- Sweden

- /

- Real Estate

- /

- OM:LOGI A

European Insider Buying Highlights 3 Undervalued Small Caps

Reviewed by Simply Wall St

In recent weeks, European markets have experienced a pullback, with the pan-European STOXX Europe 600 Index ending 1.24% lower amid concerns about overvaluation in artificial intelligence-related stocks. As major stock indexes like Germany’s DAX and France’s CAC 40 face declines, investors are increasingly focusing on small-cap opportunities that may offer value amidst broader market volatility. In this context, identifying stocks with strong fundamentals and potential for growth becomes crucial for navigating the current landscape effectively.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 12.1x | 1.5x | 29.89% | ★★★★★★ |

| Bytes Technology Group | 15.8x | 3.8x | 26.04% | ★★★★★☆ |

| Foxtons Group | 10.0x | 0.9x | 43.16% | ★★★★★☆ |

| Boozt | 17.9x | 0.8x | 47.91% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 26.57% | ★★★★★☆ |

| Nyab | 18.0x | 0.8x | 36.80% | ★★★★☆☆ |

| Senior | 24.8x | 0.8x | 25.46% | ★★★★☆☆ |

| Social Housing REIT | NA | 6.8x | 38.02% | ★★★★☆☆ |

| Fastighets AB Trianon | 9.7x | 4.7x | -20.83% | ★★★★☆☆ |

| Fiskars Oyj Abp | 40.3x | 0.9x | 23.53% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Social Housing REIT (LSE:SOHO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Social Housing REIT focuses on investing in residential properties for social housing purposes, with a market capitalization of approximately £0.38 billion.

Operations: The company generates revenue primarily from its residential REIT segment, with recent figures showing £39.07 million. Its cost structure includes a notable COGS of £7.04 million and operating expenses of £6.67 million, impacting profitability metrics such as the net income margin, which was -1.14% in the latest period analyzed. The gross profit margin has shown an upward trend reaching 88.43% by September 2023 before declining to 81.98% by mid-2025, reflecting changes in cost management and revenue generation efficiency over time.

PE: -6.0x

Social Housing REIT, a smaller player in the European market, faces challenges with declining earnings, down 37.2% annually over five years. Recent financials show a net loss of £2.86 million for H1 2025 despite stable revenue at £19.82 million. The company relies on external borrowing for funding, indicating higher risk exposure without customer deposits to cushion liabilities. Insider confidence is evident with recent share purchases by key figures, hinting at potential internal optimism about future prospects amidst board restructuring and strategic leadership changes effective March 2026.

Secure Trust Bank (LSE:STB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Secure Trust Bank is a UK-based financial institution that provides a range of banking services, including consumer and business finance, with a market capitalization of £0.17 billion.

Operations: Secure Trust Bank derives its revenue primarily from Consumer Finance, with Retail Finance contributing £77.90 million and Vehicle Finance adding £17.80 million, while Business Finance segments include Commercial and Real Estate at £19.60 million and £27.30 million respectively. The company's net income margin has shown variation, reaching 26.09% in the first quarter of 2021 before fluctuating to 13.86% by the end of 2024, indicating changes in profitability over time amidst steady gross profit margins at 100%.

PE: 8.2x

Secure Trust Bank, a smaller player in the European banking sector, is drawing attention due to its potential for value. Despite a high level of bad loans at 4.5% and low allowances (61%), earnings are expected to grow by 41.23% annually. Insider confidence is evident as an insider acquired 25,000 shares worth £229K in September 2025, reflecting strong belief in future prospects. The bank's recent inclusion in the S&P Global BMI Index and strategic board changes further underscore its evolving position within the industry.

- Click here to discover the nuances of Secure Trust Bank with our detailed analytical valuation report.

Assess Secure Trust Bank's past performance with our detailed historical performance reports.

Logistea (OM:LOGI A)

Simply Wall St Value Rating: ★★★☆☆☆

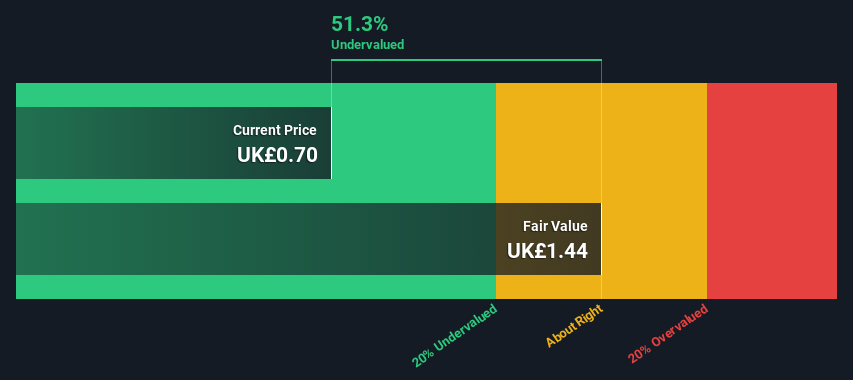

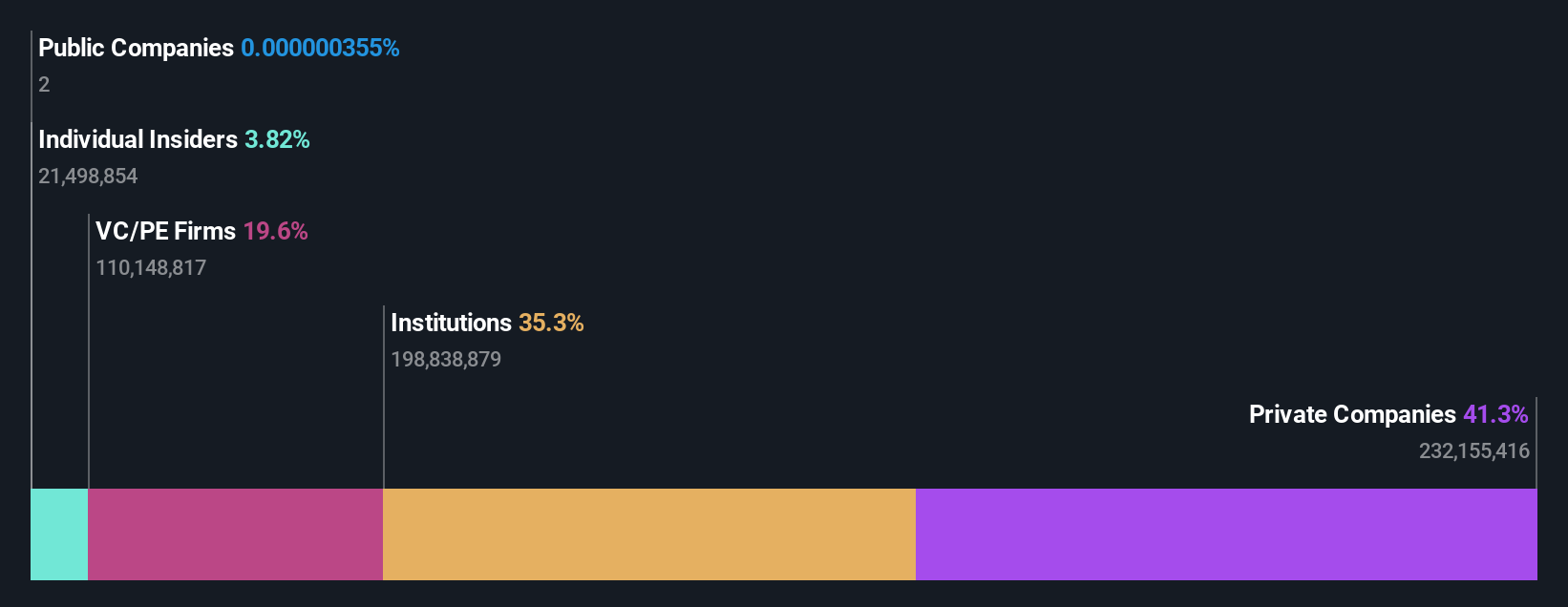

Overview: Logistea is a Swedish company focused on real estate management and development, specializing in logistics and industrial properties, with a market capitalization of SEK 1.09 billion.

Operations: Logistea's revenue model is primarily driven by its gross profit, which has shown a notable increase from SEK 159.18 million to SEK 929.0 million over the analyzed periods. The company experienced fluctuations in net income margin, with significant variations in non-operating expenses impacting overall profitability. Operating expenses and general & administrative expenses have been key cost components, influencing the net income outcomes across different periods. Notably, Logistea's gross profit margin reached as high as 89.85%, indicating efficient management of production costs relative to revenue generation at certain points in time.

PE: 9.3x

Logistea, a European property company, is expanding its portfolio with strategic acquisitions and long-term leases. Recent deals include acquiring properties in Sweden for SEK 339 million, generating annual rental income of SEK 29.2 million. Despite strong Q3 earnings with net income jumping to SEK 268 million from SEK 16 million last year, future earnings may decline by an average of 11.8% annually over the next three years due to reliance on external borrowing for funding.

- Unlock comprehensive insights into our analysis of Logistea stock in this valuation report.

Gain insights into Logistea's historical performance by reviewing our past performance report.

Where To Now?

- Click through to start exploring the rest of the 58 Undervalued European Small Caps With Insider Buying now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LOGI A

Logistea

Engages in the real estate business in Sweden, Norway, Denmark, the Netherlands, Germany, Finland, Belgium, and Poland.

Proven track record and fair value.

Market Insights

Community Narratives