- United Kingdom

- /

- Media

- /

- AIM:NFG

Next 15 Group plc (LON:NFG) Held Back By Insufficient Growth Even After Shares Climb 26%

Next 15 Group plc (LON:NFG) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. But the last month did very little to improve the 64% share price decline over the last year.

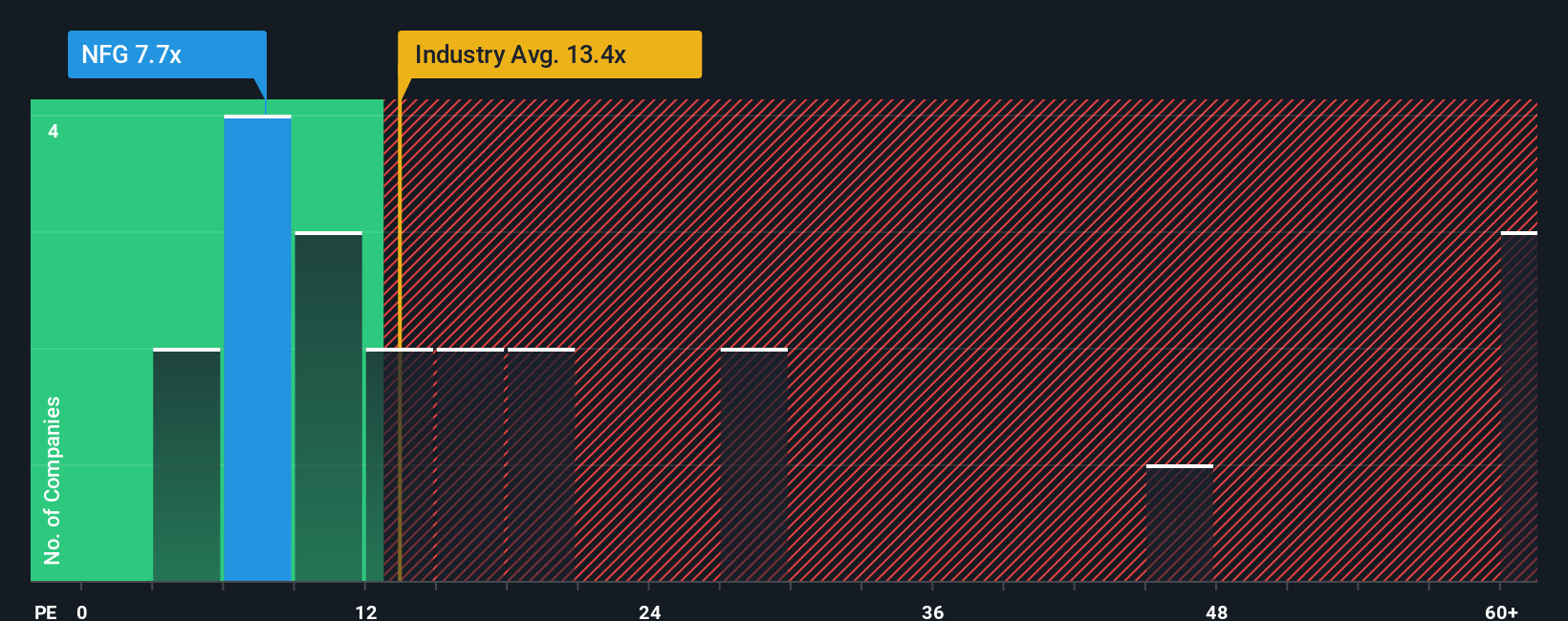

In spite of the firm bounce in price, Next 15 Group's price-to-earnings (or "P/E") ratio of 7.7x might still make it look like a strong buy right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios above 17x and even P/E's above 30x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Next 15 Group could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Next 15 Group

What Are Growth Metrics Telling Us About The Low P/E?

Next 15 Group's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's bottom line. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the six analysts covering the company suggest earnings growth is heading into negative territory, declining 3.9% per year over the next three years. Meanwhile, the broader market is forecast to expand by 15% per annum, which paints a poor picture.

In light of this, it's understandable that Next 15 Group's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Even after such a strong price move, Next 15 Group's P/E still trails the rest of the market significantly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Next 15 Group maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Next 15 Group that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Next 15 Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:NFG

Next 15 Group

Next 15 Group plc, together with its subsidiaries, customer insight, customer delivery, customer engagement, and business transformation services in the United Kingdom, Africa, the United States, Europe, Middle East, and Africa.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives