- United Kingdom

- /

- Pharma

- /

- LSE:GSK

Is Now the Right Time to Consider GSK After a 19% Rally?

Reviewed by Bailey Pemberton

Thinking about what to do with your GSK shares or considering whether now is the right time to jump in? You're not alone. This stock has been quietly gaining momentum, and making sense of its recent run involves more than just glancing at the chart. Over the last month, GSK gained 9.0%, and it’s up 19.0% for the year. Even looking further back, the stock has delivered a 17.0% return over the past year and a striking 55.7% over five years. While there was a slight dip of 0.3% last week, that hardly takes the shine off such robust long-term growth.

GSK’s steady climb hasn’t come out of nowhere. Investors have been increasingly receptive to its shift towards core pharmaceuticals, with recent moves in its product pipeline and branding strategy earning renewed attention from the market. There has also been chatter about regulatory wins and partnerships that bolster its global reach. While these are not headline-grabbing events, they add layers of confidence to GSK’s future prospects, and that is reflected in the improving risk profile the market seems to be assigning.

Now, the big question: is GSK still undervalued after this uptick, or has the latest rally already baked in the good news? Using a scoring system that checks six key valuation metrics, GSK currently notches a value score of 4 out of 6. That suggests it’s undervalued by more than half of the standard yardsticks we use. Up next, we will break down these valuation checks and explore how they stack up. Stick around until the end, because there is an even smarter way to think about GSK’s true worth that goes beyond the numbers alone.

Approach 1: GSK Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a business by projecting its future cash flows and discounting them back to their present value. This method allows investors to estimate what a company is really worth, based on its ability to generate cash in the years ahead.

For GSK, the most recent reported Free Cash Flow stands at £5.25 Billion. Analysts forecast a healthy growth trajectory, with Free Cash Flow expected to reach £8.22 Billion by 2029. Beyond the analyst forecast window, cash flow projections up through 2035 are extrapolated to provide a long-term picture of GSK’s earning potential.

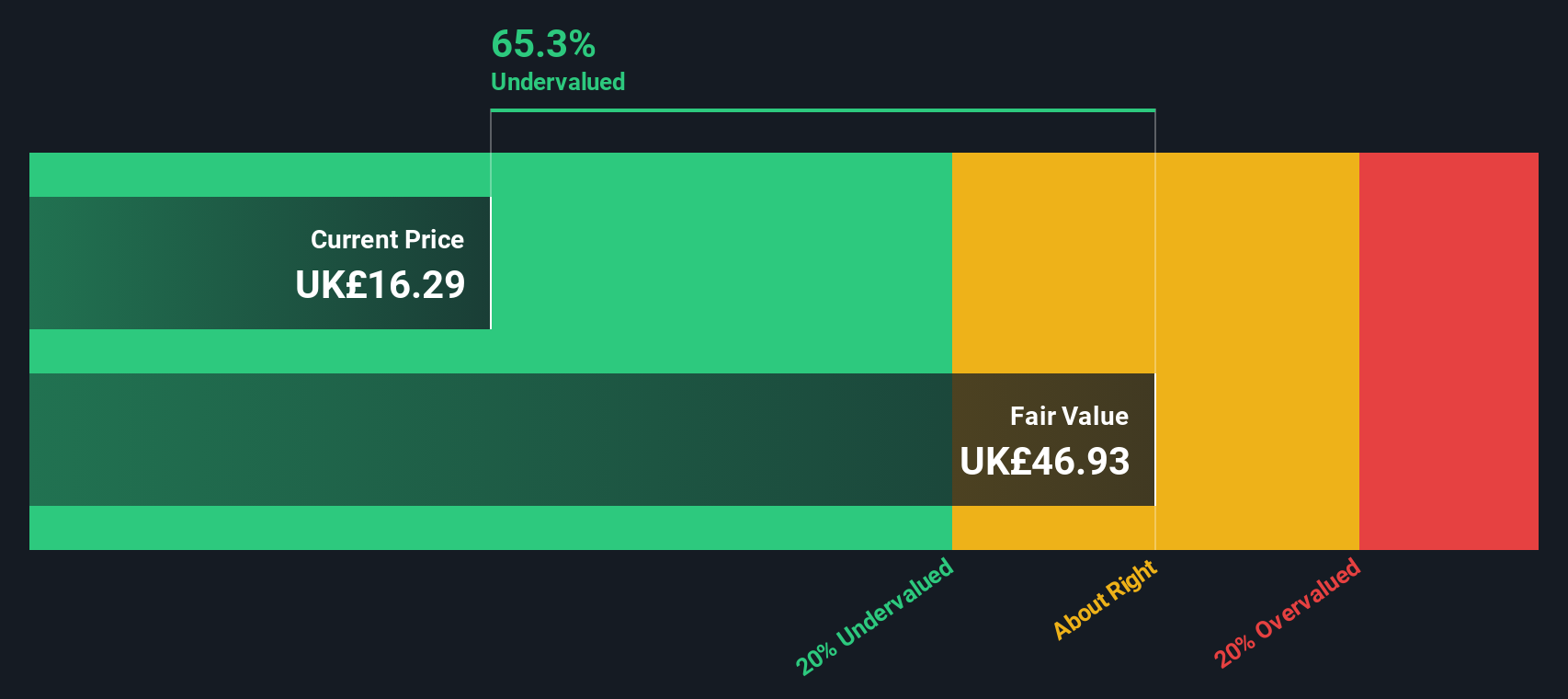

According to this approach, the calculated intrinsic value for GSK’s shares is £46.98. This figure is 65.5% higher than the current share price, suggesting a substantial margin of safety for investors considering an entry.

With such a significant implied discount, the DCF analysis points clearly to GSK being undervalued at today’s prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests GSK is undervalued by 65.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: GSK Price vs Earnings

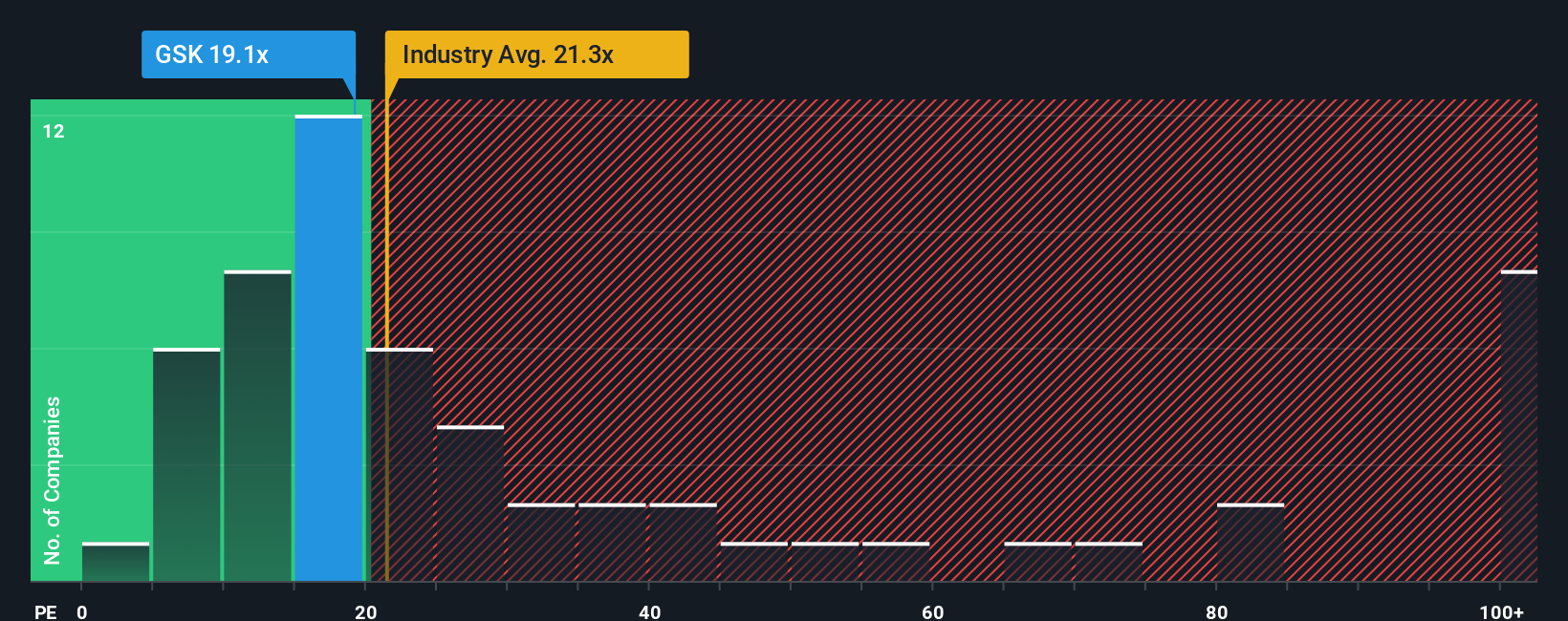

The price-to-earnings (PE) ratio is widely regarded as the go-to valuation metric for profitable companies like GSK because it directly compares the market price of a share to its underlying earnings. This approach gives investors a clear view of how much they're paying for each pound of profit, making it an intuitive yardstick for established businesses.

What constitutes a “normal” or “fair” PE ratio can shift depending on the company’s growth prospects and perceived risks. If the market expects above-average growth or views future cash flows as particularly reliable, it often supports a higher PE ratio. On the other hand, uncertainty or slower growth generally brings the ratio down.

GSK currently trades at a PE ratio of 19.0x. For context, this sits above its peer group average of 17.8x but well below the pharmaceuticals industry average of 24.5x. Rather than relying solely on those broad benchmarks, Simply Wall St evaluates what a fair PE should be for GSK based on a range of company-specific factors in a proprietary “Fair Ratio.” For GSK, this Fair Ratio is calculated at 27.6x, taking into account factors like earnings growth, profit margin, market cap and risk profile.

Comparing the Fair Ratio to GSK’s current PE ratio, the shares appear undervalued compared to where they could be trading if all relevant fundamentals are factored in.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GSK Narrative

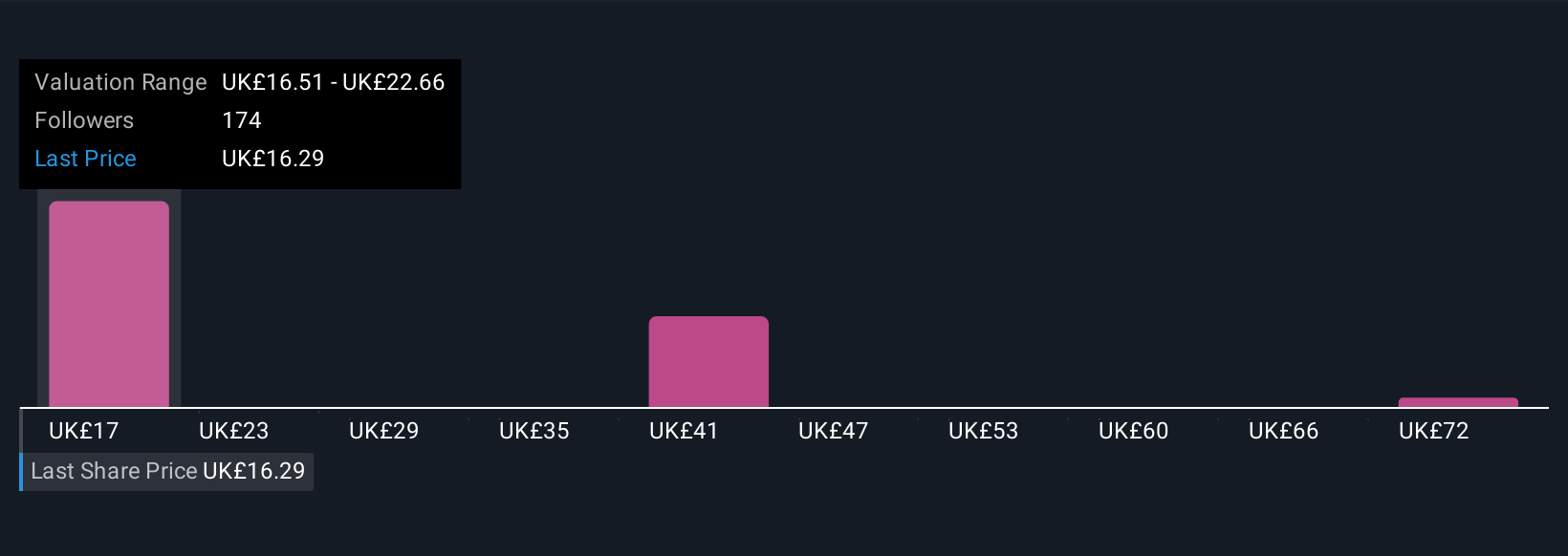

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company, connecting your view of GSK’s strategy or future direction to your own financial forecast and, ultimately, your personal fair value estimate.

Narratives help bridge the gap between the numbers and the “why” behind them by letting you combine your assumptions about growth, margins, and risk with real events, such as regulatory wins or market shifts. On Simply Wall St’s Community page, millions of investors can easily access these Narratives and share their perspective with others, making it a powerful, practical tool for decision-making.

With Narratives, you can see how your story and fair value stack up against the current market price. This makes it easier to decide whether to buy, hold, or sell. When news or earnings updates hit, the Narrative’s numbers update automatically. For example, some GSK investors may see the company’s specialty medicines pipeline and global vaccine demand as justification for a fair value near £78.00. More cautious analysts might land closer to £11.20 due to concerns over patent risks and litigation. This demonstrates how personalized perspectives can lead to very different conclusions about opportunity or caution.

Do you think there's more to the story for GSK? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GSK

GSK

Engages in the research, development, and manufacture of vaccines, specialty medicines, and general medicines to prevent and treat disease in the United Kingdom, the United States, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives