| Instabank | 11.2x | 3.0x | 19.51% | ★★★☆☆☆ |

| Social Housing REIT | NA | 7.1x | 32.97% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

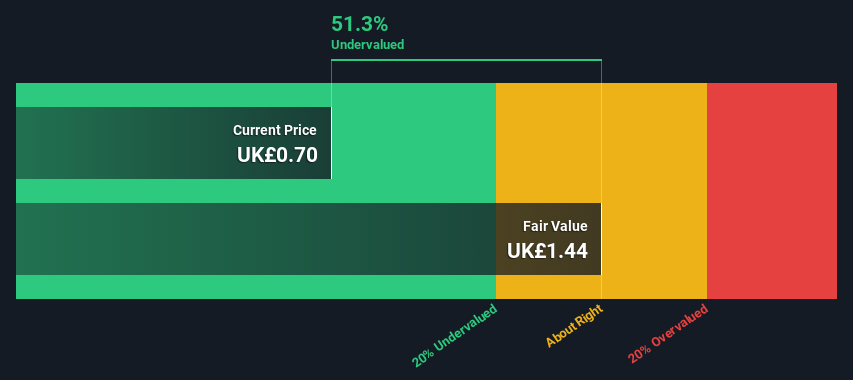

Social Housing REIT (LSE:SOHO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Social Housing REIT focuses on providing high-quality, affordable housing solutions for vulnerable individuals across the UK and has a market cap of approximately £0.38 billion.

Operations: Social Housing REIT generates revenue primarily through its rental income, with a notable gross profit margin reaching as high as 88.59% in recent periods. The company incurs costs related to COGS and operating expenses, including general and administrative expenses, which have fluctuated over time. Notably, recent data shows a decline in net income margin into negative territory due to increasing non-operating expenses.

PE: -6.2x

Social Housing REIT, a smaller player in the European market, has faced challenges with earnings declining by 37% annually over the past five years. Recent reports show a net loss of £2.86 million for H1 2025 compared to a net income of £5.3 million last year, indicating financial hurdles. Despite these setbacks, there's insider confidence as insiders have been purchasing shares since June 2025. The company relies entirely on external borrowing, which adds risk but also suggests potential for strategic growth if managed well.

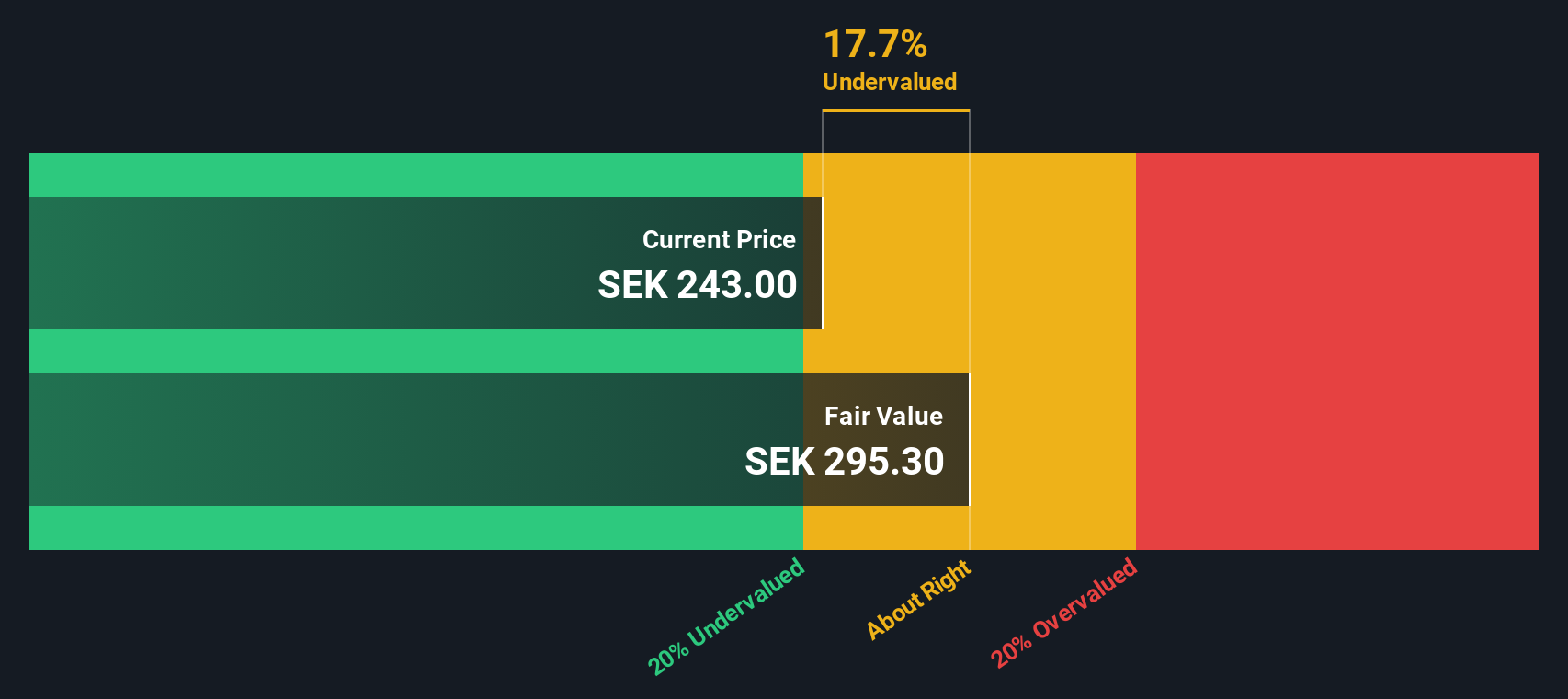

Beijer Alma (OM:BEIA B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Beijer Alma is an industrial group focusing on manufacturing and distributing springs, wire products, and technology solutions through its subsidiaries Lesjöfors and Beijer Tech, with a market cap of SEK 8.45 billion.

Operations: Lesjöfors and Beijer Tech are the primary revenue streams, contributing SEK 4.99 billion and SEK 2.49 billion, respectively. The gross profit margin has shown fluctuations over time, with a recent figure of 30.75% as of June 2025. Operating expenses have consistently been a significant component of costs, with general and administrative expenses being notable contributors within this category.

PE: 23.8x

Beijer Alma, a European small cap, presents an intriguing investment case with its recent insider confidence demonstrated by share purchases earlier this year. Despite high debt levels and reliance on external borrowing, the company has shown resilience with sales reaching SEK 2 billion in Q2 2025, up from SEK 1.9 billion a year ago. Although net income dipped to SEK 82 million from SEK 142 million last year, earnings are forecasted to grow annually by over 15%, suggesting potential for future growth amidst financial challenges.

- Dive into the specifics of Beijer Alma here with our thorough valuation report.

Explore historical data to track Beijer Alma's performance over time in our Past section.

Diös Fastigheter (OM:DIOS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Diös Fastigheter is a Swedish real estate company focused on owning and managing properties across several regions, with a market capitalization of SEK 8.59 billion.

Operations: The company generates revenue from various regions, with Luleå and Dalarna contributing significantly. Over recent periods, its gross profit margin has shown an upward trend, reaching 69.07% by September 2024. Operating expenses have remained relatively stable, while non-operating expenses have fluctuated significantly, impacting net income margins.

PE: 15.5x

Diös Fastigheter stands out in the European small-cap landscape with its strategic focus on transforming underutilized properties into vibrant community assets. Recent insider confidence is demonstrated by an independent director acquiring 15,000 shares for approximately SEK 987,450, signaling belief in future prospects. Despite relying solely on external borrowing for funding, Diös continues to innovate by signing a significant 10-year lease with AcadeMedia to develop educational facilities. This initiative is set to enhance income from property management by around 0.7%.

- Click to explore a detailed breakdown of our findings in Diös Fastigheter's valuation report.

Evaluate Diös Fastigheter's historical performance by accessing our past performance report.

Summing It All Up

- Investigate our full lineup of 49 Undervalued European Small Caps With Insider Buying right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijer Alma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BEIA B

Beijer Alma

Engages in component manufacturing and industrial trading businesses in Sweden, rest of Nordic Region, rest of Europe, North America, Asia, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives