- United Kingdom

- /

- Media

- /

- LSE:BMY

Top UK Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

In the wake of recent data showing faltering trade from China, the UK's FTSE 100 index has experienced some turbulence, reflecting broader global economic challenges. Amidst these market fluctuations, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate uncertain times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.11% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 5.60% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.96% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 6.45% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.02% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.73% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.32% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.51% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.45% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.52% | ★★★★★★ |

Click here to see the full list of 53 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Andrews Sykes Group (AIM:ASY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Andrews Sykes Group plc is an investment holding company that specializes in the hire, sale, and installation of environmental control equipment across the UK, Europe, the Middle East, Africa, and internationally with a market cap of £224.99 million.

Operations: Andrews Sykes Group plc generates revenue through the hire, sale, and installation of environmental control equipment across various regions including the UK, Europe, the Middle East, Africa, and other international markets.

Dividend Yield: 4.8%

Andrews Sykes Group's dividend payments have been volatile and unreliable over the past decade, though they are currently covered by both earnings (payout ratio of 63.2%) and cash flows (cash payout ratio of 74.8%). Despite a low dividend yield compared to top UK payers, dividends have shown growth over ten years. Recent earnings reports show stable net income growth, with an interim dividend maintained at 11.90 pence per share for October 2025 distribution.

- Take a closer look at Andrews Sykes Group's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Andrews Sykes Group shares in the market.

Bloomsbury Publishing (LSE:BMY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bloomsbury Publishing Plc is a global publisher of academic, educational, and general fiction and non-fiction books for various audiences including children, general readers, teachers, students, researchers, libraries, and professionals with a market cap of £383.05 million.

Operations: Bloomsbury Publishing Plc's revenue is derived from its Consumer segment (£256 million) and Non-Consumer segments, which include Special Interest (£21.70 million) and Academic & Professional (£83.30 million).

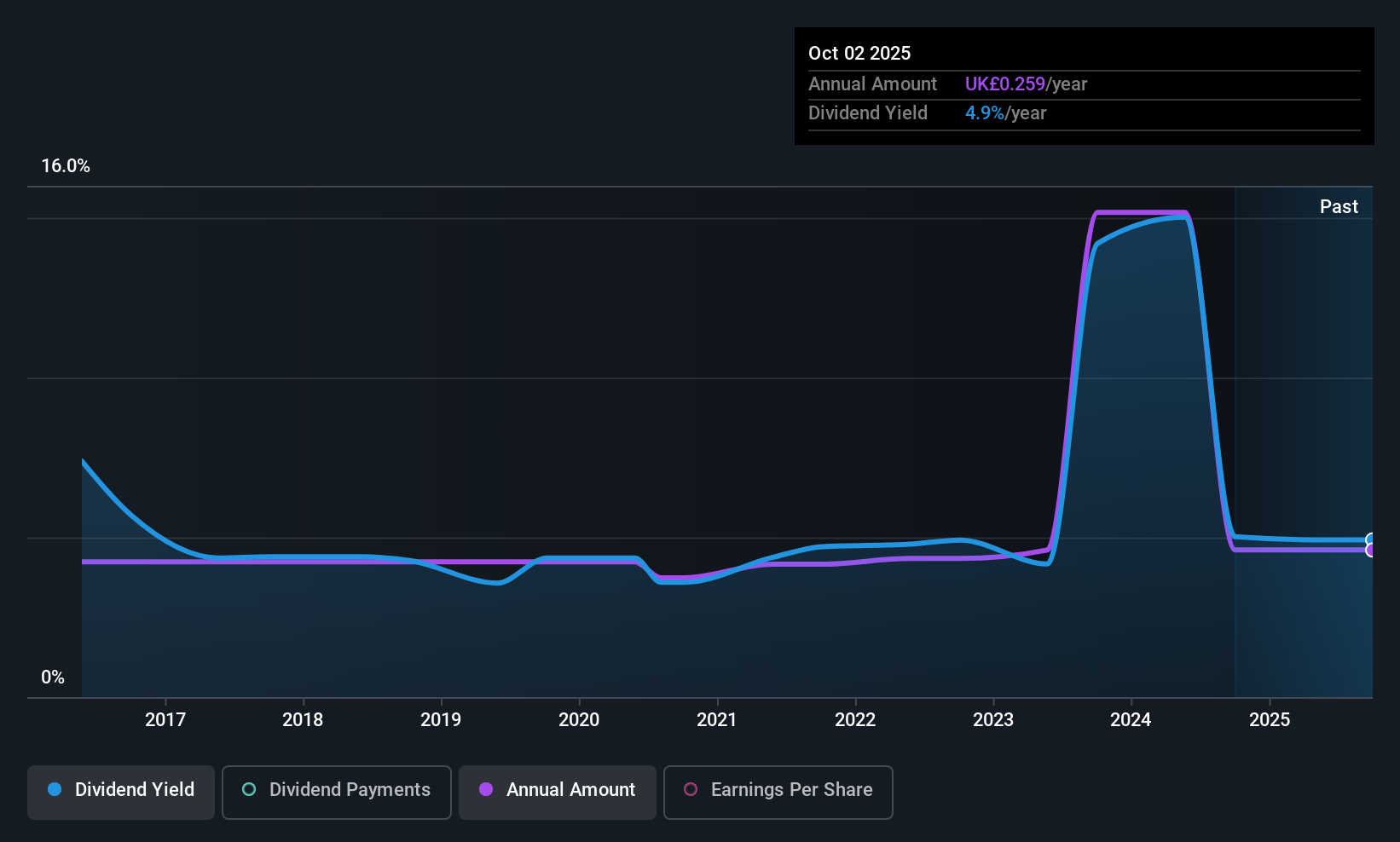

Dividend Yield: 3.3%

Bloomsbury Publishing's dividend history has been inconsistent over the past decade, yet current payments are supported by earnings (payout ratio of 49.5%) and cash flows (cash payout ratio of 35.3%). While its yield is lower than top UK dividend payers, it has seen growth in dividends over ten years. Recent developments include dropping from key indices and appointing Keith Underwood as COO, potentially influencing future strategic direction and financial performance.

- Delve into the full analysis dividend report here for a deeper understanding of Bloomsbury Publishing.

- Our comprehensive valuation report raises the possibility that Bloomsbury Publishing is priced lower than what may be justified by its financials.

Seplat Energy (LSE:SEPL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Seplat Energy Plc is an independent energy company involved in oil and gas exploration, production, and processing across several countries including Nigeria, with a market cap of £1.73 billion.

Operations: Seplat Energy's revenue is primarily derived from its oil segment, which generated $1.92 billion, and its gas segment, which contributed $158.28 million.

Dividend Yield: 5.6%

Seplat Energy's dividend yield is among the top 25% in the UK, supported by a low cash payout ratio (30.8%) and reasonable earnings coverage (70.9%). However, its dividend history has been volatile despite recent increases, including a planned 10% rise for Q3 2025. The company aims to return $1 billion in dividends by 2030 through a new policy tied to free cash flow and Brent prices, ensuring sustainability amid fluctuating earnings.

- Get an in-depth perspective on Seplat Energy's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Seplat Energy is trading beyond its estimated value.

Key Takeaways

- Reveal the 53 hidden gems among our Top UK Dividend Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bloomsbury Publishing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BMY

Bloomsbury Publishing

Bloomsbury Publishing Plc publishes academic, educational, and general fiction and non-fiction books publishing for children, general reader, teachers, students, researchers, libraries, researchers, and professionals worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success