- United Kingdom

- /

- Diversified Financial

- /

- AIM:MAB1

3 High Growth UK Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

In the last week, the United Kingdom market has stayed flat, although the Materials sector gained 4.4%. With the market up 7.1% over the past year and earnings forecast to grow by 14% annually, identifying growth companies with significant insider ownership can be a strategic move for investors seeking robust opportunities.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Energean (LSE:ENOG) | 10.6% | 30.4% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Helios Underwriting (AIM:HUW) | 23.9% | 16.1% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| Judges Scientific (AIM:JDG) | 11.9% | 21.2% |

| Belluscura (AIM:BELL) | 36.3% | 113.4% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| IQGeo Group (AIM:IQG) | 13% | 63.6% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.0% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

We're going to check out a few of the best picks from our screener tool.

IQGeo Group (AIM:IQG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: IQGeo Group plc, with a market cap of £31.00 million, provides geospatial software solutions for telecom and utility network operators across various countries including the UK, US, Canada, Belgium, Germany, Japan, and Malaysia.

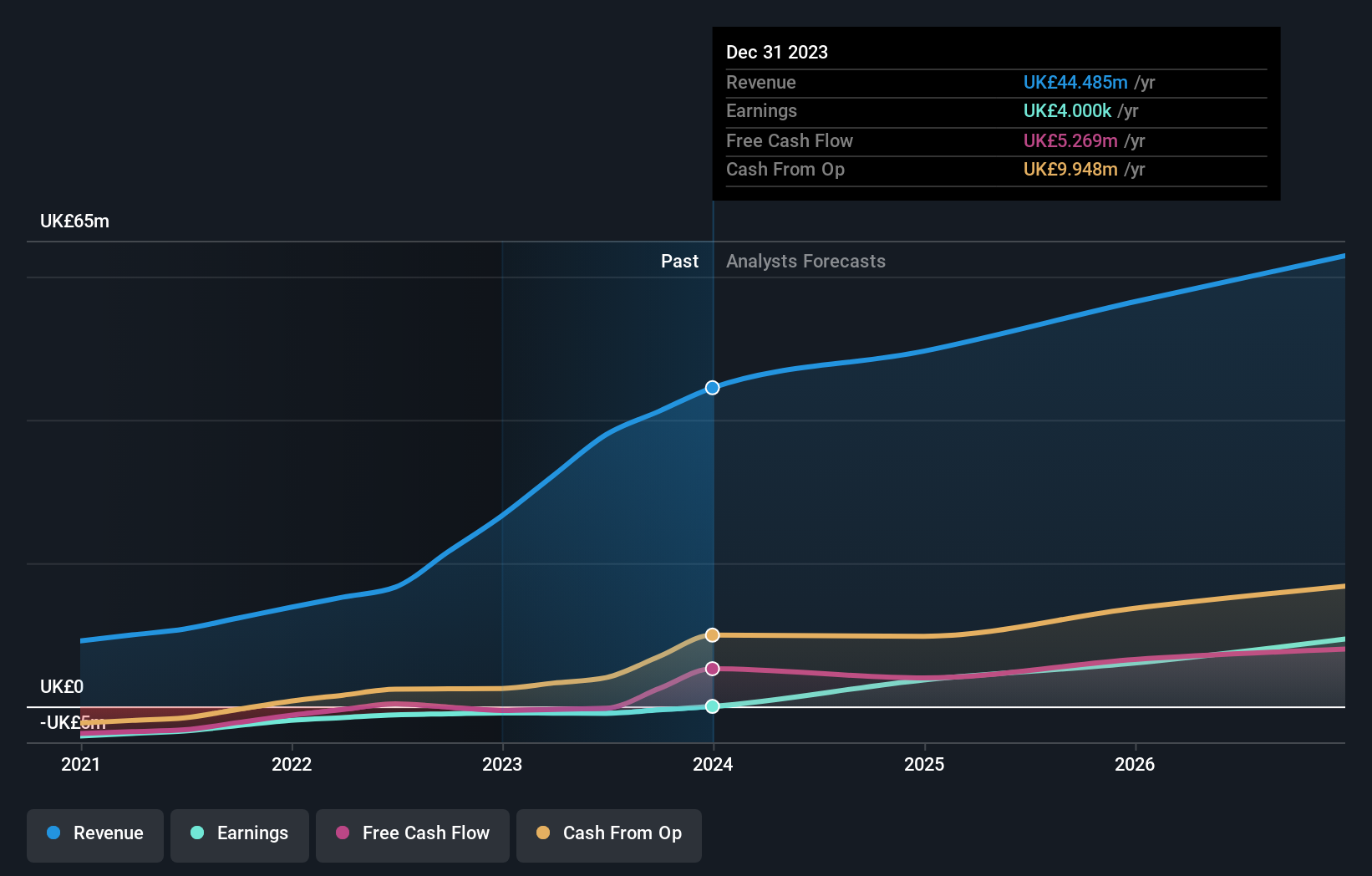

Operations: The company's revenue segment primarily consists of geospatial software solutions, generating £44.49 million.

Insider Ownership: 13%

IQGeo Group, recently acquired by Geologist Bidco Limited and delisted from AIM, shows promising growth prospects with forecasted revenue growth of 11.5% per year and earnings expected to grow significantly at 63.61% annually over the next three years. Despite past shareholder dilution, IQGeo's return on equity is projected to be high at 21.5%. The company became profitable this year, indicating a positive trajectory for future performance in the UK market.

- Get an in-depth perspective on IQGeo Group's performance by reading our analyst estimates report here.

- Our valuation report here indicates IQGeo Group may be overvalued.

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mortgage Advice Bureau (Holdings) plc, with a market cap of £357.01 million, offers mortgage advice services across the United Kingdom through its subsidiaries.

