- United Kingdom

- /

- Media

- /

- AIM:SYS1

System1 Group PLC (LON:SYS1) Stocks Shoot Up 25% But Its P/S Still Looks Reasonable

System1 Group PLC (LON:SYS1) shares have continued their recent momentum with a 25% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 93%.

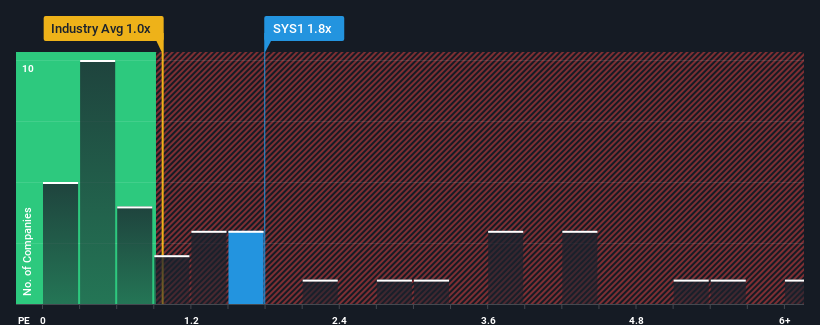

After such a large jump in price, given close to half the companies operating in the United Kingdom's Media industry have price-to-sales ratios (or "P/S") below 1x, you may consider System1 Group as a stock to potentially avoid with its 1.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for System1 Group

What Does System1 Group's Recent Performance Look Like?

Recent times haven't been great for System1 Group as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on System1 Group.How Is System1 Group's Revenue Growth Trending?

System1 Group's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. Revenue has also lifted 20% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 18% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 2.4%, which is noticeably less attractive.

With this information, we can see why System1 Group is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

System1 Group's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into System1 Group shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for System1 Group you should be aware of, and 2 of them are concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SYS1

System1 Group

Provides market research data and insight services in the United Kingdom, the United States, Latin America, rest of Europe, and the Asia Pacific.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives