- United Kingdom

- /

- REITS

- /

- LSE:SHC

Analysts Have Made A Financial Statement On Capital & Counties Properties PLC's (LON:CAPC) Full-Year Report

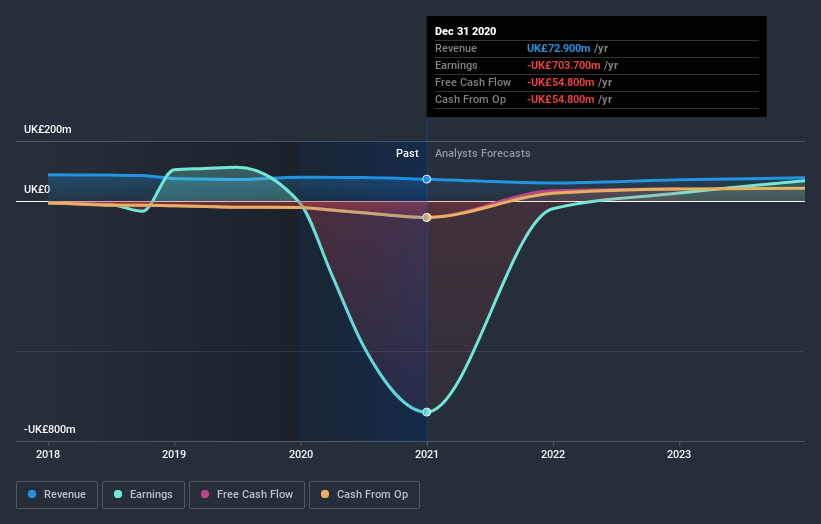

Last week, you might have seen that Capital & Counties Properties PLC (LON:CAPC) released its full-year result to the market. The early response was not positive, with shares down 6.7% to UK£1.68 in the past week. Revenues of UK£73m crushed expectations, although expenses also blew out, with the company reporting a statutory loss per share of UK£0.82, 34% bigger than analysts expected. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

View our latest analysis for Capital & Counties Properties

Taking into account the latest results, the seven analysts covering Capital & Counties Properties provided consensus estimates of UK£60.0m revenue in 2021, which would reflect a chunky 18% decline on its sales over the past 12 months. Earnings are expected to improve, with Capital & Counties Properties forecast to report a statutory profit of UK£0.033 per share. Before this earnings announcement, the analysts had been modelling revenues of UK£58.8m and losses of UK£0.12 per share in 2021. So we can see there's been a pretty clear upgrade to expectations following the latest results, with a modest lift to revenues expected to lead to profitability earlier than previously forecast.

Althoughthe analysts have upgraded their earnings estimates, there was no change to the consensus price target of UK£1.65, suggesting that the forecast performance does not have a long term impact on the company's valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Capital & Counties Properties, with the most bullish analyst valuing it at UK£2.11 and the most bearish at UK£1.20 per share. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. One more thing stood out to us about these estimates, and it's the idea that Capital & Counties Properties' decline is expected to accelerate, with revenues forecast to fall at an annualised rate of 18% to the end of 2021. This tops off a historical decline of 8.7% a year over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue grow 4.0% per year. So while a broad number of companies are forecast to grow, unfortunately Capital & Counties Properties is expected to see its sales affected worse than other companies in the industry.

The Bottom Line

The most important thing to take away is that the analysts now expect Capital & Counties Properties to become profitable next year, compared to previous expectations that it would report a loss. They also upgraded their revenue estimates for next year, even though sales are expected to grow slower than the wider industry. The consensus price target held steady at UK£1.65, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Capital & Counties Properties going out to 2023, and you can see them free on our platform here..

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Capital & Counties Properties , and understanding it should be part of your investment process.

If you’re looking to trade Capital & Counties Properties, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:SHC

Shaftesbury Capital

Shaftesbury Capital PLC ("Shaftesbury Capital") is the leading central London mixed-use REIT and is a constituent of the FTSE250 Index.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026