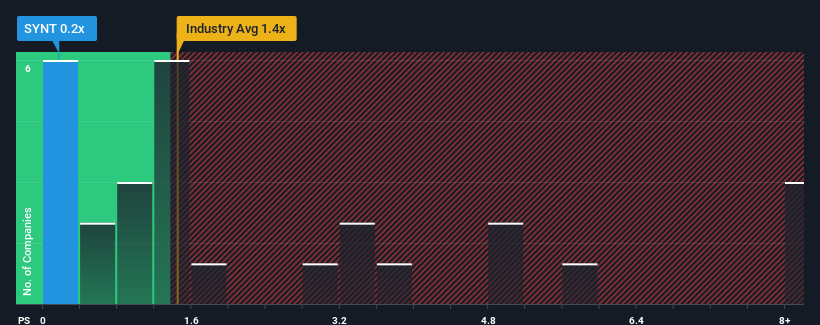

You may think that with a price-to-sales (or "P/S") ratio of 0.2x Synthomer plc (LON:SYNT) is a stock worth checking out, seeing as almost half of all the Chemicals companies in the United Kingdom have P/S ratios greater than 1.4x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Synthomer

How Synthomer Has Been Performing

The recently shrinking revenue for Synthomer has been in line with the industry. Perhaps the market is expecting future revenue performance to deteriorate further, which has kept the P/S suppressed. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. At the very least, you'd be hoping that revenue doesn't fall off a cliff if your plan is to pick up some stock while it's out of favour.

Keen to find out how analysts think Synthomer's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Synthomer?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Synthomer's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.2%. As a result, revenue from three years ago have also fallen 7.7% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should demonstrate some strength in company's business, generating growth of 4.1% as estimated by the eight analysts watching the company. Meanwhile, the broader industry is forecast to contract by 13%, which would indicate the company is doing better than the majority of its peers.

In light of this, it's quite peculiar that Synthomer's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Synthomer's analyst forecasts has shown that it could be trading at a significant discount in terms of P/S, as it is expected to far outperform the industry. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 3 warning signs for Synthomer you should be aware of, and 2 of them shouldn't be ignored.

If these risks are making you reconsider your opinion on Synthomer, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:SYNT

Synthomer

Manufactures and supplies specialised polymers and ingredients for coatings, construction, adhesives, and health and protection sectors.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion