Stock Analysis

- United Kingdom

- /

- Professional Services

- /

- LSE:WIL

Exploring Three Undiscovered Gems In The United Kingdom

Reviewed by Simply Wall St

The United Kingdom market has seen a positive uptrend, rising by 4.5% over the past year with earnings expected to grow by 13% annually. In this context, identifying stocks that have not yet caught the attention of mainstream investors but show potential for growth can be particularly compelling.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| Georgia Capital | NA | -27.80% | 18.94% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Ros Agro | 57.18% | 17.80% | 18.35% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Bioventix (AIM:BVXP)

Simply Wall St Value Rating: ★★★★★★

Overview: Bioventix PLC is a company focused on the creation, manufacturing, and supply of sheep monoclonal antibodies for diagnostic uses globally, with a market capitalization of £227.06 million.

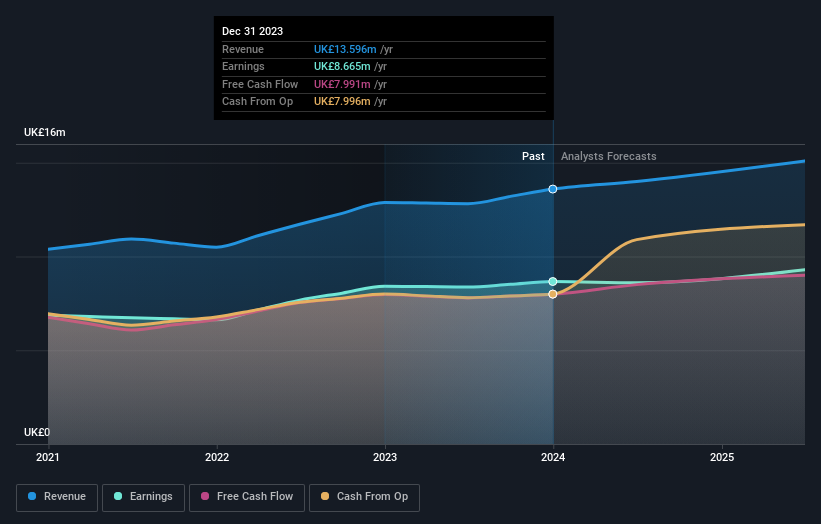

Operations: The biotechnology firm generates revenue through its specialized products, evidenced by a consistent gross profit margin averaging around 93.74% over the past decade, reflecting efficient cost management and strong pricing power. The company's net income has shown growth, reaching £8.67 million as of the latest reporting period in 2024, up from £1.61 million in late 2013.

Bioventix, a lesser-known player in the biotech sector, showcases solid financial health with a debt-free status and a price-to-earnings ratio of 26.2, below the industry average of 32.6. The company's earnings have grown by 3% over the past year, outpacing the industry's growth rate of 2.8%. Looking ahead, Bioventix is expected to see earnings grow by approximately 5% annually. This growth trajectory is supported by high-quality earnings and positive free cash flow, positioning Bioventix as an attractive prospect within its niche market.

- Unlock comprehensive insights into our analysis of Bioventix stock in this health report.

Examine Bioventix's past performance report to understand how it has performed in the past.

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

Overview: Warpaint London PLC, together with its subsidiaries, specializes in the production and sale of cosmetics, operating with a market capitalization of £490.64 million.

