- United Kingdom

- /

- Software

- /

- AIM:GBG

High Growth Tech Stocks in the UK for October 2024

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has risen by 1.6%, contributing to an impressive 11% climb over the past year, with earnings anticipated to grow by 14% annually in the coming years. In this favorable environment, high growth tech stocks stand out as promising opportunities due to their potential for innovation and expansion within a thriving market landscape.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| Oxford Biomedica | 21.00% | 98.44% | ★★★★★☆ |

| Thruvision Group | 20.76% | 63.31% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

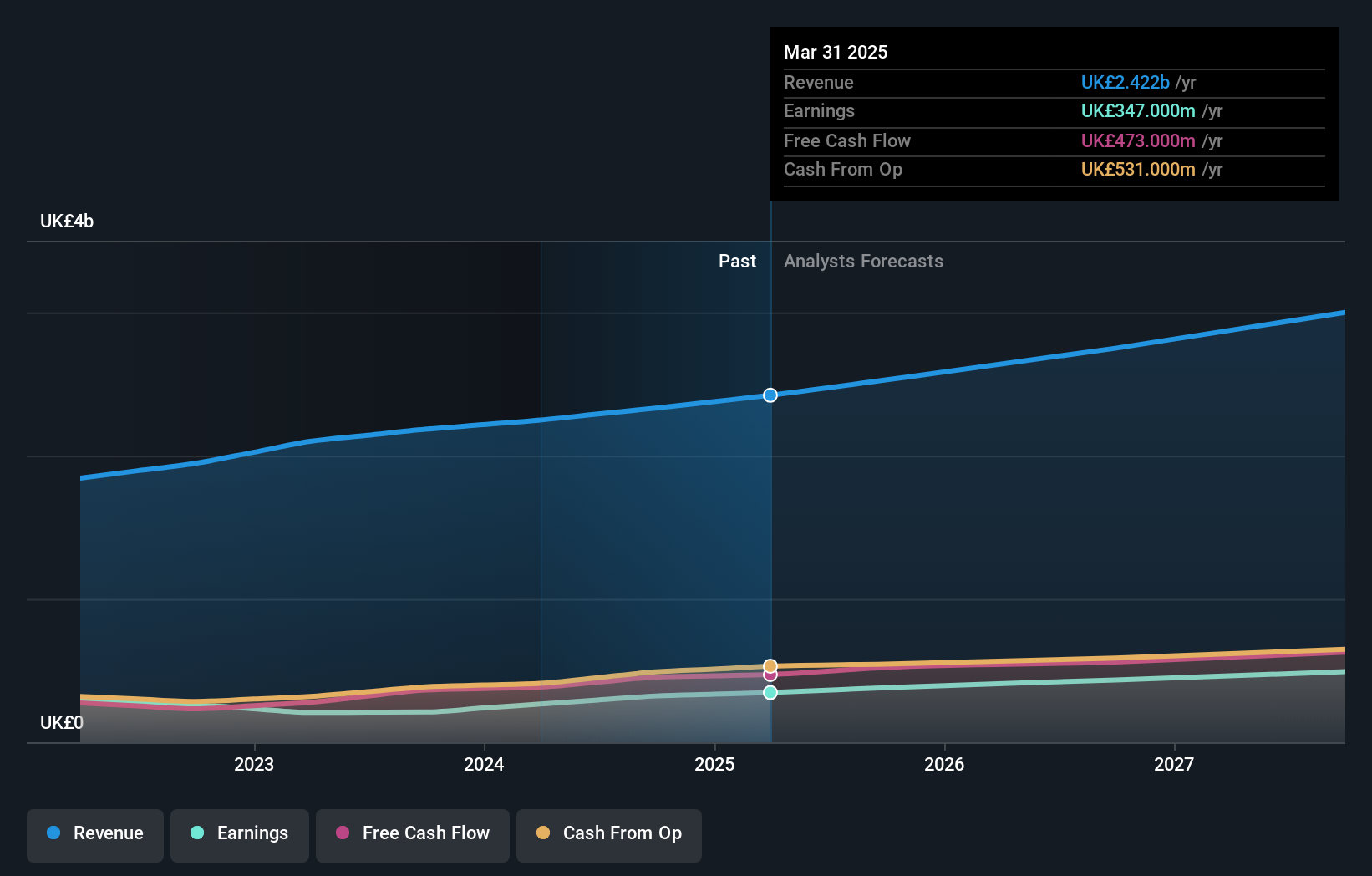

GB Group (AIM:GBG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GB Group plc, along with its subsidiaries, offers identity data intelligence products and services across the UK, US, Australia, and globally with a market capitalization of £824.92 million.

Operations: The company generates revenue through three primary segments: Identity (£156.06 million), Location (£81.07 million), and Fraud (£40.20 million).

GB Group, amidst a challenging tech landscape, demonstrates promising growth potential with expected revenue increases of 6.3% annually, outpacing the UK market's average of 3.5%. This growth is underscored by a significant anticipated surge in earnings, projected at nearly 89.8% per year. Despite current unprofitability, the company's strategic focus on R&D could catalyze future gains; however, its return on equity is forecasted to remain low at 3.4%. Recently enhancing shareholder value, GB Group declared a final dividend of 4.20 pence in July and is poised to reveal its first half of 2025 sales results soon, which could provide further insights into its operational trajectory and market positioning within the high-tech sector.

- Delve into the full analysis health report here for a deeper understanding of GB Group.

Understand GB Group's track record by examining our Past report.

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc is an international company specializing in events, digital services, and academic research with operations across the UK, Continental Europe, the US, China, and other global markets; it has a market cap of £11.11 billion.

Operations: Informa generates revenue primarily from its four segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company's diverse operations span events, digital services, and academic research across various global markets including the UK, Europe, the US, and China.

Informa, a key player in the global B2B events sector, is set to outpace the UK market with its revenue growth forecast at 7.4% annually, significantly above the national average of 3.5%. This growth trajectory is supported by strategic acquisitions such as Ascential plc, enhancing Informa's offerings in luxury and lifestyle sectors. Despite a challenging past marked by a one-off loss of £213.5 million impacting earnings, future prospects appear robust with earnings expected to surge by 22.5% per year. Additionally, Informa's commitment to innovation is evident from its R&D investments which are critical for maintaining its competitive edge in high-growth tech markets across Europe and beyond.

- Unlock comprehensive insights into our analysis of Informa stock in this health report.

Review our historical performance report to gain insights into Informa's's past performance.

Sage Group (LSE:SGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Sage Group plc, along with its subsidiaries, offers technology solutions and services tailored for small and medium businesses across the United States, the United Kingdom, France, and other international markets, with a market capitalization of approximately £10.24 billion.

Operations: Sage Group generates revenue primarily from its technology solutions and services, with North America contributing £1.01 billion and Europe £595 million. The company focuses on serving small and medium businesses internationally.

Sage Group, a stalwart in the UK tech landscape, is navigating through dynamic shifts with a keen focus on enhancing its software solutions. The company's recent partnership with VoPay to integrate advanced payment technologies into Sage Business Cloud underscores its commitment to streamlining financial operations for SMBs. This strategic move not only addresses efficiency challenges faced by 51% of businesses still reliant on manual spreadsheets but also fortifies Sage's market position by embedding essential financial services within its offerings. Financially, Sage has demonstrated robust performance with a revenue uptick of 9% in the latest quarter, pushing nine-month figures to £1.73 billion. Moreover, their R&D investment strategy remains aggressive, aligning well with an anticipated earnings growth of 15.1% per year and revenue projections growing at 7.7% annually—outpacing the broader UK market significantly.

- Take a closer look at Sage Group's potential here in our health report.

Gain insights into Sage Group's historical performance by reviewing our past performance report.

Seize The Opportunity

- Delve into our full catalog of 46 UK High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GBG

GB Group

Provides identity data intelligence products and services in the United Kingdom, the United States, Australia, and internationally.

Undervalued with reasonable growth potential.