- United Kingdom

- /

- Media

- /

- AIM:SBDS

Market Might Still Lack Some Conviction On Silver Bullet Data Services Group PLC (LON:SBDS) Even After 44% Share Price Boost

Silver Bullet Data Services Group PLC (LON:SBDS) shareholders are no doubt pleased to see that the share price has bounced 44% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 39% over that time.

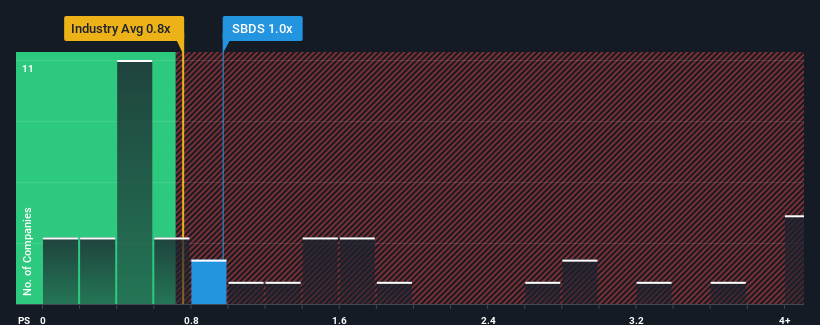

Even after such a large jump in price, there still wouldn't be many who think Silver Bullet Data Services Group's price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in the United Kingdom's Media industry is similar at about 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Silver Bullet Data Services Group

How Silver Bullet Data Services Group Has Been Performing

Silver Bullet Data Services Group has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Silver Bullet Data Services Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Silver Bullet Data Services Group's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Silver Bullet Data Services Group?

The only time you'd be comfortable seeing a P/S like Silver Bullet Data Services Group's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 170% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

In contrast to the company, the rest of the industry is expected to decline by 3.2% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this in mind, we find it intriguing that Silver Bullet Data Services Group's P/S matches its industry peers. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Key Takeaway

Silver Bullet Data Services Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Silver Bullet Data Services Group revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Silver Bullet Data Services Group (of which 2 are a bit unpleasant!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SBDS

Silver Bullet Data Services Group

Provides data and digital transformation services and tools for marketing and advertising purposes in the United Kingdom, rest of Europe, the United States, and internationally.

Slight risk and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026