- United Kingdom

- /

- Media

- /

- AIM:SAA

Top UK Growth Stocks With High Insider Ownership In October 2024

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic uncertainties. In such a volatile environment, growth companies with high insider ownership can be appealing as they often indicate strong management confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Gaming Realms (AIM:GMR) | 20.1% | 22.1% |

| LSL Property Services (LSE:LSL) | 10.8% | 28.2% |

| Foresight Group Holdings (LSE:FSG) | 31.8% | 27.9% |

| Judges Scientific (AIM:JDG) | 11% | 23% |

| Enteq Technologies (AIM:NTQ) | 20% | 53.8% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 80.6% |

Let's dive into some prime choices out of the screener.

Loungers (AIM:LGRS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Loungers plc operates cafés, bars, and restaurants under the Lounge and Cosy Club brand names in England and Wales with a market cap of £281.47 million.

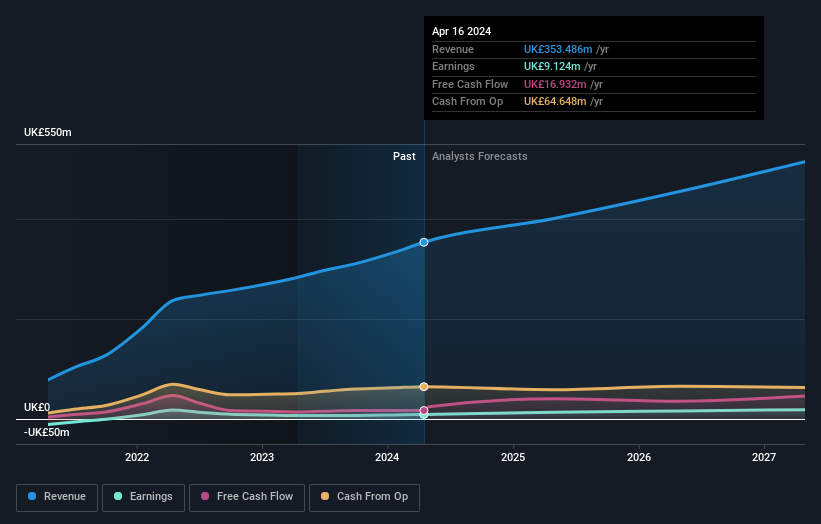

Operations: Revenue from operating café bars and café restaurants amounted to £353.49 million.

Insider Ownership: 13.7%

Loungers plc demonstrates strong growth potential, with earnings expected to rise 22.5% annually, outpacing the UK market's 14.3% forecast. Revenue is also set to grow at 12.3%, significantly above the market rate of 3.7%. The company reported sales of £353.49 million for the year ending April 2024, up from £283.51 million previously, and net income increased to £9.12 million from £6.93 million, highlighting its robust financial performance amidst high insider ownership levels.

- Unlock comprehensive insights into our analysis of Loungers stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Loungers shares in the market.

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mortgage Advice Bureau (Holdings) plc, with a market cap of £394.11 million, provides mortgage advice services in the United Kingdom through its subsidiaries.

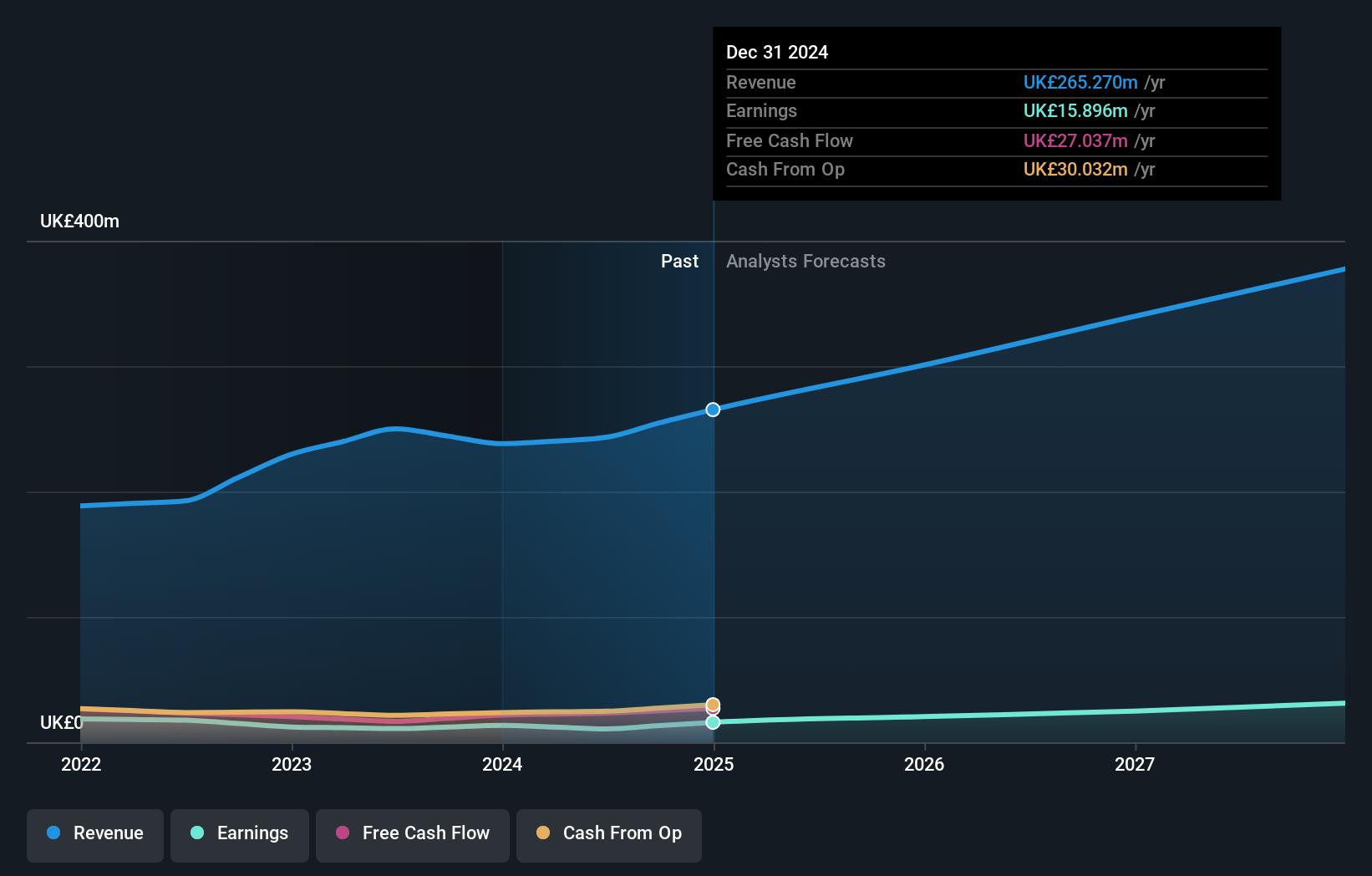

Operations: The company generates revenue of £243.31 million from its financial services offerings in the UK.

Insider Ownership: 19.8%

Mortgage Advice Bureau (Holdings) plc, with significant insider ownership, shows promising growth prospects despite recent earnings decline. The company reported a net income of £3.7 million for the half year ended June 2024, down from £6.42 million previously. Earnings are forecasted to grow at 29.6% annually, surpassing the UK market's average growth rate of 14.3%. However, its dividend yield of 4.13% is not well covered by earnings and share price volatility remains high.

- Navigate through the intricacies of Mortgage Advice Bureau (Holdings) with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Mortgage Advice Bureau (Holdings) is priced higher than what may be justified by its financials.

M&C Saatchi (AIM:SAA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: M&C Saatchi plc offers advertising and marketing communications services across the UK, Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of £222.51 million.

Operations: Revenue segments for the company include advertising and marketing communications services across various regions including the UK, Europe, the Middle East, Africa, Asia Pacific, and the Americas.

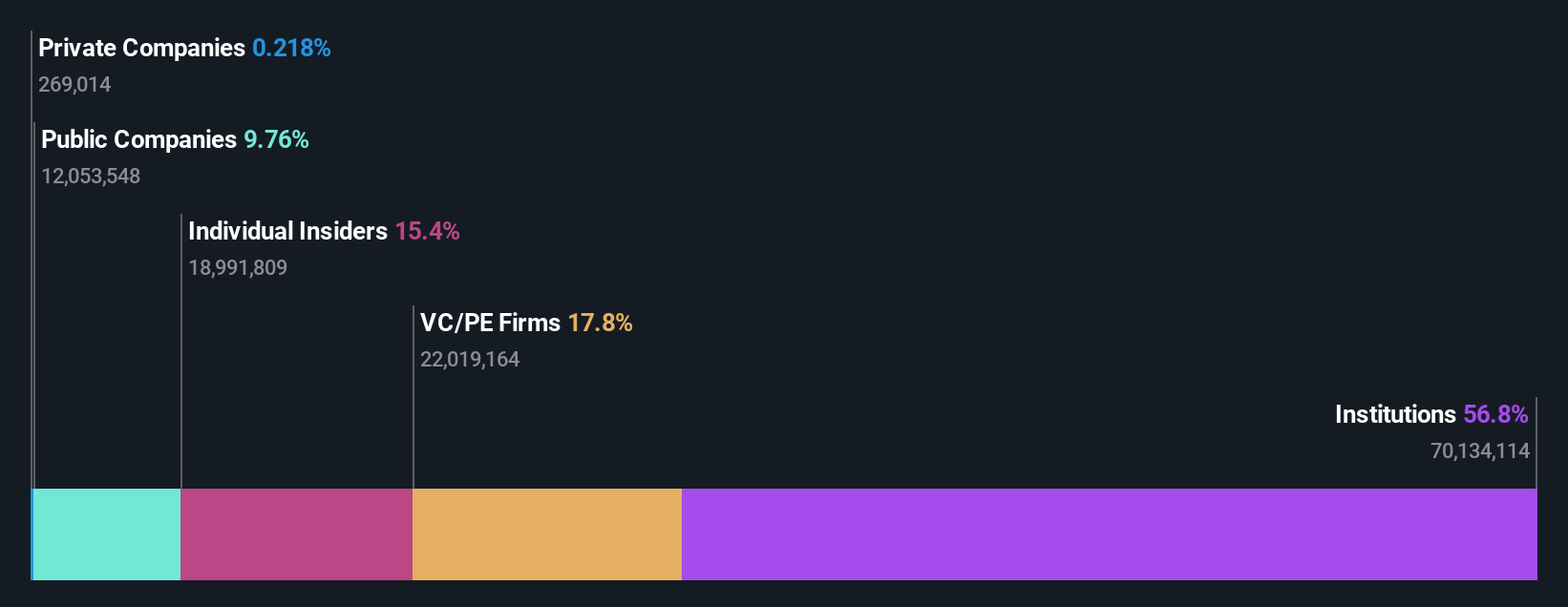

Insider Ownership: 16.2%

M&C Saatchi, with substantial insider buying and high insider ownership, shows strong growth potential. Its earnings are forecast to grow significantly at 27.4% annually, outpacing the UK market average. Despite a projected revenue decline of 15.1% per year, the company is trading well below its estimated fair value and has recently turned profitable with net income of £8.11 million for H1 2024 compared to a loss last year.

- Click here and access our complete growth analysis report to understand the dynamics of M&C Saatchi.

- According our valuation report, there's an indication that M&C Saatchi's share price might be on the cheaper side.

Taking Advantage

- Gain an insight into the universe of 65 Fast Growing UK Companies With High Insider Ownership by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SAA

M&C Saatchi

Provides advertising and marketing communications services in the United Kingdom, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Undervalued with excellent balance sheet.