- United Kingdom

- /

- Pharma

- /

- AIM:STX

Shield Therapeutics plc (LON:STX) Soars 27% But It's A Story Of Risk Vs Reward

Shield Therapeutics plc (LON:STX) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 68%.

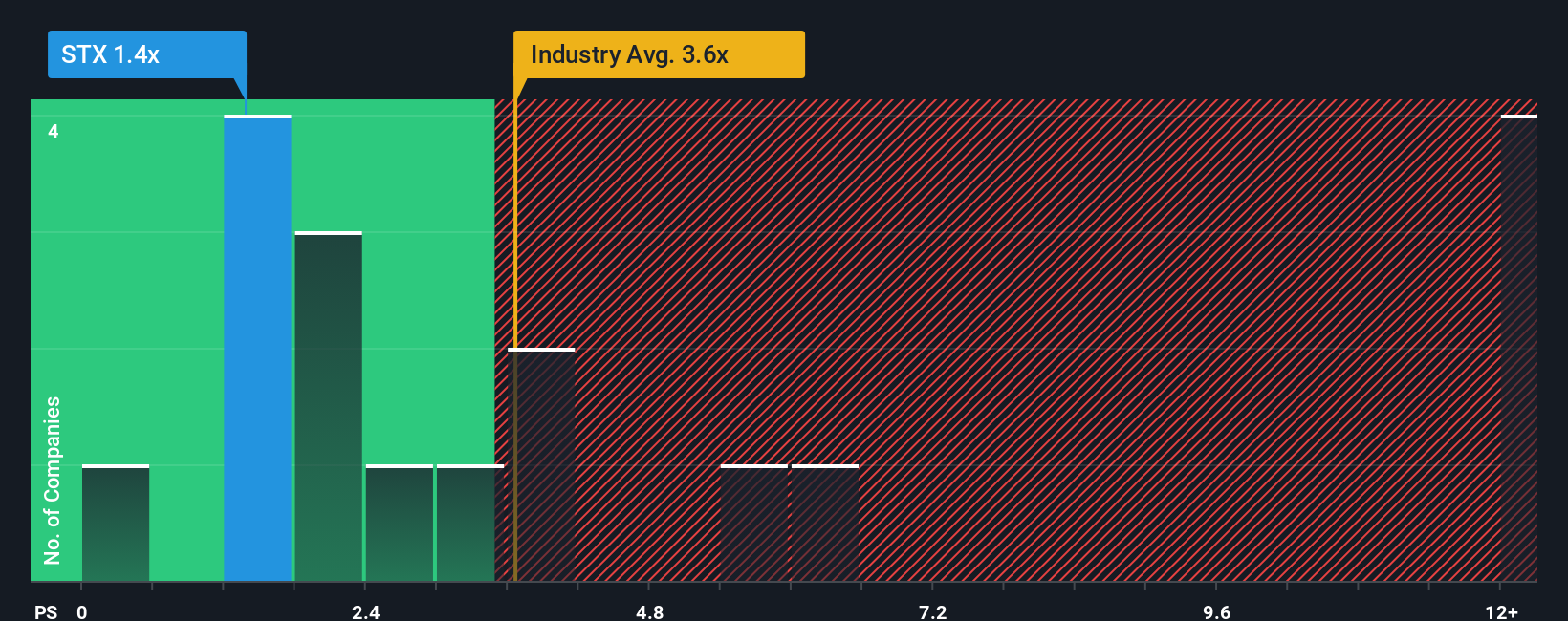

Although its price has surged higher, Shield Therapeutics may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.4x, since almost half of all companies in the Pharmaceuticals industry in the United Kingdom have P/S ratios greater than 2.7x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Shield Therapeutics

What Does Shield Therapeutics' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Shield Therapeutics has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Shield Therapeutics will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Shield Therapeutics would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 146%. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 48% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 5.3% per annum, which is noticeably less attractive.

In light of this, it's peculiar that Shield Therapeutics' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Despite Shield Therapeutics' share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Shield Therapeutics' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Shield Therapeutics (3 are a bit unpleasant) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:STX

Shield Therapeutics

A commercial stage specialty pharmaceutical company, focuses on development and commercialization of clinical-stage pharmaceuticals to treat unmet medical needs.

High growth potential moderate.

Similar Companies

Market Insights

Community Narratives