- United Kingdom

- /

- Real Estate

- /

- OFEX:ZNT

The Market Lifts Zentra Group PLC (LON:ZNT) Shares 67% But It Can Do More

Zentra Group PLC (LON:ZNT) shareholders are no doubt pleased to see that the share price has bounced 67% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 72% share price decline over the last year.

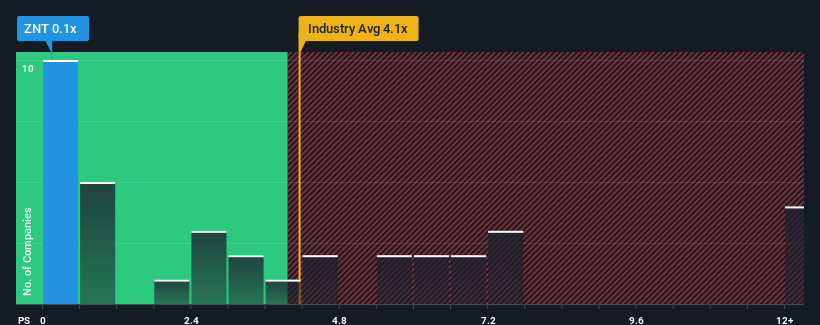

Although its price has surged higher, Zentra Group may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Real Estate industry in the United Kingdom have P/S ratios greater than 4.1x and even P/S higher than 7x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Zentra Group

How Has Zentra Group Performed Recently?

As an illustration, revenue has deteriorated at Zentra Group over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Zentra Group will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zentra Group's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Zentra Group?

In order to justify its P/S ratio, Zentra Group would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.0%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Comparing that to the industry, which is predicted to shrink 6.8% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

In light of this, it's quite peculiar that Zentra Group's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What We Can Learn From Zentra Group's P/S?

Even after such a strong price move, Zentra Group's P/S still trails the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at the figures, it's surprising to see Zentra Group currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this positive performance. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

Plus, you should also learn about these 4 warning signs we've spotted with Zentra Group.

If you're unsure about the strength of Zentra Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Zentra Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OFEX:ZNT

Zentra Group

Operates as a property development and management company in the United Kingdom.

Good value with slight risk.

Market Insights

Community Narratives