- United Kingdom

- /

- Entertainment

- /

- AIM:DEVO

Analysts Have Been Trimming Their Devolver Digital, Inc. (LON:DEVO) Price Target After Its Latest Report

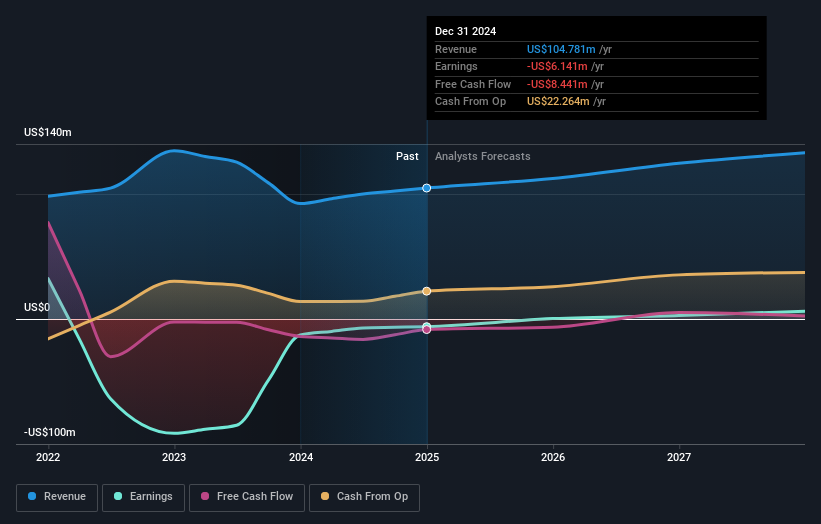

It's been a good week for Devolver Digital, Inc. (LON:DEVO) shareholders, because the company has just released its latest full-year results, and the shares gained 3.8% to UK£0.20. Revenues were in line with expectations, at US$105m, while statutory losses ballooned to US$0.013 per share. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

We check all companies for important risks. See what we found for Devolver Digital in our free report.

Following the latest results, Devolver Digital's six analysts are now forecasting revenues of US$112.5m in 2025. This would be a modest 7.3% improvement in revenue compared to the last 12 months. Earnings are expected to improve, with Devolver Digital forecast to report a statutory profit of US$0.0031 per share. Before this earnings report, the analysts had been forecasting revenues of US$116.4m and earnings per share (EPS) of US$0.001 in 2025. While revenue forecasts have been revised downwards, the analysts look to have become more optimistic on the company's cost base, given the great increase in to the earnings per share numbers.

View our latest analysis for Devolver Digital

The consensus price target fell 5.4% to UK£0.34, with the analysts signalling that the weaker revenue outlook was a more powerful indicator than the upgraded EPS forecasts. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Devolver Digital, with the most bullish analyst valuing it at UK£0.39 and the most bearish at UK£0.25 per share. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Of course, another way to look at these forecasts is to place them into context against the industry itself. For example, we noticed that Devolver Digital's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 7.3% growth to the end of 2025 on an annualised basis. That is well above its historical decline of 2.5% a year over the past three years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 4.5% annually. Not only are Devolver Digital's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Devolver Digital's earnings potential next year. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. Even so, earnings are more important to the intrinsic value of the business. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of Devolver Digital's future valuation.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have forecasts for Devolver Digital going out to 2027, and you can see them free on our platform here.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:DEVO

Devolver Digital

Develops and publishes digital video games for PC, console, and mobile platforms in Europe, North America, the Asia Pacific, Latin America, the United Kingdom, the Middle East, and North Africa.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Duolingo: Billion Dollar Business Hiding in Plain Sight

Kyocera: The Hidden AI Enabler

Santos: Undervalued After Takeover Fallout

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks