- United Kingdom

- /

- Real Estate

- /

- LSE:LSL

UK Growth Companies With High Insider Ownership In September 2024

Reviewed by Simply Wall St

The UK market has faced recent turbulence, with the FTSE 100 index closing lower due to weak trade data from China and declining commodity prices impacting major companies. Amid these challenging conditions, identifying growth companies with high insider ownership can provide valuable insights into businesses where those closest to the company have a significant stake and confidence in its future prospects.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 28.6% | 33.5% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Helios Underwriting (AIM:HUW) | 23.9% | 14.7% |

| Foresight Group Holdings (LSE:FSG) | 31.7% | 27.9% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 36.1% | 113.4% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Velocity Composites (AIM:VEL) | 27.6% | 188.7% |

| Judges Scientific (AIM:JDG) | 11.9% | 26.9% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

We'll examine a selection from our screener results.

Judges Scientific (AIM:JDG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Judges Scientific plc designs, manufactures, and sells scientific instruments and has a market cap of £717.26 million.

Operations: The company's revenue segments include £63.60 million from Vacuum and £72.50 million from Materials Sciences.

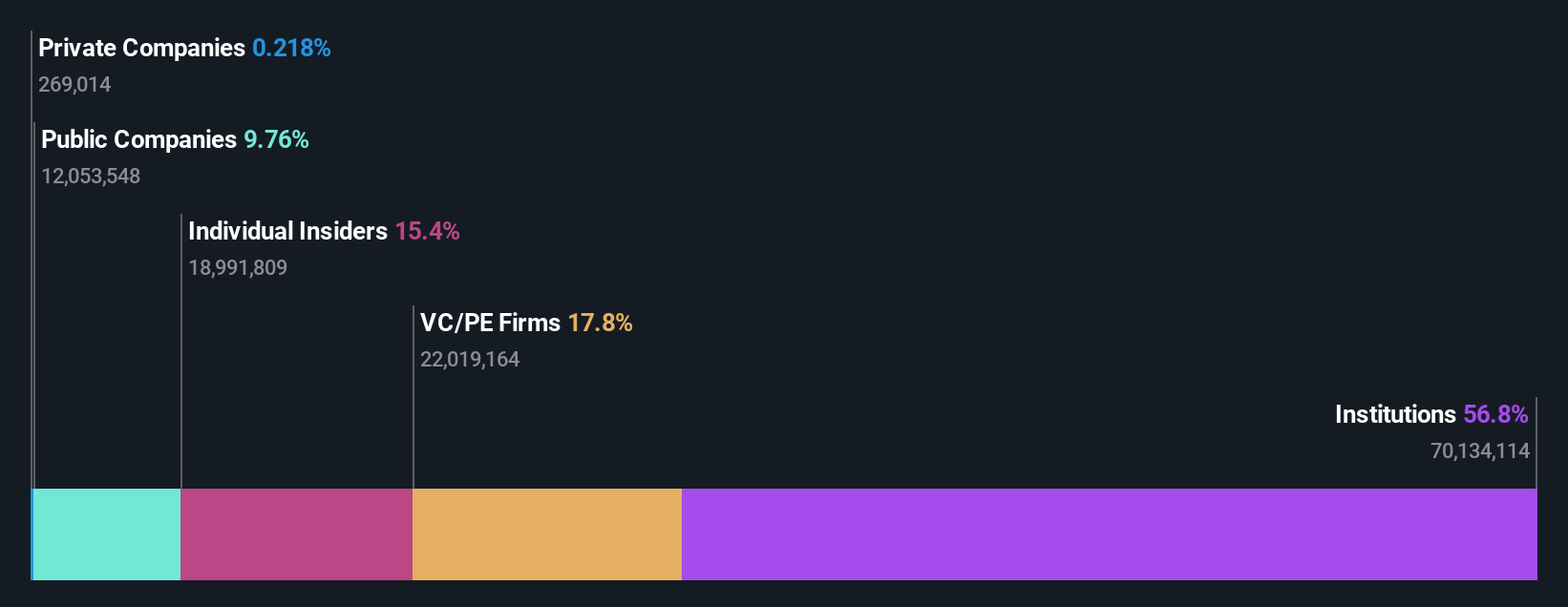

Insider Ownership: 11.9%

Return On Equity Forecast: 21% (2026 estimate)

Judges Scientific has seen significant insider selling over the past three months, yet insiders have also made substantial purchases. The company recently appointed Dr. Ian Wilcock as Group Commercial Director, bringing extensive experience in technology commercialization and innovation. While revenue growth is forecasted at 6.3% per year, slower than 20%, earnings are expected to grow significantly at 26.88% annually, outpacing the UK market's average of 14.4%. Despite high debt levels and a volatile share price, Judges Scientific's return on equity is projected to be strong at 20.9% in three years.

- Delve into the full analysis future growth report here for a deeper understanding of Judges Scientific.

- The analysis detailed in our Judges Scientific valuation report hints at an inflated share price compared to its estimated value.

M&C Saatchi (AIM:SAA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: M&C Saatchi plc offers advertising and marketing communications services across the UK, Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of £260.41 million.

Operations: The company generates revenue through advertising and marketing communications services across various regions, including the UK, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Insider Ownership: 16.1%

Return On Equity Forecast: 45% (2026 estimate)

M&C Saatchi is undergoing significant executive changes, with Simon Fuller replacing Bruce Marson as CFO. Despite expected revenue declines of -14.2% annually over the next three years, earnings are forecast to grow 43.75% per year, and the company is anticipated to become profitable within this period. Trading at 52.5% below estimated fair value, M&C Saatchi's high insider ownership aligns with a projected return on equity of 45.5%.

- Take a closer look at M&C Saatchi's potential here in our earnings growth report.

- The valuation report we've compiled suggests that M&C Saatchi's current price could be quite moderate.

LSL Property Services (LSE:LSL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LSL Property Services plc, with a market cap of £348.08 million, provides business-to-business services to mortgage intermediaries and estate agency franchisees, as well as valuation services to lenders in the United Kingdom.

Operations: LSL Property Services generates revenue from three primary segments: Financial Services (£51.69 million), Surveying and Valuation (£67.83 million), and Estate Agency excluding Financial Services (£24.89 million).

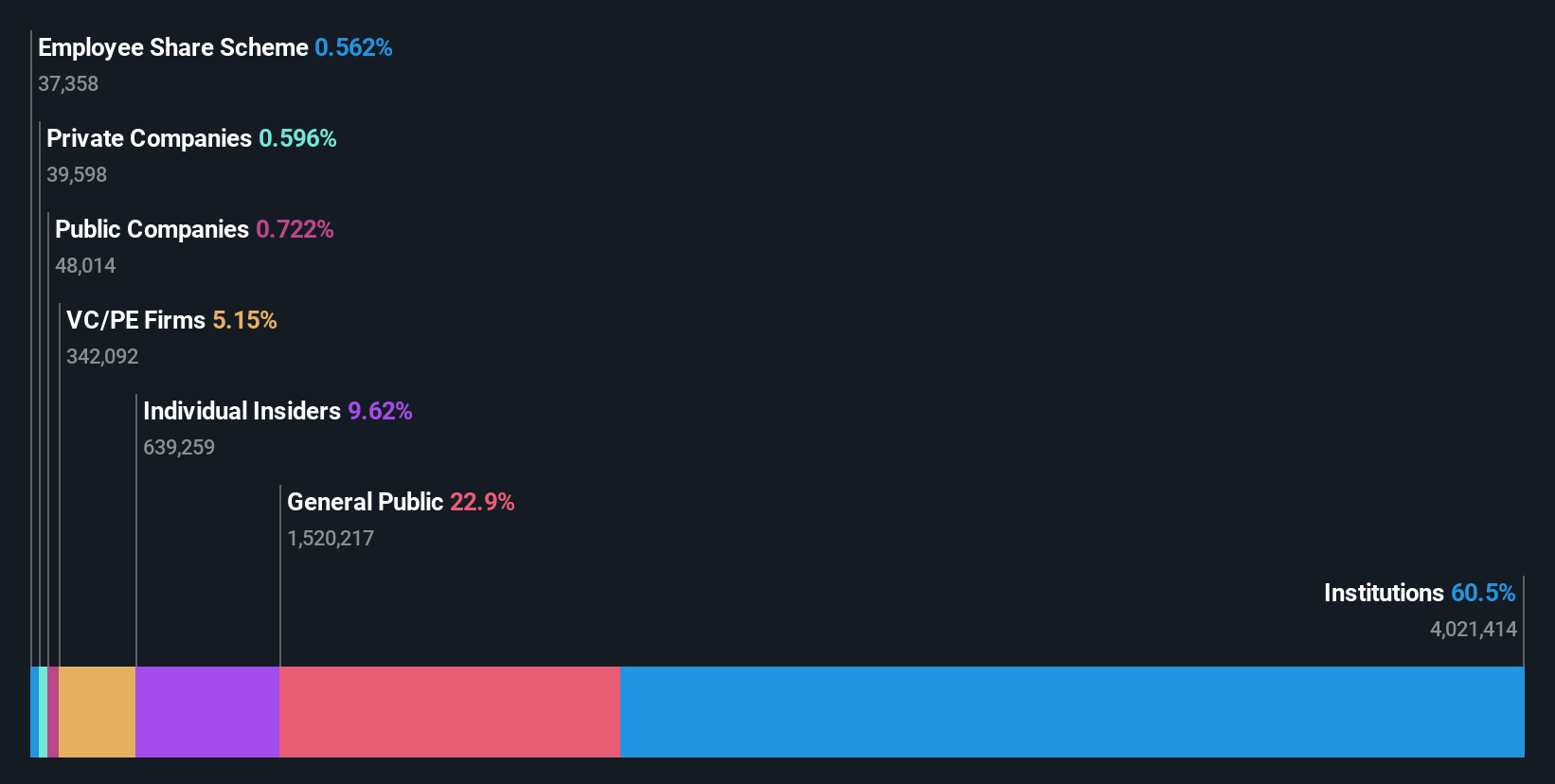

Insider Ownership: 10.8%

Return On Equity Forecast: 25% (2026 estimate)

LSL Property Services is poised for significant earnings growth, forecasted at 33.3% annually, outpacing the UK market's 14.4%. Despite a slower revenue growth rate of 11% per year, it remains above the market average of 3.7%. The recent appointment of Michael Stoop as Non-Executive Director brings valuable industry expertise. Trading at 52.8% below estimated fair value, LSL's high insider ownership reflects confidence in its future prospects despite concerns over dividend sustainability and non-cash earnings quality.

- Get an in-depth perspective on LSL Property Services' performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility LSL Property Services' shares may be trading at a premium.

Taking Advantage

- Embark on your investment journey to our 69 Fast Growing UK Companies With High Insider Ownership selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LSL

LSL Property Services

Engages in the provision of business-to-business services to mortgage intermediaries and estate agency franchisees, and valuation services to lenders in the United Kingdom.

Flawless balance sheet with high growth potential.