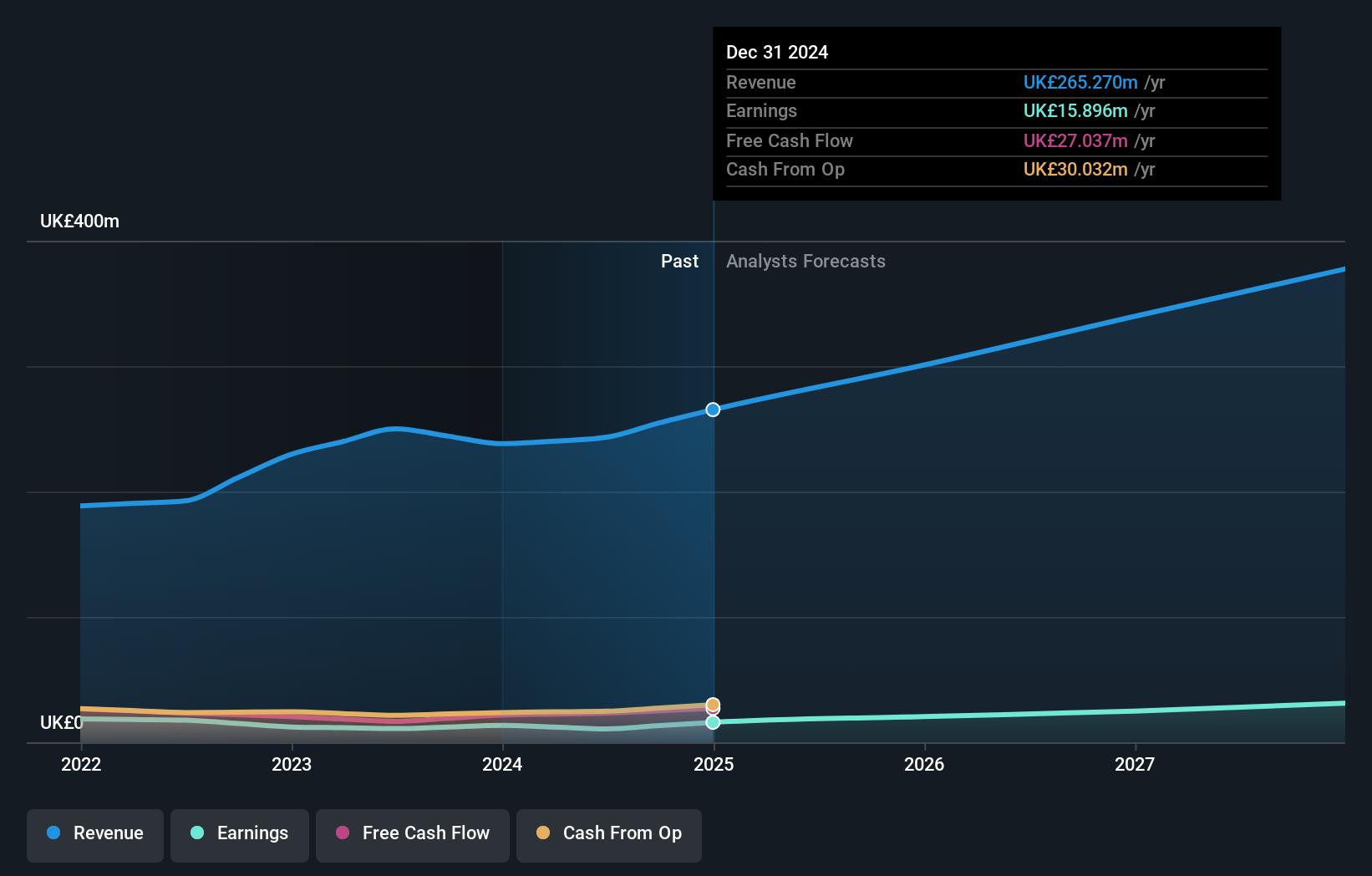

Operations: The company's revenue segments are derived from providing mortgage advice services throughout the United Kingdom.

Insider Ownership: 19.8%

Mortgage Advice Bureau (Holdings) plc, a growth company with high insider ownership, recently reported a decline in net income to £3.7 million for the half year ended June 30, 2024, from £6.42 million a year ago. Despite this, earnings are forecast to grow significantly at 29% per year over the next three years. Insiders have been buying more shares than selling in the past three months. Revenue is also expected to grow faster than the UK market at 15.1% annually.

- Take a closer look at Mortgage Advice Bureau (Holdings)'s potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Mortgage Advice Bureau (Holdings) is priced higher than what may be justified by its financials.

International Workplace Group (LSE:IWG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Workplace Group plc, with a market cap of £1.77 billion, provides workspace solutions across the Americas, Europe, the Middle East, Africa, and the Asia Pacific through its subsidiaries.

