Rightmove's (LON:RMV) Dividend Will Be Increased To £0.036

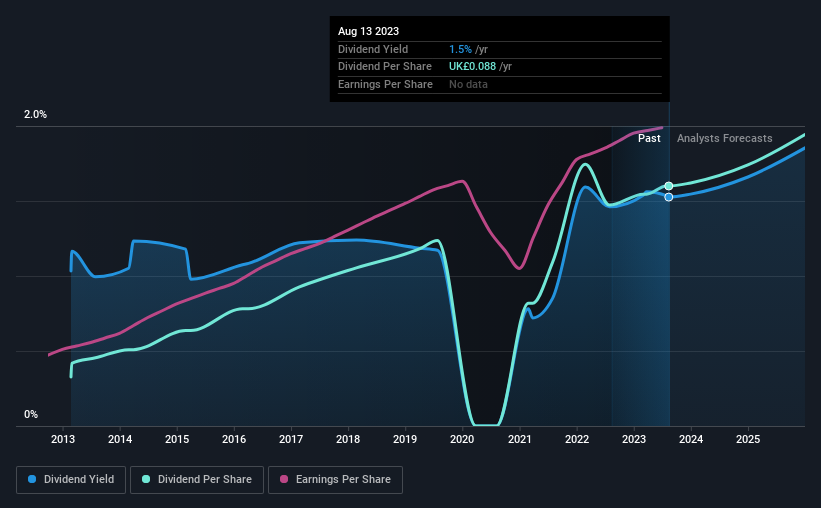

Rightmove plc (LON:RMV) has announced that it will be increasing its periodic dividend on the 27th of October to £0.036, which will be 9.1% higher than last year's comparable payment amount of £0.033. This makes the dividend yield about the same as the industry average at 1.5%.

Check out our latest analysis for Rightmove

Rightmove's Payment Has Solid Earnings Coverage

Solid dividend yields are great, but they only really help us if the payment is sustainable. However, prior to this announcement, Rightmove's dividend was comfortably covered by both cash flow and earnings. This means that most of what the business earns is being used to help it grow.

The next year is set to see EPS grow by 24.5%. Assuming the dividend continues along recent trends, we think the payout ratio could be 32% by next year, which is in a pretty sustainable range.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The dividend has gone from an annual total of £0.018 in 2013 to the most recent total annual payment of £0.088. This implies that the company grew its distributions at a yearly rate of about 17% over that duration. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

Rightmove Could Grow Its Dividend

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Rightmove has impressed us by growing EPS at 7.6% per year over the past five years. With a decent amount of growth and a low payout ratio, we think this bodes well for Rightmove's prospects of growing its dividend payments in the future.

In Summary

Overall, it's great to see the dividend being raised and that it is still in a sustainable range. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Earnings growth generally bodes well for the future value of company dividend payments. See if the 21 Rightmove analysts we track are forecasting continued growth with our free report on analyst estimates for the company. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:RMV

Rightmove

Operates digital property advertising and information portal in the United Kingdom and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026