- United Kingdom

- /

- Pharma

- /

- LSE:AZN

AstraZeneca (LSE:AZN): Fresh Growth Sparks New Valuation Debate

Reviewed by Simply Wall St

AstraZeneca (LSE:AZN) has delivered double-digit growth in both revenue and net income over the past year. This performance has sparked renewed discussion about its potential for long-term returns. The company’s shares have gained 12% in the past month.

See our latest analysis for AstraZeneca.

AstraZeneca’s share price momentum has accelerated, with an 11.8% one-month gain and 16% return over the past quarter. Recent growth and a steady stream of scientific updates seem to have rekindled optimism. Its 12-month total shareholder return now sits at 10.3%, underscoring both resilience and renewed interest among investors.

With strong results making headlines, now is a perfect moment to see what else is available. Check out the latest opportunities in our healthcare stocks discovery list: See the full list for free.

Given the recent rally and double-digit financial growth, investors now face a key question: is AstraZeneca trading below its true value, or have the markets already factored in every bit of its future potential?

Most Popular Narrative: 11% Undervalued

With AstraZeneca’s last close price at £125.32 and the most-followed narrative estimating fair value near £140.96, market watchers are debating whether the recent rally still leaves upside on the table, especially given strong pipeline expectations and the industry’s evolving landscape.

The company's robust and diversified late-stage pipeline, particularly in oncology, rare diseases, and cardiovascular/metabolic therapies, is set to deliver multiple blockbuster launches over the next several years. Management estimates these new medicines could generate $10+ billion in peak risk-adjusted revenue, directly supporting both long-term high-margin revenue growth and future earnings expansion.

Want to know how AstraZeneca’s narrative arrives at this bullish number? Bold revenue and profit expansion forecasts are at the core. Could analysts be betting on historic margin improvements, blockbuster launches and a surprisingly high future profit multiple? See why this fair value projection is turning heads beyond typical sector trends.

Result: Fair Value of £140.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming regulatory changes or increased biosimilar competition could challenge AstraZeneca’s growth story and shift market sentiment in the months ahead.

Find out about the key risks to this AstraZeneca narrative.

Another View: Pricing Risk Under the Microscope

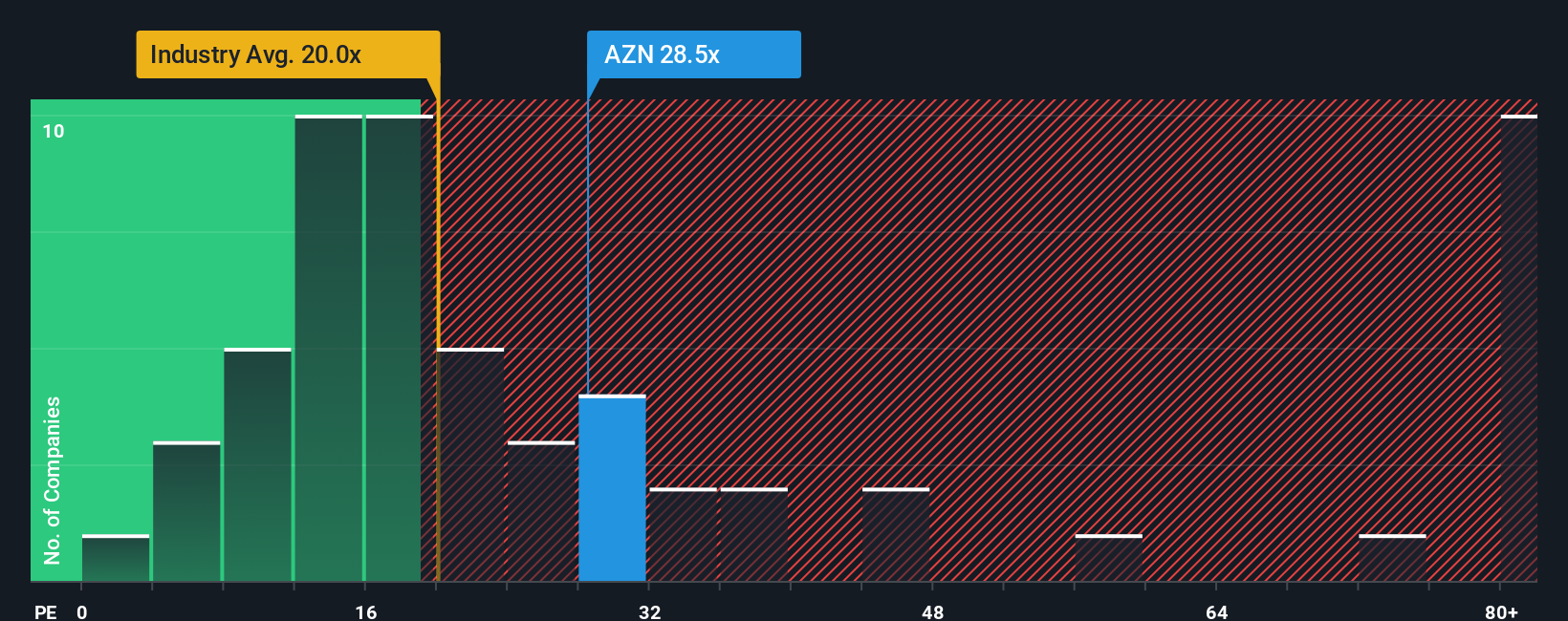

Looking through the lens of earnings multiples, AstraZeneca’s share price currently trades at 31.2 times earnings, which is more than double the peer average of 14.8x and well above the industry average of 22.9x. Although the fair ratio is 33.1x, this premium means investors face higher valuation risk if growth stumbles or sector sentiment changes. Is the market rewarding AstraZeneca for its pipeline, or simply chasing recent momentum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AstraZeneca Narrative

If you have a different perspective or want to test your own investment thesis, you can shape your own analysis in just a few minutes. Do it your way

A great starting point for your AstraZeneca research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking For More Investment Ideas?

Opportunities are out there waiting for investors who act decisively. Give yourself an edge by checking out these hand-picked stock ideas tailored to multiple strategies:

- Accelerate your search for tomorrow's leaders by tapping into these 27 AI penny stocks, which are poised to shape advances in artificial intelligence and automation.

- Secure reliable returns by targeting income-generating picks with these 17 dividend stocks with yields > 3%, offering yields above 3%.

- Capture upside in the market by zeroing in on these 877 undervalued stocks based on cash flows, which are trading below their intrinsic value based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AZN

AstraZeneca

A biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives