- United Kingdom

- /

- Media

- /

- LSE:VOX

Market Still Lacking Some Conviction On Vox Valor Capital Limited (LON:VOX)

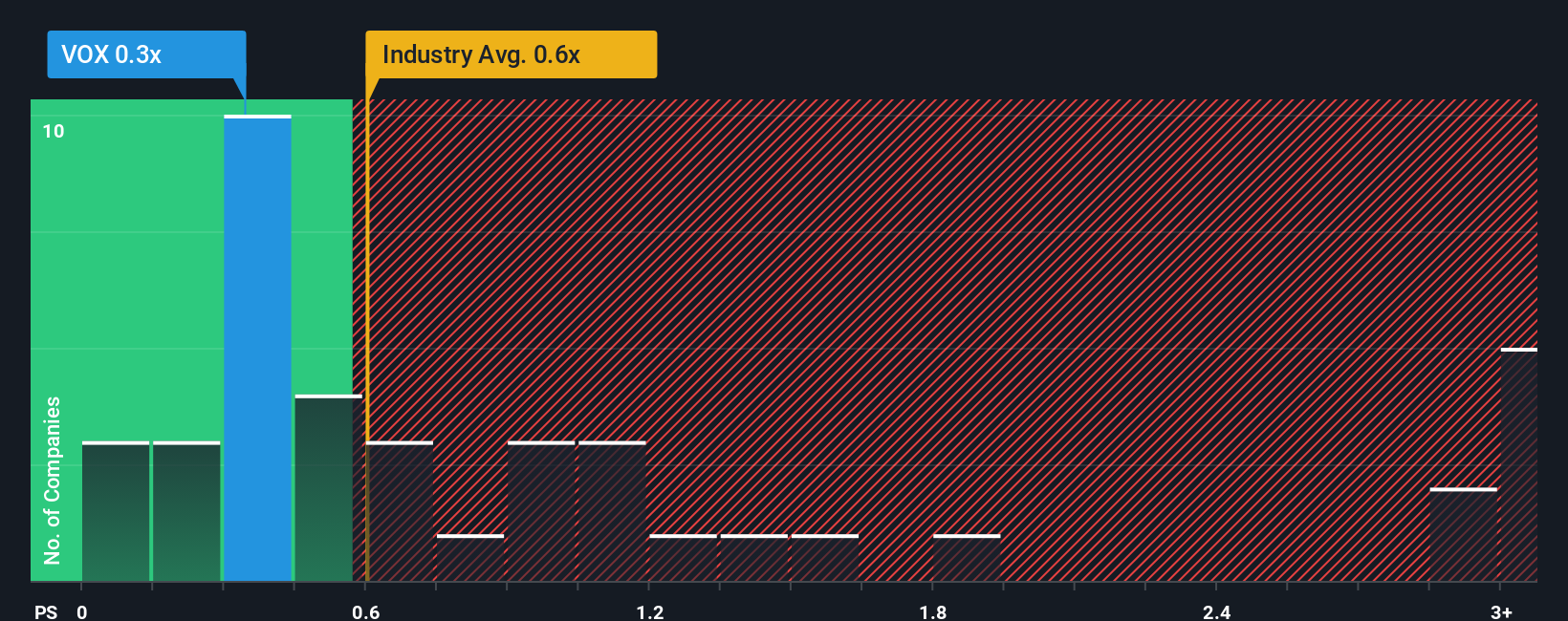

It's not a stretch to say that Vox Valor Capital Limited's (LON:VOX) price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" for companies in the Media industry in the United Kingdom, where the median P/S ratio is around 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Vox Valor Capital

What Does Vox Valor Capital's P/S Mean For Shareholders?

Recent times have been quite advantageous for Vox Valor Capital as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Vox Valor Capital's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Vox Valor Capital would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 117% gain to the company's top line. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 3.7% shows it's a great look while it lasts.

With this information, we find it odd that Vox Valor Capital is trading at a fairly similar P/S to the industry. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Vox Valor Capital revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Vox Valor Capital that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:VOX

Vox Valor Capital

Engages in the business of digital marketing, advertising, and content.

Good value with mediocre balance sheet.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026