- United Kingdom

- /

- Medical Equipment

- /

- AIM:NIOX

We're Interested To See How Circassia Group (LON:CIR) Uses Its Cash Hoard To Grow

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given this risk, we thought we'd take a look at whether Circassia Group (LON:CIR) shareholders should be worried about its cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for Circassia Group

Does Circassia Group Have A Long Cash Runway?

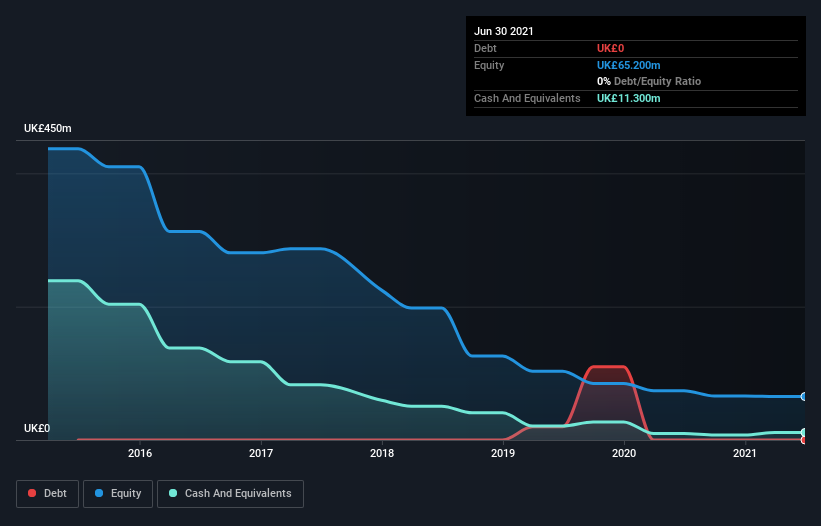

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In June 2021, Circassia Group had UK£11m in cash, and was debt-free. Importantly, its cash burn was UK£5.2m over the trailing twelve months. So it had a cash runway of about 2.2 years from June 2021. Importantly, though, analysts think that Circassia Group will reach cashflow breakeven before then. In that case, it may never reach the end of its cash runway. The image below shows how its cash balance has been changing over the last few years.

How Well Is Circassia Group Growing?

Happily, Circassia Group is travelling in the right direction when it comes to its cash burn, which is down 81% over the last year. Mundanely, though, operating revenue growth was flat. We think it is growing rather well, upon reflection. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Circassia Group To Raise More Cash For Growth?

While Circassia Group seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Circassia Group has a market capitalisation of UK£184m and burnt through UK£5.2m last year, which is 2.8% of the company's market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

Is Circassia Group's Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Circassia Group's cash burn. For example, we think its cash burn reduction suggests that the company is on a good path. Although its falling revenue does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. It's clearly very positive to see that analysts are forecasting the company will break even fairly soon. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 1 warning sign for Circassia Group that potential shareholders should take into account before putting money into a stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

Valuation is complex, but we're here to simplify it.

Discover if NIOX Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:NIOX

NIOX Group

Engages in the design, development, and commercialization of medical devices for asthma diagnosis, monitoring, and management worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026