- United Kingdom

- /

- Life Sciences

- /

- LSE:ONT

What You Can Learn From Oxford Nanopore Technologies plc's (LON:ONT) P/SAfter Its 25% Share Price Crash

Unfortunately for some shareholders, the Oxford Nanopore Technologies plc (LON:ONT) share price has dived 25% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 60% share price decline.

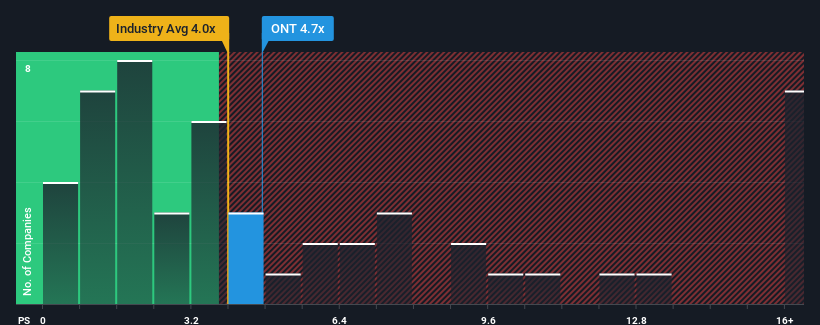

Even after such a large drop in price, given close to half the companies operating in the United Kingdom's Life Sciences industry have price-to-sales ratios (or "P/S") below 3.6x, you may still consider Oxford Nanopore Technologies as a stock to potentially avoid with its 4.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Oxford Nanopore Technologies

How Oxford Nanopore Technologies Has Been Performing

Oxford Nanopore Technologies hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Oxford Nanopore Technologies.Is There Enough Revenue Growth Forecasted For Oxford Nanopore Technologies?

The only time you'd be truly comfortable seeing a P/S as high as Oxford Nanopore Technologies' is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. Still, the latest three year period has seen an excellent 49% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 22% each year during the coming three years according to the nine analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 11% per annum, which is noticeably less attractive.

With this information, we can see why Oxford Nanopore Technologies is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Oxford Nanopore Technologies' P/S

There's still some elevation in Oxford Nanopore Technologies' P/S, even if the same can't be said for its share price recently. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Oxford Nanopore Technologies maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Life Sciences industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Oxford Nanopore Technologies that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ONT

Oxford Nanopore Technologies

Engages in the research, development, manufacture, and commercialization of a novel generation of deoxyribonucleic acid (DNA) or ribonucleic acid (RNA) sequencing technology that allows the real-time analysis of DNA or RNA.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives