How Do Analysts See Mereo BioPharma Group plc (LON:MPH) Performing Over The Next Few Years?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

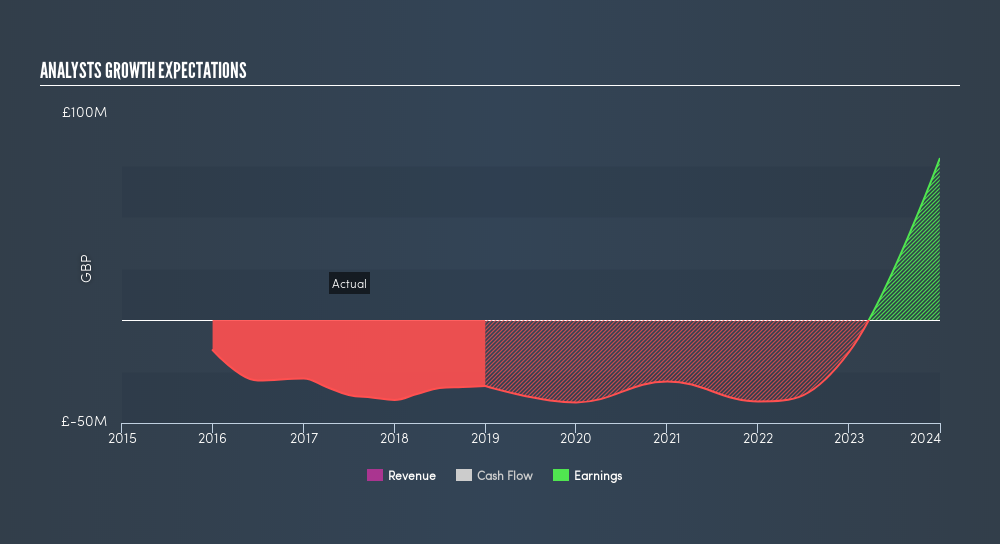

Mereo BioPharma Group plc's (LON:MPH) latest earnings update in April 2019 signalled company earnings became less negative compared to the previous year's level - great news for investors Today I want to provide a brief commentary on how market analysts perceive Mereo BioPharma Group's earnings growth trajectory over the next few years and whether the future looks brighter. I will be looking at earnings excluding extraordinary items to exclude one-off activities to get a better understanding of the underlying drivers of earnings.

Check out our latest analysis for Mereo BioPharma Group

Market analysts' prospects for next year seems pessimistic, with earnings becoming even more negative, reaching -UK£40.0m in 2020. Moreover, earnings are expected to fall off in the following year, before bouncing back up again to -UK£39.5m in 2022.

Even though it is informative knowing the rate of growth each year relative to today’s value, it may be more valuable to evaluate the rate at which the earnings are growing every year, on average. The advantage of this approach is that we can get a bigger picture of the direction of Mereo BioPharma Group's earnings trajectory over the long run, irrespective of near term fluctuations, be more volatile. To calculate this rate, I put a line of best fit through the forecasted earnings by market analysts. The slope of this line is the rate of earnings growth, which in this case is 40%. This means, we can anticipate Mereo BioPharma Group will grow its earnings by 40% every year for the next couple of years.

Next Steps:

For Mereo BioPharma Group, I've compiled three important aspects you should further research:

- Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

- Management:Have insiders been ramping up their shares to take advantage of the market's sentiment for MPH's future outlook? Check out our management and board analysis with insights on CEO compensation and governance factors.

- Other High-Growth Alternatives: Are there other high-growth stocks you could be holding instead of MPH? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion