- United Kingdom

- /

- Consumer Services

- /

- LSE:PSON

Why It Might Not Make Sense To Buy Pearson plc (LON:PSON) For Its Upcoming Dividend

Readers hoping to buy Pearson plc (LON:PSON) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Therefore, if you purchase Pearson's shares on or after the 24th of March, you won't be eligible to receive the dividend, when it is paid on the 6th of May.

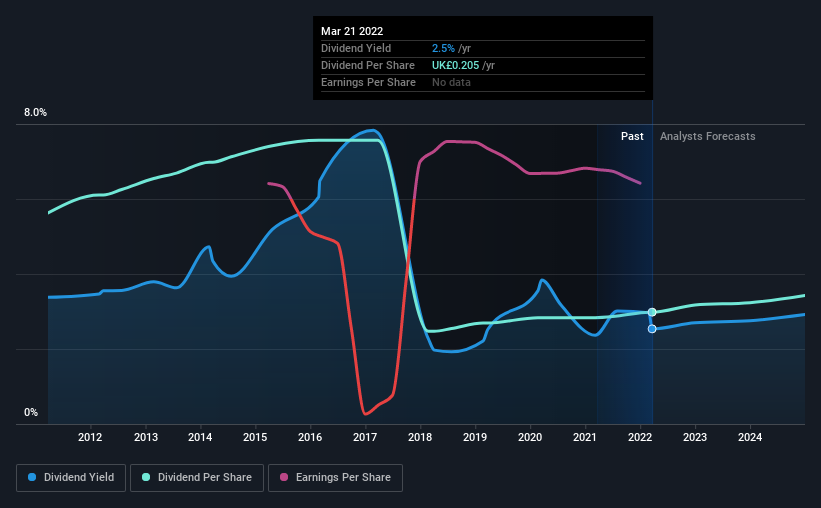

The company's upcoming dividend is UK£0.14 a share, following on from the last 12 months, when the company distributed a total of UK£0.20 per share to shareholders. Last year's total dividend payments show that Pearson has a trailing yield of 2.5% on the current share price of £8.08. If you buy this business for its dividend, you should have an idea of whether Pearson's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for Pearson

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Last year Pearson paid out 97% of its profits as dividends to shareholders, suggesting the dividend is not well covered by earnings. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It paid out 99% of its free cash flow in the form of dividends last year, which is outside the comfort zone for most businesses. Companies usually need cash more than they need earnings - expenses don't pay themselves - so it's not great to see it paying out so much of its cash flow.

Cash is slightly more important than profit from a dividend perspective, but given Pearson's payments were not well covered by either earnings or cash flow, we are concerned about the sustainability of this dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. It's encouraging to see Pearson has grown its earnings rapidly, up 54% a year for the past five years. Earnings per share are increasing at a rapid rate, but the company is paying out more than we are comfortable with, based on current earnings. Generally, when a company is growing this quickly and paying out all of its earnings as dividends, it can suggest either that the company is borrowing heavily to fund its growth, or that earnings growth is likely to slow due to lack of reinvestment.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Pearson's dividend payments per share have declined at 6.2% per year on average over the past 10 years, which is uninspiring. It's unusual to see earnings per share increasing at the same time as dividends per share have been in decline. We'd hope it's because the company is reinvesting heavily in its business, but it could also suggest business is lumpy.

Final Takeaway

Is Pearson worth buying for its dividend? While it's nice to see earnings per share growing, we're curious about how Pearson intends to continue growing, or maintain the dividend in a downturn given that it's paying out such a high percentage of its earnings and cashflow. It's not an attractive combination from a dividend perspective, and we're inclined to pass on this one for the time being.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Pearson. For instance, we've identified 4 warning signs for Pearson (1 is a bit unpleasant) you should be aware of.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:PSON

Pearson

Provides educational courseware, assessments, and services in the United Kingdom, the United States, Canada, the Asia Pacific, other European countries, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion