Stock Analysis

- United Kingdom

- /

- Media

- /

- AIM:YOU

Exploring YouGov And 2 High Growth Tech Stocks In The UK

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently closed lower, impacted by weak trade data from China, indicating broader market sentiment challenges. In this environment, identifying high-growth tech stocks like YouGov and others becomes crucial as investors seek resilient opportunities amid global economic uncertainties.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 67.08% | 130.82% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 44 stocks from our UK High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

YouGov (AIM:YOU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: YouGov plc provides online market research services across the United Kingdom, the United States, the Middle East, Mainland Europe, and the Asia Pacific with a market cap of £534.79 million.

Operations: YouGov generates revenue primarily from its Data Products segment, which contributed £85.10 million. The company has a market cap of £534.79 million and operates in multiple regions including the United Kingdom, the United States, and the Asia Pacific.

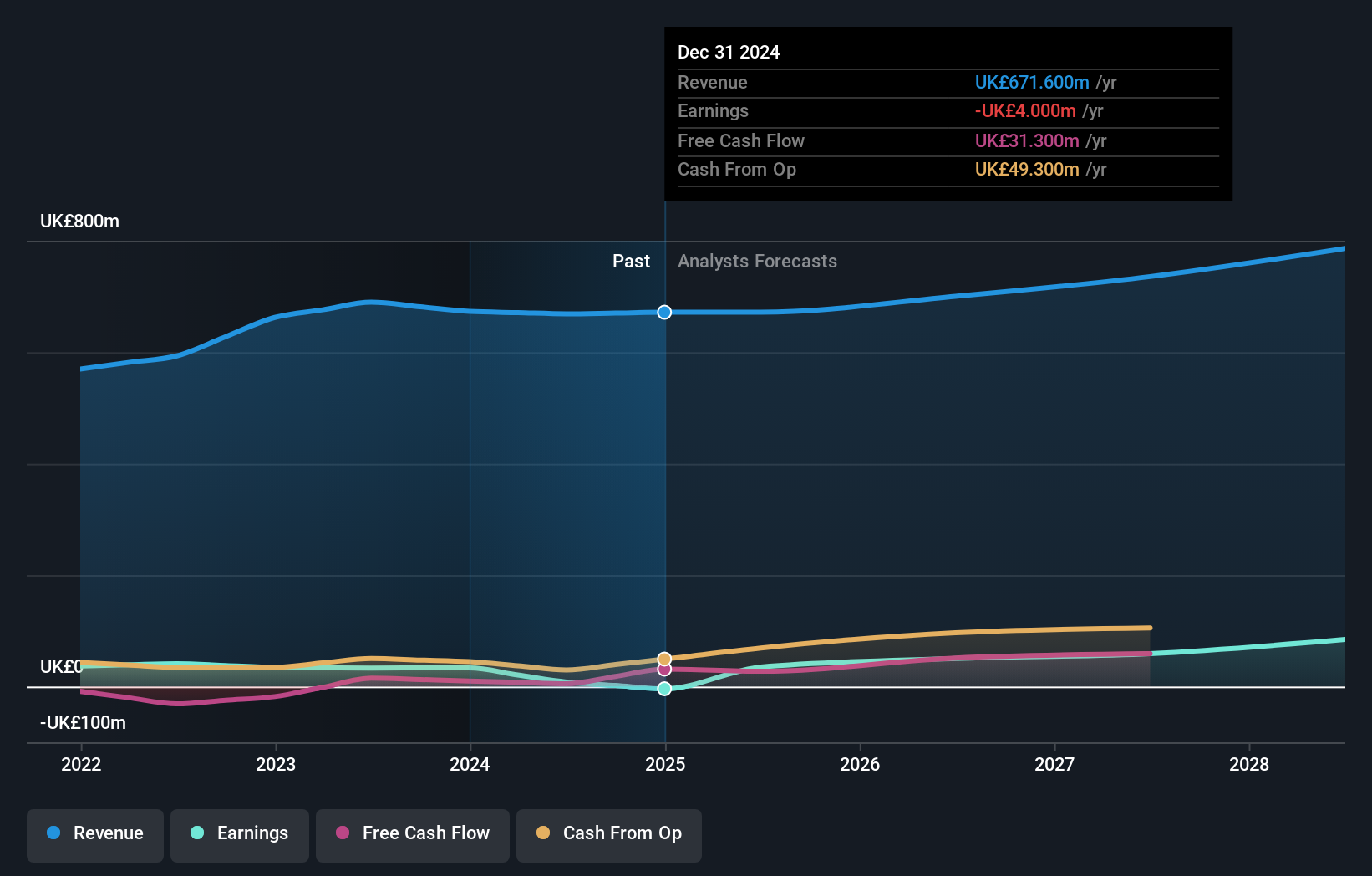

YouGov's revenue is forecasted to grow at 14.3% annually, outpacing the UK market's 3.7% growth rate but falling short of the 20% high-growth threshold. Despite a -15.3% earnings drop last year, future earnings are expected to surge by 29.8%, significantly above the UK market's projected 14.2%. The company repurchased shares in the past year and anticipates revenues between £327-330 million for FY2024, reflecting a positive outlook despite recent volatility and lower-than-expected sales bookings. Increased R&D spending underscores YouGov’s commitment to innovation; their focus on audience intelligence and brand tracking products is pivotal for sustained growth in an increasingly data-driven industry. With Marc Ryan joining as Chief Product Officer from SCUBA Analytics, YouGov aims to enhance its product suite further, potentially boosting its competitive edge in the media sector where software firms are increasingly adopting SaaS models for recurring revenue streams.

- Click to explore a detailed breakdown of our findings in YouGov's health report.

Understand YouGov's track record by examining our Past report.

Genus (LSE:GNS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genus plc is an animal genetics company with operations spanning North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia; it has a market cap of £1.28 billion.

Operations: Genus plc generates revenue primarily through its Genus ABS and Genus PIC segments, contributing £314.90 million and £352.50 million respectively. The company also has a smaller revenue stream from its Central segment at £1.40 million.

Genus plc's earnings are projected to grow at an impressive 39.4% annually, significantly outpacing the UK market's 14.2%. Despite a challenging year with a -76.3% earnings drop and net income falling to £7.9 million from £33.3 million, the company remains committed to innovation with substantial R&D investments driving future growth prospects in its biotech segment. Revenue is forecasted to increase by 4.1% per year, surpassing the broader market's 3.7%, while profit margins have dipped from 4.8% to 1.2%.

- Dive into the specifics of Genus here with our thorough health report.

Explore historical data to track Genus' performance over time in our Past section.

Sage Group (LSE:SGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Sage Group plc, together with its subsidiaries, provides technology solutions and services for small and medium businesses in the United States, the United Kingdom, France, and internationally; it has a market cap of £10.15 billion.

Operations: Sage Group generates revenue primarily from its technology solutions and services for small and medium businesses, with significant contributions from North America (£1.01 billion) and Europe (£595 million). The company also operates in the United Kingdom & Ireland, generating £488 million.

The Sage Group's earnings are forecasted to grow 15.1% annually, outpacing the UK market's 14.2%. Revenue is expected to increase by 8% per year, driven by the Sage Business Cloud portfolio, which saw a third-quarter revenue rise of 9% to £585 million. The company has strategically partnered with VoPay to enhance its payroll functionalities for SMBs, addressing inefficiencies and manual processes that plague over half of businesses. R&D expenses have been pivotal in driving innovation; last year alone, they invested £179 million into developing new technologies and improving existing services.

Where To Now?

- Discover the full array of 44 UK High Growth Tech and AI Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:YOU

YouGov

Provides online market research services in the United Kingdom, the United States, the Middle East, Mainland Europe, and the Asia Pacific.