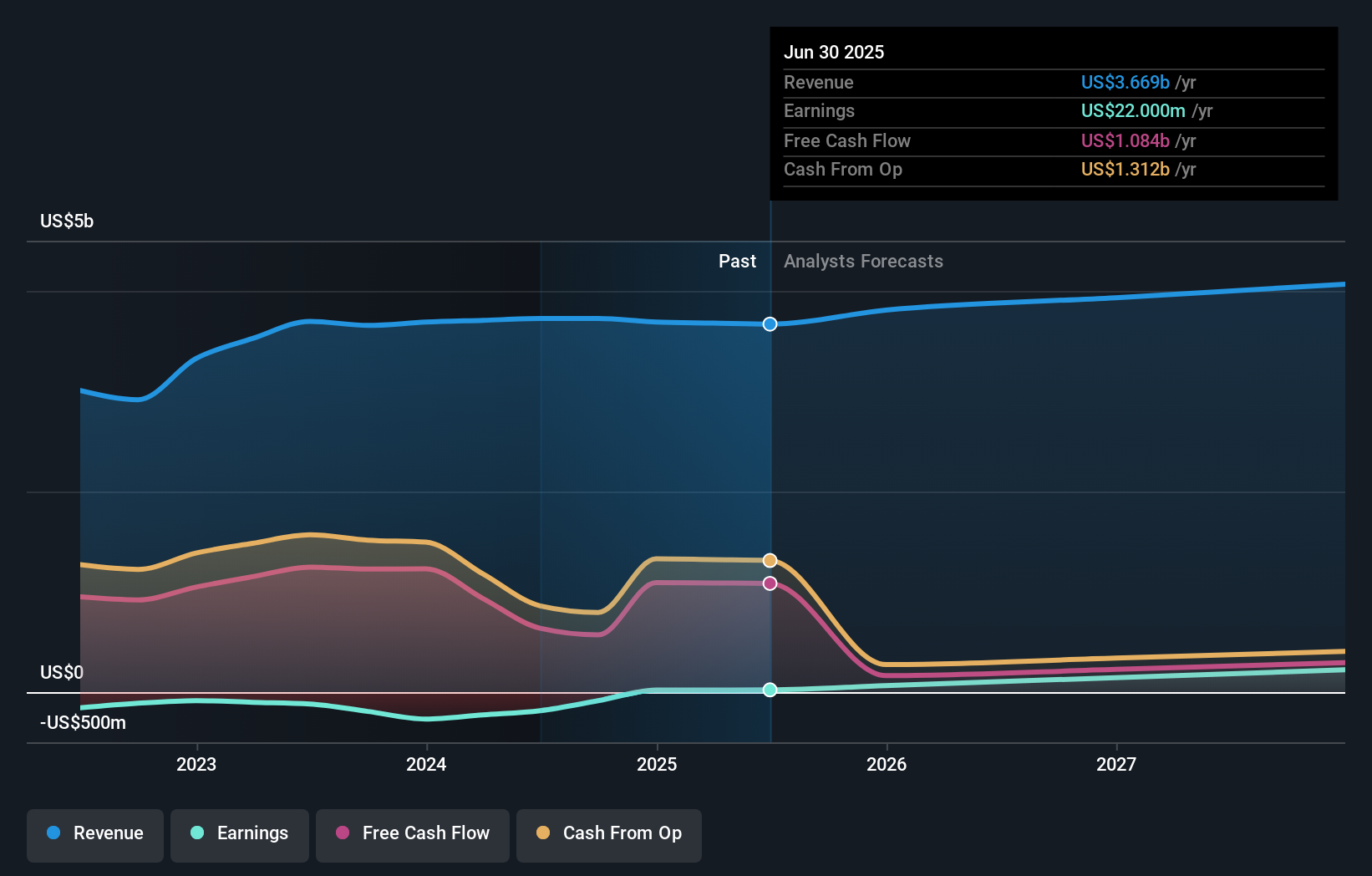

Operations: The company's revenue segments include $1.29 billion from the Americas, $1.69 billion from Europe, the Middle East and Africa (EMEA), $341.30 million from Asia Pacific, and $400.56 million from Worka.

Insider Ownership: 25.2%

International Workplace Group (IWG) has seen more insider buying than selling over the past three months, indicating confidence in its future. Although its Return on Equity is forecast to be low at 13.8% in three years, earnings are expected to grow significantly at 115.58% annually. IWG is trading at good value compared to peers and analysts project a 31.5% rise in stock price. Recent investor activism highlights potential strategies for value maximization, including a US listing and share buyback program.

- Dive into the specifics of International Workplace Group here with our thorough growth forecast report.

- The valuation report we've compiled suggests that International Workplace Group's current price could be quite moderate.

Make It Happen

- Discover the full array of 68 Fast Growing UK Companies With High Insider Ownership right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MAB1

Mortgage Advice Bureau (Holdings)

Provides mortgage advice services in the United Kingdom.

High growth potential with mediocre balance sheet.