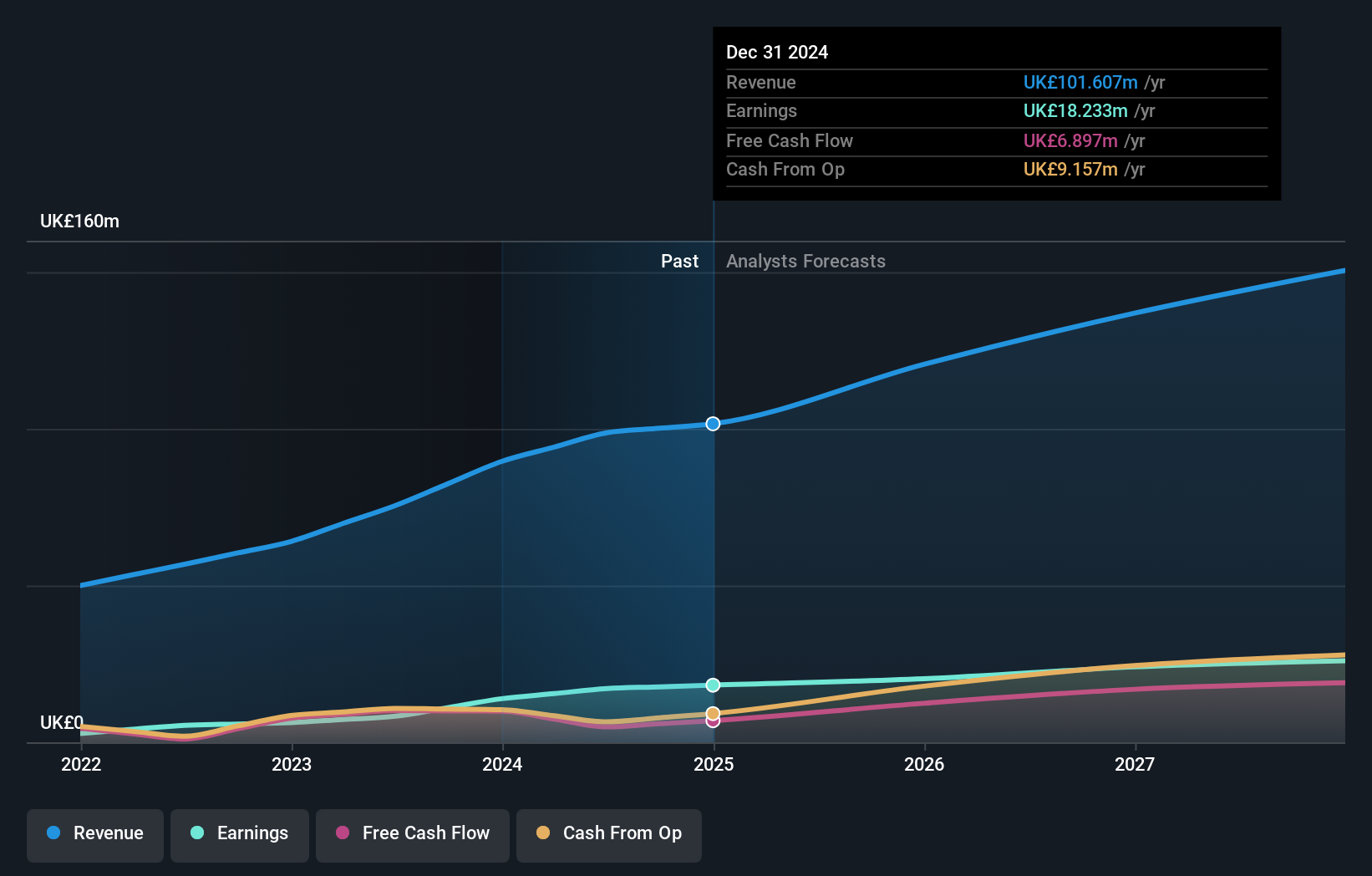

Operations: Warpaint London primarily generates its revenue from its own brand products, contributing £87.07 million, while close-out sales add an additional £2.52 million. The company's business model has shown a notable increase in gross profit margin over the years, rising from 37.79% in 2013 to 39.87% by the end of 2023, indicating improved efficiency in managing production costs relative to sales revenue.

Warpaint London PLC, a lesser-known gem in the UK market, has demonstrated robust financial health with a 122.4% earnings growth over the past year, significantly outpacing its industry's 16.5% growth. The company is debt-free, having reduced its debt from a ratio of 5.2% five years ago to zero today. Recent activities include a £31.5 million equity offering and an increased dividend payout of 6 pence per share, underscoring confidence in sustained profitability and growth prospects estimated at 14.71% annually.

- Click here and access our complete health analysis report to understand the dynamics of Warpaint London.

Evaluate Warpaint London's historical performance by accessing our past performance report.

Wilmington (LSE:WIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Wilmington plc is a global provider of information, data, training, and education solutions to professional markets, with a market capitalization of £356.87 million.

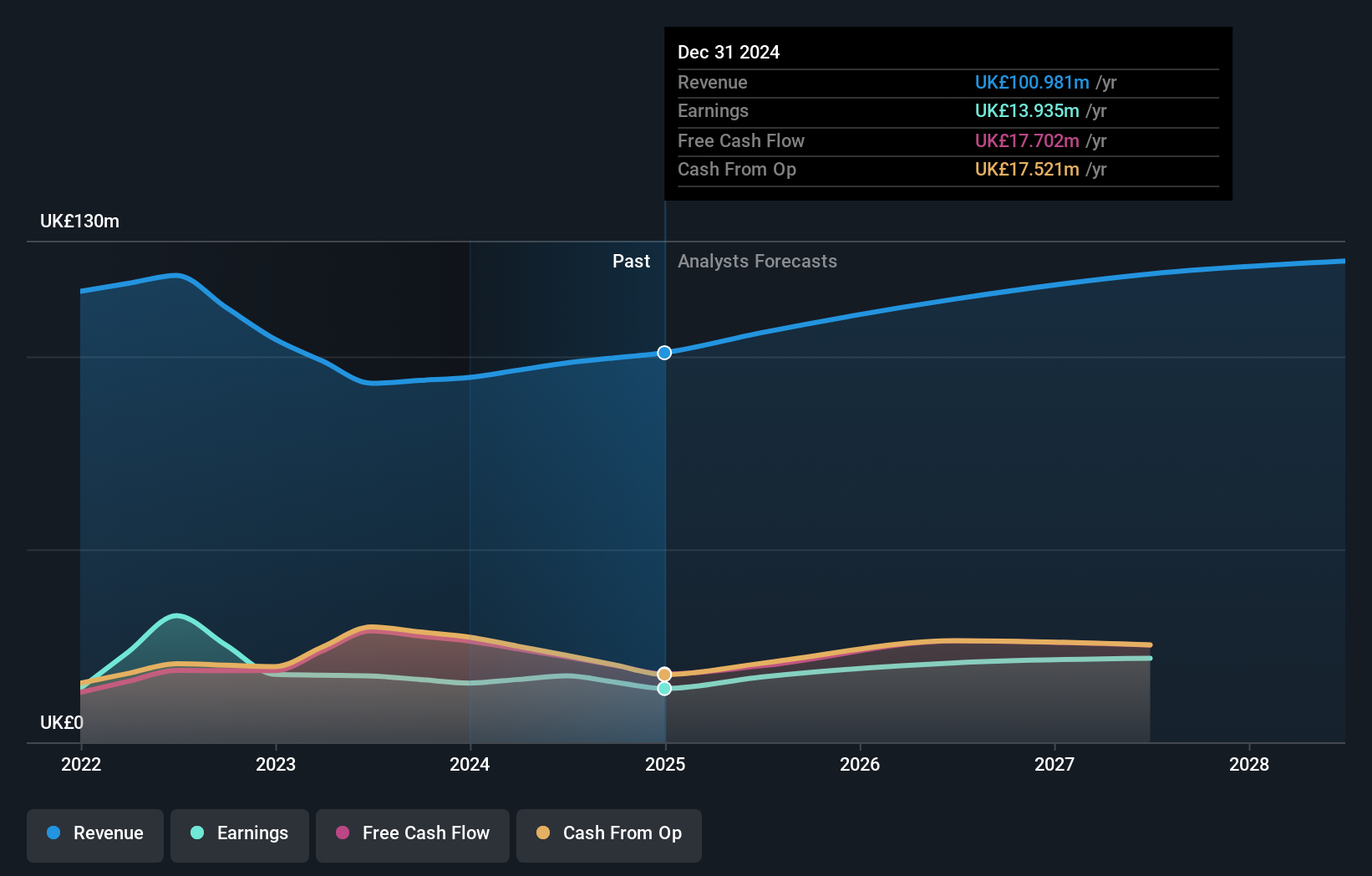

Operations: Wilmington generates revenue through two primary segments: Intelligence, which contributed £57.86 million, and Training & Education, which added £67.13 million. The company's financial performance shows a trend of increasing gross profit margins over recent periods, indicating an improvement in the efficiency of its operations.

Wilmington stands out as an intriguing investment, currently trading at 28.6% below its estimated fair value. With no debt and a past year earnings growth of 4.4%, it surpasses the Professional Services industry's growth by 1%. Despite projections of a 6.6% annual earnings decline over the next three years, Wilmington's robust financial health, underscored by high-quality earnings and a significant reduction in debt from five years ago, positions it as a potentially undervalued opportunity in the market.

- Get an in-depth perspective on Wilmington's performance by reading our health report here.

Understand Wilmington's track record by examining our Past report.

Where To Now?

- Gain an insight into the universe of 77 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wilmington might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WIL

Wilmington

Provides information, data, training, and education solutions to professional markets in the United Kingdom, the rest of Europe, North America, and internationally.

Flawless balance sheet with proven track record and pays a dividend.