- United Kingdom

- /

- Pharma

- /

- AIM:N4P

Here's Why We're Not Too Worried About N4 Pharma's (LON:N4P) Cash Burn Situation

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, N4 Pharma (LON:N4P) shareholders have done very well over the last year, with the share price soaring by 133%. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

In light of its strong share price run, we think now is a good time to investigate how risky N4 Pharma's cash burn is. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for N4 Pharma

Does N4 Pharma Have A Long Cash Runway?

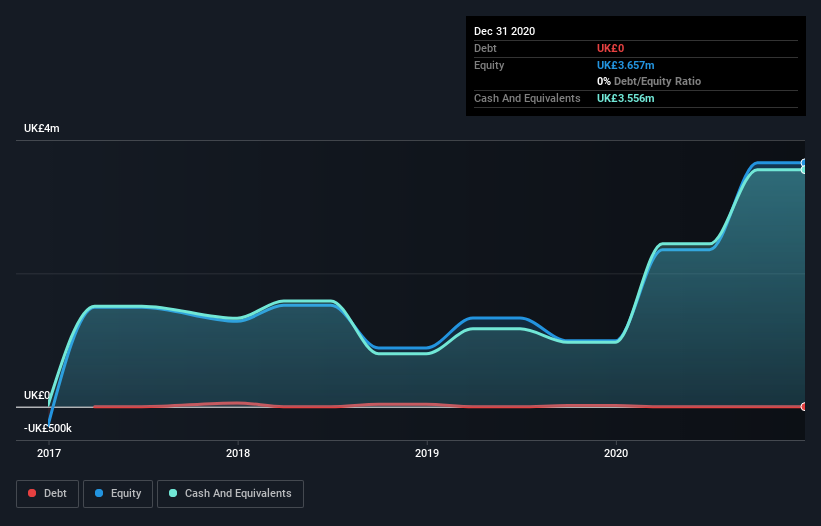

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When N4 Pharma last reported its balance sheet in December 2020, it had zero debt and cash worth UK£3.6m. Importantly, its cash burn was UK£1.4m over the trailing twelve months. Therefore, from December 2020 it had 2.6 years of cash runway. Arguably, that's a prudent and sensible length of runway to have. You can see how its cash balance has changed over time in the image below.

How Is N4 Pharma's Cash Burn Changing Over Time?

N4 Pharma didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. Over the last year its cash burn actually increased by a very significant 72%. While this spending increase is no doubt intended to drive growth, if the trend continues the company's cash runway will shrink very quickly. N4 Pharma makes us a little nervous due to its lack of substantial operating revenue. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Easily Can N4 Pharma Raise Cash?

While N4 Pharma does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

N4 Pharma has a market capitalisation of UK£17m and burnt through UK£1.4m last year, which is 8.0% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

So, Should We Worry About N4 Pharma's Cash Burn?

As you can probably tell by now, we're not too worried about N4 Pharma's cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Although its increasing cash burn does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. On another note, N4 Pharma has 3 warning signs (and 1 which is significant) we think you should know about.

Of course N4 Pharma may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading N4 Pharma or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if N4 Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:N4P

N4 Pharma

A specialist pharmaceutical company, develops nanoparticle silica delivery systems to enhance the cellular delivery and potency of cancer treatments and vaccines in the United Kingdom.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives