- United Kingdom

- /

- REITS

- /

- LSE:AEWU

AEW UK REIT plc's (LON:AEWU) Has Been On A Rise But Financial Prospects Look Weak: Is The Stock Overpriced?

AEW UK REIT's (LON:AEWU) stock is up by a considerable 11% over the past three months. However, in this article, we decided to focus on its weak fundamentals, as long-term financial performance of a business is what ultimatley dictates market outcomes. In this article, we decided to focus on AEW UK REIT's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for AEW UK REIT

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for AEW UK REIT is:

3.5% = UK£5.2m ÷ UK£147m (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. Another way to think of that is that for every £1 worth of equity, the company was able to earn £0.04 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of AEW UK REIT's Earnings Growth And 3.5% ROE

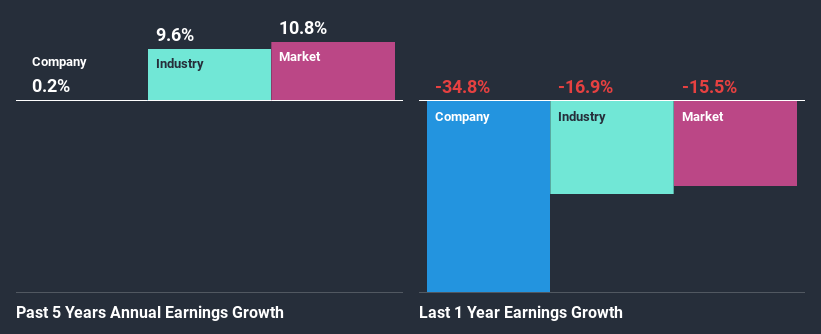

When you first look at it, AEW UK REIT's ROE doesn't look that attractive. We then compared the company's ROE to the broader industry and were disappointed to see that the ROE is lower than the industry average of 5.7%. Therefore, AEW UK REIT's flat earnings over the past five years can possibly be explained by the low ROE amongst other factors.

We then compared AEW UK REIT's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 9.6% in the same period, which is a bit concerning.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if AEW UK REIT is trading on a high P/E or a low P/E, relative to its industry.

Is AEW UK REIT Making Efficient Use Of Its Profits?

AEW UK REIT seems to be paying out most of its income as dividends judging by its three-year median payout ratio of 95%, meaning that the company retains only 5.2% of its profits. However, this is typical for REITs as they are often required by law to distribute most of their earnings. Accordingly, this suggests that the company's earnings growth was miniscule as a result of the high payout.

Moreover, AEW UK REIT has been paying dividends for five years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer dividends over earnings growth. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 100%.

Summary

Overall, we would be extremely cautious before making any decision on AEW UK REIT. Because the company is not reinvesting much into the business, and given the low ROE, it's not surprising to see the lack or absence of growth in its earnings. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. To gain further insights into AEW UK REIT's past profit growth, check out this visualization of past earnings, revenue and cash flows.

When trading AEW UK REIT or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:AEWU

AEW UK REIT

AEW UK REIT plc (LSE: AEWU) aims to deliver an attractive total return to shareholders by investing predominantly in smaller commercial properties (typically less than £15 million), on shorter occupational leases in strong commercial locations across the United Kingdom.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives