- United Kingdom

- /

- Biotech

- /

- AIM:BVXP

Lacklustre Performance Is Driving Bioventix PLC's (LON:BVXP) 26% Price Drop

To the annoyance of some shareholders, Bioventix PLC (LON:BVXP) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 43% share price drop.

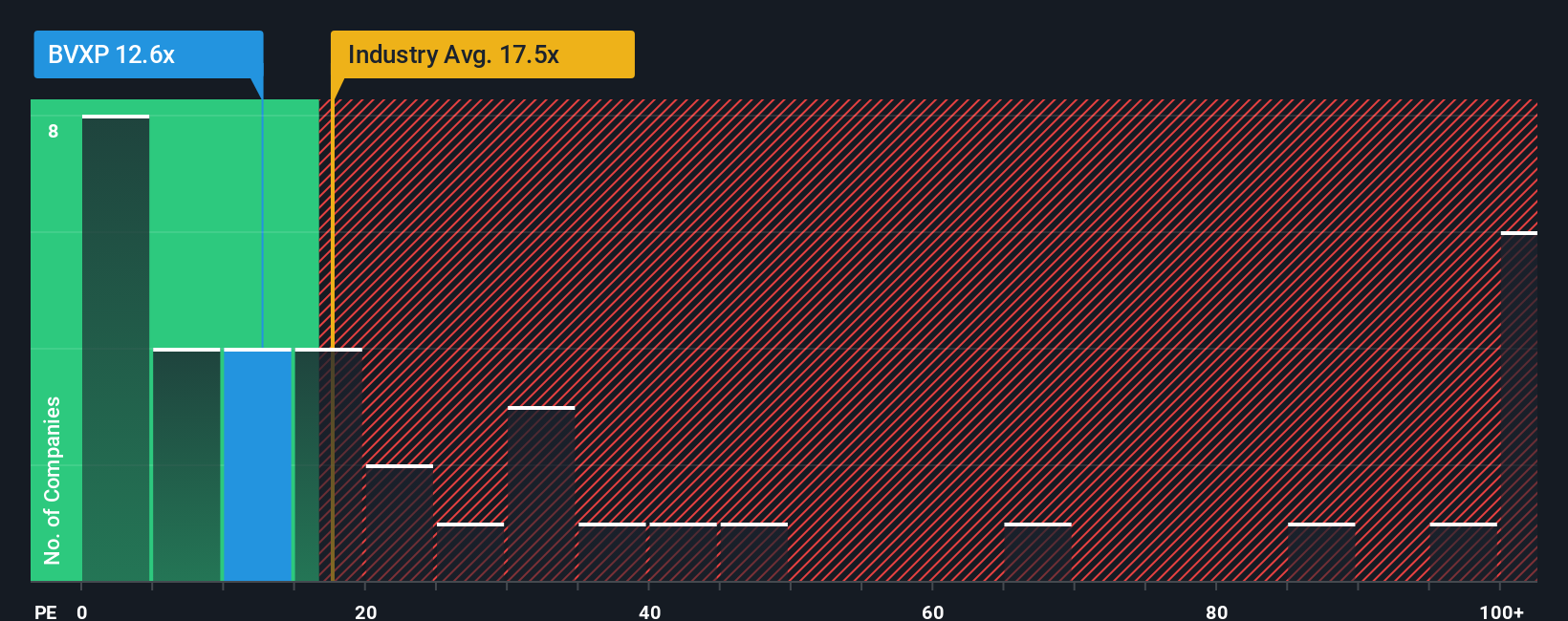

Even after such a large drop in price, given about half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 17x, you may still consider Bioventix as an attractive investment with its 12.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Bioventix could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Bioventix

How Is Bioventix's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Bioventix's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 6.3%. The last three years don't look nice either as the company has shrunk EPS by 1.5% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 6.2% during the coming year according to the one analyst following the company. That's not great when the rest of the market is expected to grow by 23%.

With this information, we are not surprised that Bioventix is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Bioventix's P/E?

The softening of Bioventix's shares means its P/E is now sitting at a pretty low level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Bioventix maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Bioventix is showing 1 warning sign in our investment analysis, you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Bioventix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:BVXP

Bioventix

Bioventix PLC creates, manufactures, and supplies sheep monoclonal antibodies (SMAs) for diagnostic applications worldwide.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives