- United Kingdom

- /

- Pharma

- /

- LSE:GSK

How the Recent 10.7% Price Surge Shapes the GSK Valuation Debate

Reviewed by Bailey Pemberton

- Thinking about whether GSK is a bargain or overpriced? If you’re curious about how the stock stacks up right now, you’re definitely not alone.

- GSK has caught the market’s attention lately with a 10.7% jump over the last month and a strong 43.4% rally over the past year. These are clear signs of shifting sentiment or rising confidence.

- Momentum for GSK has picked up, in part, as investors respond to a string of positive regulatory approvals and new drug launches that bolster the company’s growth outlook. Recent announcements around expanded vaccine applications and the pipeline’s potential impact have added fuel to the share price journey.

- As for valuation, GSK scores a 5 out of 6 on our value checks (see the breakdown), putting it in rare company among peers. Let’s dig into how these scores are calculated and, even more importantly, dive into a smarter way to understand what GSK might actually be worth by the end of this article.

Approach 1: GSK Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a cornerstone of company valuation. It forecasts GSK's future cash flows and discounts them back to today’s value. This offers a view of what the company could truly be worth based on its ability to generate cash over time.

According to the latest data, GSK produced £5.13 billion in Free Cash Flow (FCF) over the last twelve months. Analyst estimates suggest steady growth, projecting annual FCF to reach nearly £8.0 billion by 2029. While professional analysts typically only forecast five years ahead, further projections are calculated using extrapolation methods to provide a ten-year outlook. This approach balances expert consensus with longer-term estimates and gives a fuller picture of GSK’s cash-generating potential.

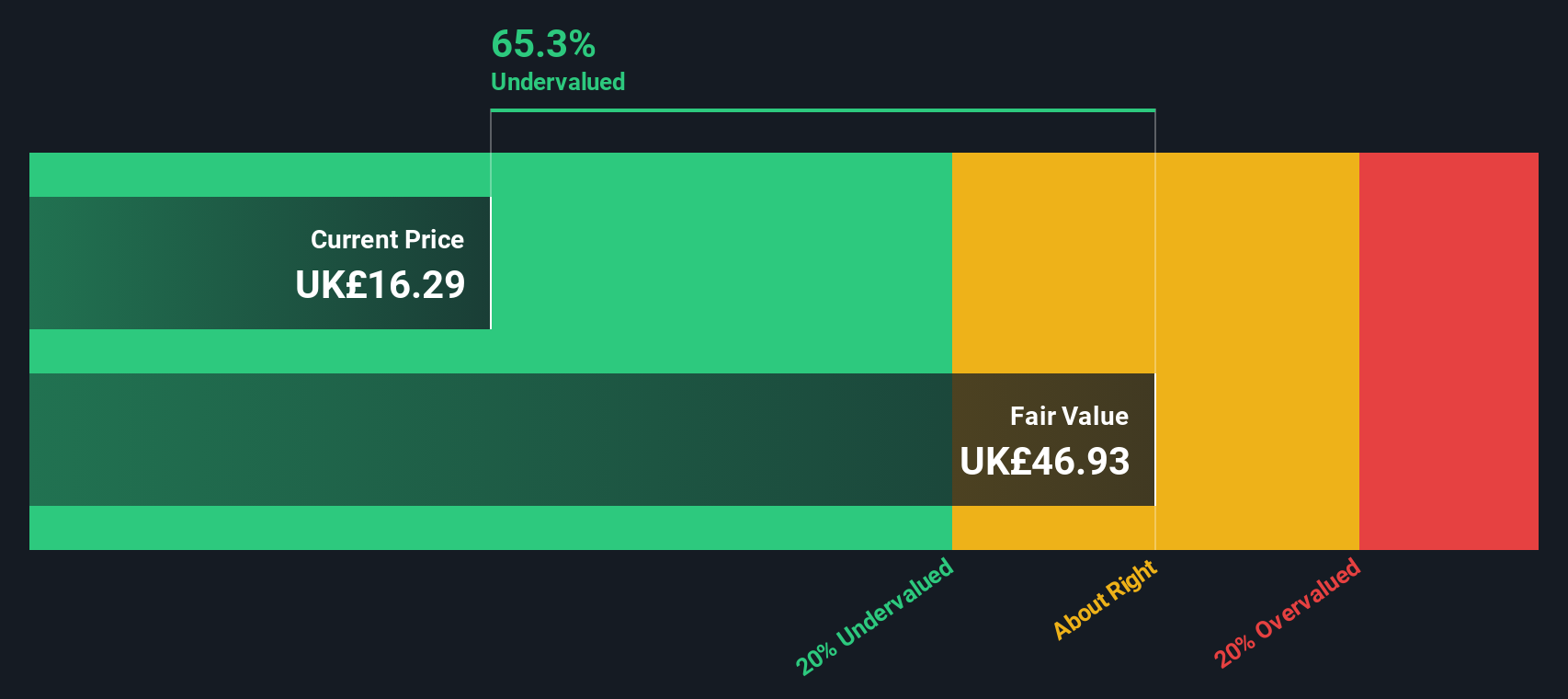

After discounting these projected cash flows, the DCF model arrives at an estimated intrinsic value of £45.51 per share. This figure implies GSK is currently trading at a substantial 60.5% discount to its calculated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests GSK is undervalued by 60.5%. Track this in your watchlist or portfolio, or discover 897 more undervalued stocks based on cash flows.

Approach 2: GSK Price vs Earnings

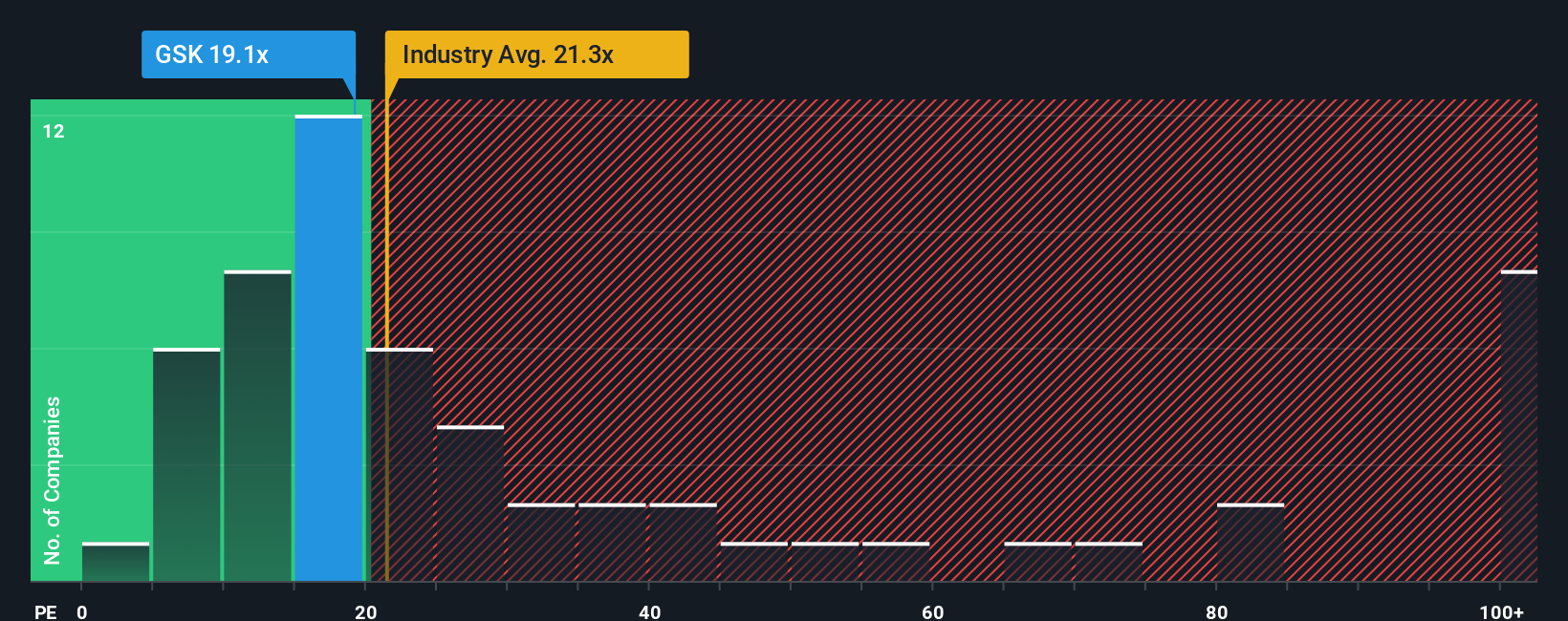

The Price-to-Earnings (PE) ratio is a widely used tool for valuing profitable companies like GSK. This metric gauges how much investors are willing to pay for each pound of current earnings, making it especially relevant for established firms generating consistent profits.

However, not all PE ratios are created equal. Growth expectations and risk play key roles in determining what a “normal” or “fair” PE should be. Companies with higher expected earnings growth, lower risk, or stronger profitability typically command higher PE ratios because investors expect more future value.

GSK currently trades at a PE ratio of 13.2x. For context, the pharmaceutical industry average sits at 24.0x, and GSK’s peer group averages 17.3x. At first glance, GSK appears cheaper than both its industry and direct competitors.

To add another layer, Simply Wall St calculates a proprietary “Fair Ratio” for each company, an ideal PE that factors in GSK’s unique earnings growth, risk profile, profit margins, size, and competitive landscape. In this case, GSK’s Fair Ratio is estimated at 25.4x. This tailored benchmark offers a more complete valuation snapshot than simply comparing to peers or the broader industry.

Because GSK’s actual PE ratio is well below its Fair Ratio, the data points to the stock being undervalued at today’s price.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GSK Narrative

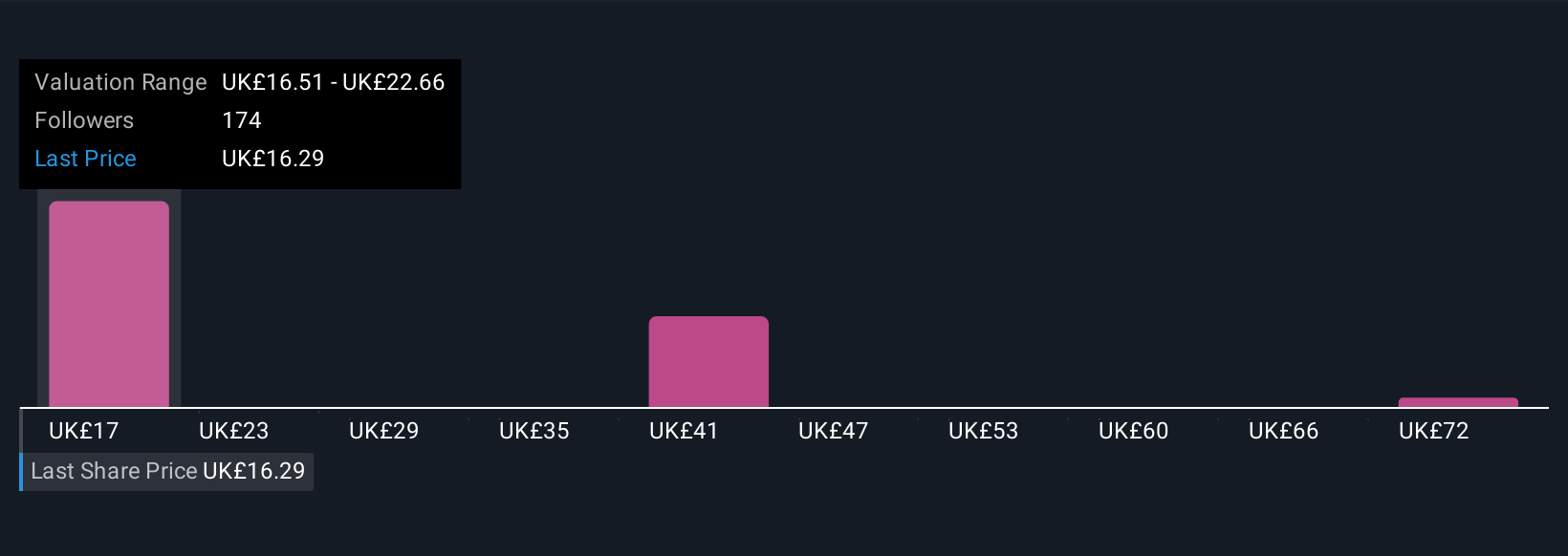

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your own story about a company’s future, captured in a set of forecasts and a personal view of fair value. Essentially, it translates your perspective and assumptions about GSK (like growth rates, profit margins, and fair price) into a transparent, financial outlook.

Narratives link what you believe about a company’s strategy, its risks, or industry trends directly to expected numbers and an estimated fair value. This shows how your outlook compares to others and reveals whether you think the current price is a bargain or not.

On Simply Wall St’s Community page, Narratives are as easy to use as any social feed (with millions of investors sharing their views), and they update automatically when big news or fresh earnings reports hit. This helps keep your thinking relevant in real time.

By comparing the Fair Value from your Narrative to today’s share price, you get a clear signal for buying, holding, or selling, with context for why your view might differ from others.

For example, some GSK Narratives today set fair value as high as £78 per share, reflecting optimistic revenue jumps and margin expansion. Others are more cautious, with fair values as low as £11.2, showing a wide range of perspectives driven by different expectations.

Do you think there's more to the story for GSK? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GSK

GSK

Engages in the research, development, and manufacture of vaccines, specialty medicines, and general medicines to prevent and treat disease in the United Kingdom, the United States, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives