- United Kingdom

- /

- Health Care REITs

- /

- LSE:AGR

3 Undervalued Small Caps In United Kingdom With Insider Activity

Reviewed by Simply Wall St

The United Kingdom's stock market has been experiencing turbulence, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China and global economic uncertainties. As major economies grapple with post-pandemic recovery challenges, identifying undervalued small-cap stocks with insider activity can offer promising opportunities for investors seeking to navigate these volatile conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 24.5x | 5.5x | 13.26% | ★★★★★☆ |

| GB Group | NA | 3.0x | 34.96% | ★★★★★☆ |

| Norcros | 7.4x | 0.5x | 4.23% | ★★★★☆☆ |

| Mercia Asset Management | NA | 4.8x | 49.46% | ★★★★☆☆ |

| Foxtons Group | 26.4x | 1.2x | 45.61% | ★★★★☆☆ |

| Harworth Group | 14.1x | 7.4x | -509.59% | ★★★★☆☆ |

| CVS Group | 22.0x | 1.2x | 46.51% | ★★★★☆☆ |

| Hochschild Mining | NA | 1.6x | 46.19% | ★★★★☆☆ |

| Diaceutics | NA | 4.5x | -2.65% | ★★★☆☆☆ |

| Hammerson | NA | 5.9x | -56.48% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

Assura (LSE:AGR)

Simply Wall St Value Rating: ★★★☆☆☆

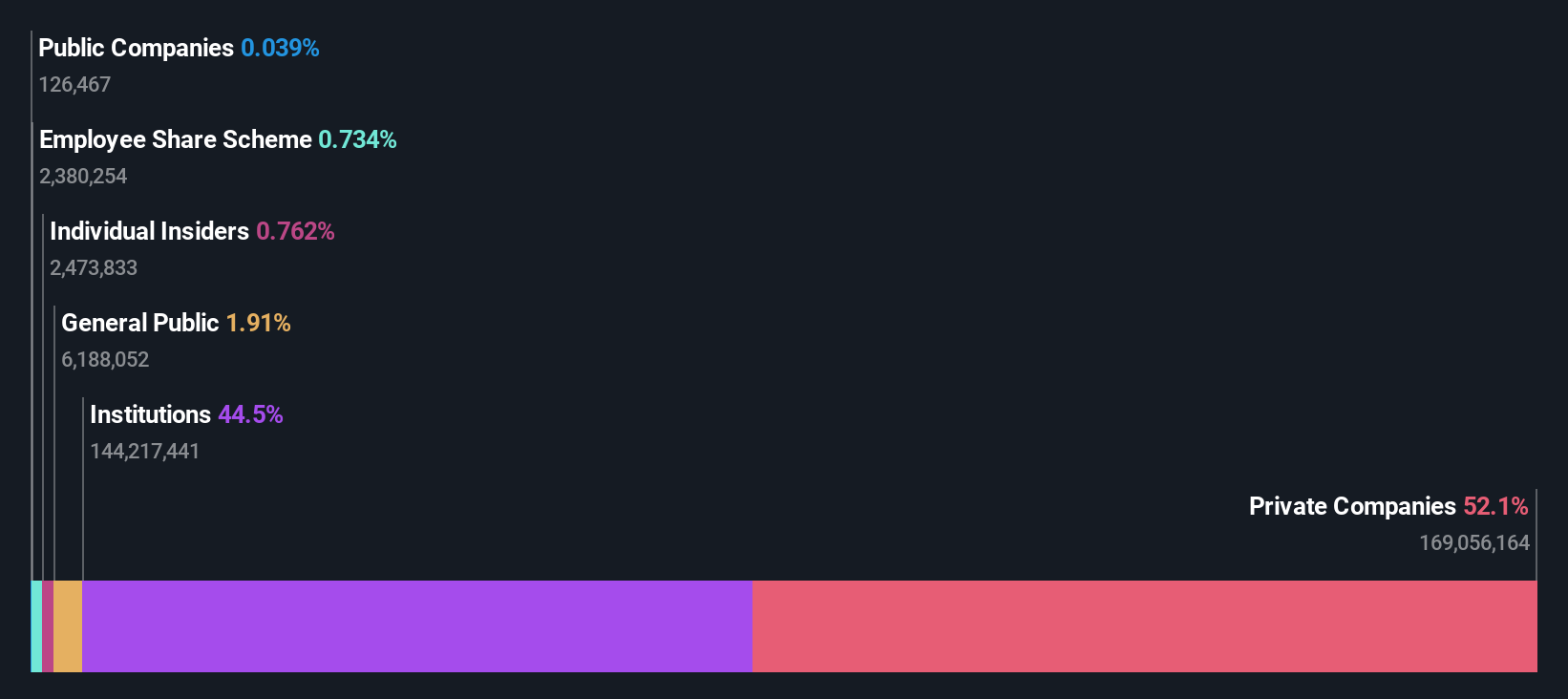

Overview: Assura is a UK-based healthcare real estate investment trust specializing in the development and management of primary care properties, with a market cap of approximately £2.22 billion.

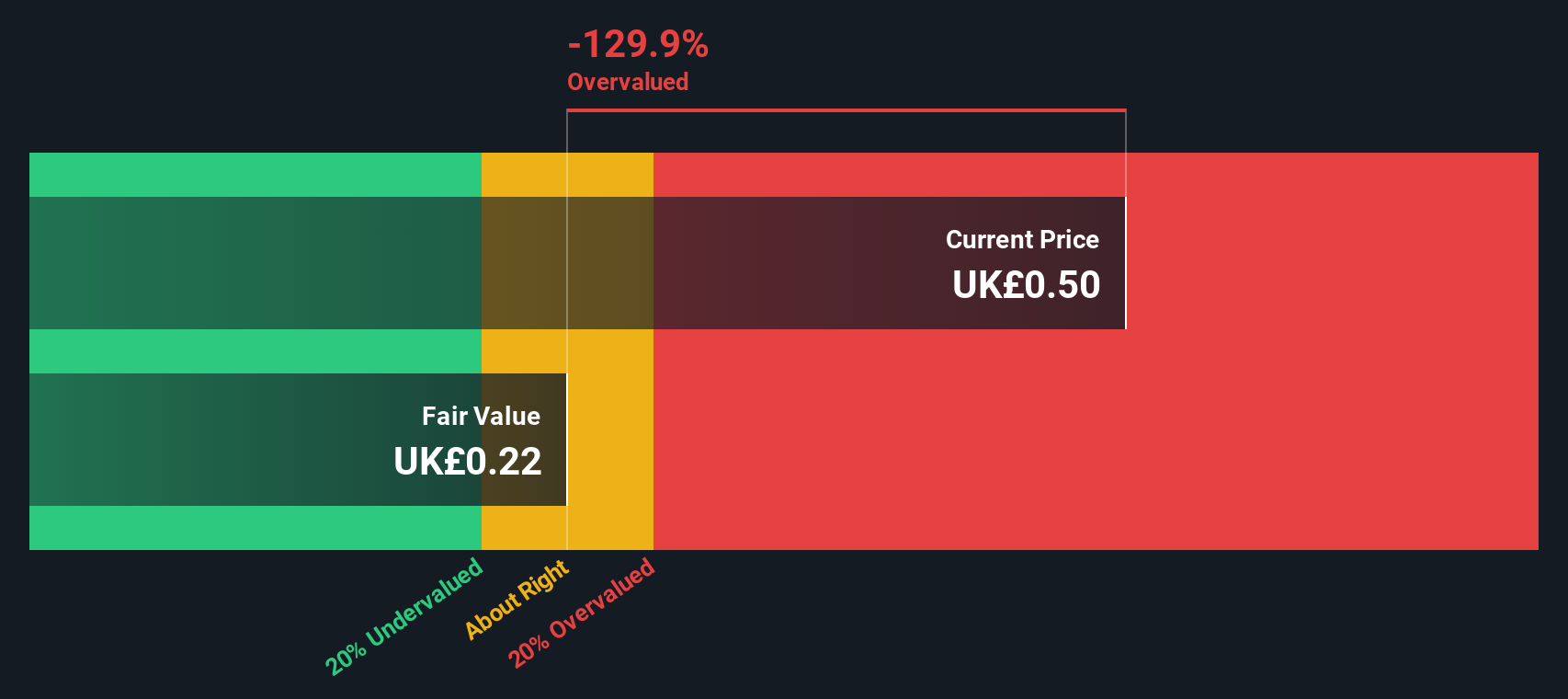

Operations: The company generates revenue primarily from its core segment, reaching £157.8 million as of the latest period. Gross profit margin has shown a downward trend from 95.76% in June 2017 to 90.81% in March 2024, while net income has fluctuated significantly, turning negative in recent periods with a net loss of £28.8 million by March 2024 due to high non-operating expenses reaching £158.1 million. Operating expenses have remained relatively stable around £14 million recently.

PE: -43.2x

Assura, a specialist healthcare property investor, reported sales of £157.8 million for the year ending March 31, 2024, up from £150.4 million the previous year. Despite a net loss of £28.8 million, down from £119.2 million last year, insider confidence remains high with recent share purchases by executives in June 2024. The company announced a joint venture with Universities Superannuation Scheme Limited worth £250 million to invest in NHS infrastructure and plans to recycle proceeds into new acquisitions and developments across medical centres and broader healthcare markets.

- Click here to discover the nuances of Assura with our detailed analytical valuation report.

Explore historical data to track Assura's performance over time in our Past section.

Harworth Group (LSE:HWG)

Simply Wall St Value Rating: ★★★★☆☆

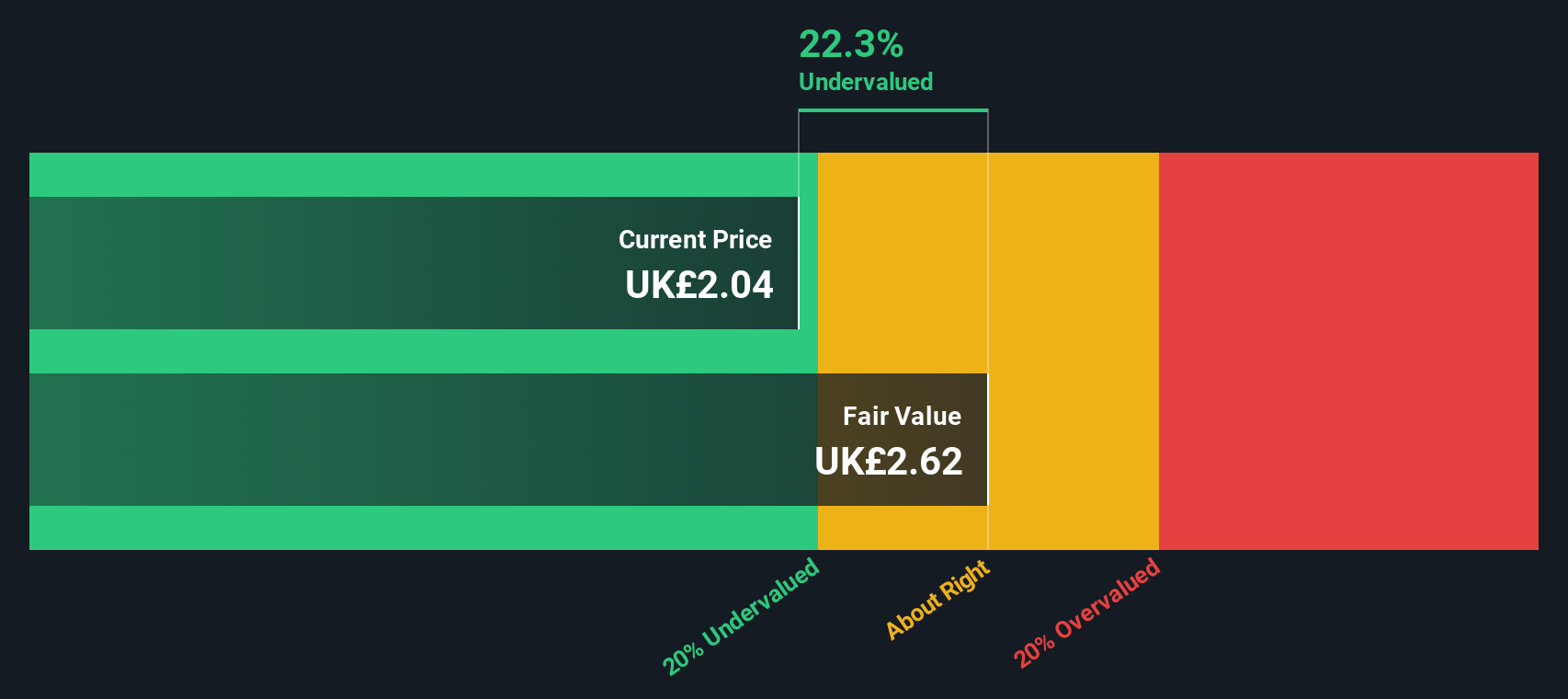

Overview: Harworth Group is a UK-based company specializing in the regeneration of brownfield land and property development, with a market cap of approximately £0.48 billion.

Operations: Harworth Group's revenue primarily comes from Income Generation (£23.41 million) and Capital Growth activities, including the Sale of Development Properties (£46.73 million). The company has seen fluctuations in its net profit margin, which reached a high of 10.50% in June 2015 but turned negative at -0.40% by June 2023.

PE: 14.1x

Harworth Group, a UK-based company focused on land and property development, recently announced significant insider confidence with Alastair Lyons purchasing 50,000 shares for approximately £80,000 in June 2024. This purchase increased their holdings by 14%. The company secured planning permission for a major industrial hub at Gascoigne Interchange in Leeds and appointed Gareth Thomas as development director for the Midlands. Harworth's earnings are forecasted to grow by nearly 26% annually.

- Click here and access our complete valuation analysis report to understand the dynamics of Harworth Group.

Gain insights into Harworth Group's historical performance by reviewing our past performance report.

International Personal Finance (LSE:IPF)

Simply Wall St Value Rating: ★★★★★★

Overview: International Personal Finance operates as a provider of consumer credit through its digital and home credit segments in Mexico and Europe, with a market cap of approximately £0.25 billion.

Operations: The company generates revenue primarily from Digital (£128.10 million), Mexico Home Credit (£276.10 million), and European Home Credit (£355.30 million) segments. Gross profit margin has shown a notable trend, peaking at 89.76% in December 2021 before declining to 78.97% by June 2024. Operating expenses and non-operating expenses are significant cost components, with general & administrative expenses consistently being the largest part of operating costs across periods analyzed.

PE: 6.8x

International Personal Finance, a smaller UK company, has shown potential for growth with recent insider confidence. In the first half of 2024, it reported sales of £371.7 million and net income of £19.7 million. The company announced a share repurchase program worth £15 million starting August 5, 2024, aiming to return capital to shareholders and reduce share capital. Additionally, they raised their interim dividend by 9.7% to 3.4 pence per share due to strong performance and positive growth prospects for the year ahead.

Key Takeaways

- Take a closer look at our Undervalued UK Small Caps With Insider Buying list of 21 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AGR

Assura

Assura plc is a national healthcare premises specialist and UK REIT based in Altrincham, UK - caring for more than 600 primary healthcare buildings, from which over six million patients are served.

6 star dividend payer and fair value.